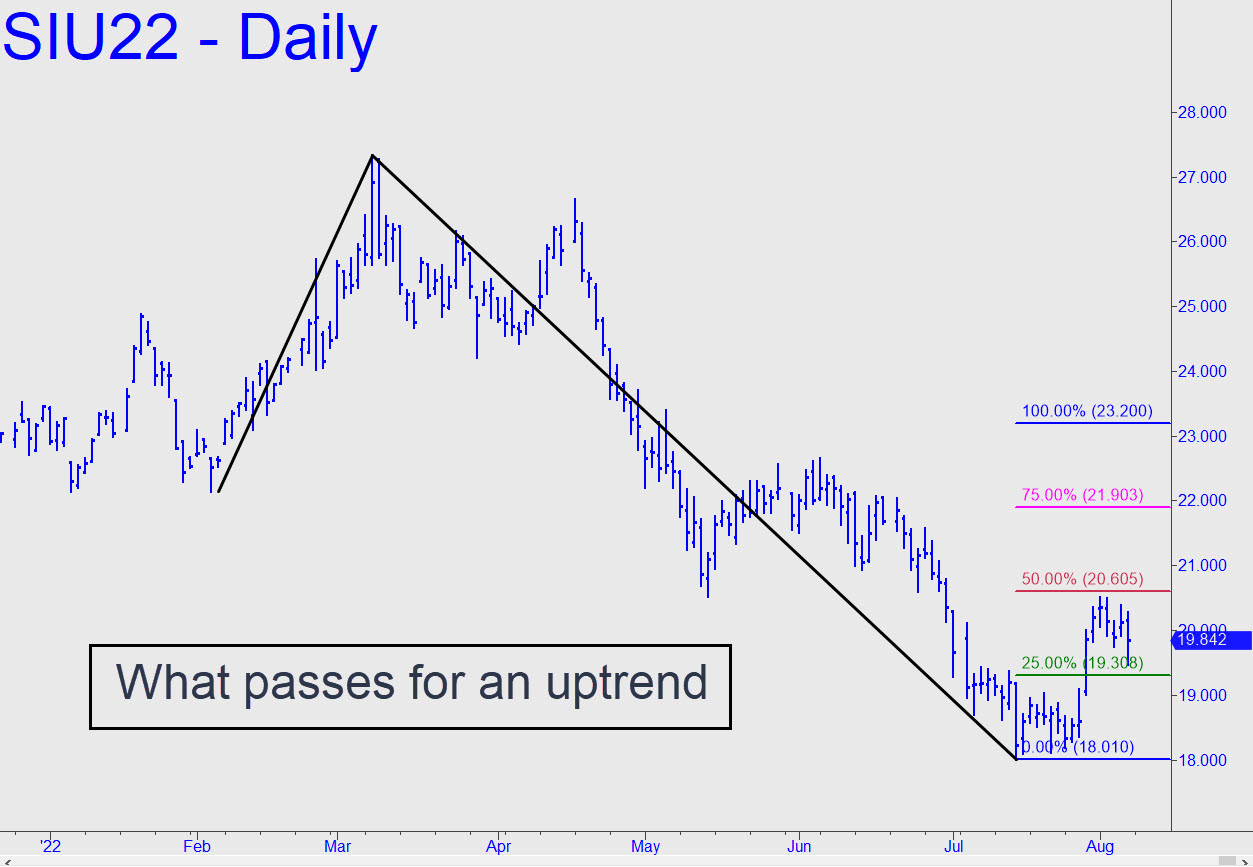

Silver has performed somewhat better than gold recently, but that’s not saying much. Since the September contract didn’t quite reach the red line last week, I cannot recommend a ‘mechanical’ buy if it touches the green line on Monday. My gut feeling is that the trade would make money, but there’s no compelling reason to cast discipline aside. There’s a potential gain of around $6400 per contract on a one-level move to p=20.60. however, so don’t feel constrained from trying if you know how to keep theoretical risk down to $400 or less by applying ‘camouflage’ on the five-minute chart. ______ UPDATE (Aug 8, 11:35 p.m.) With an easy pop through p=20.54 today, and then a relaxed consolidation above it, September Silver looked terrific. If it closes higher on Tuesday, that would strongly imply the rally is destined for a minimum 21.62, the D target shown here. _______ UPDATE (Aug 11, 5:10 p.m.): A drop to x=20.00 would trigger an attractive ‘mechanical’ buy, stop 19.46. With about $2600 of initial risk per contract, the trade is recommended only to those familiar with ‘camo’ set-ups who can pare the theoretical risk down to $200 or so,

Silver has performed somewhat better than gold recently, but that’s not saying much. Since the September contract didn’t quite reach the red line last week, I cannot recommend a ‘mechanical’ buy if it touches the green line on Monday. My gut feeling is that the trade would make money, but there’s no compelling reason to cast discipline aside. There’s a potential gain of around $6400 per contract on a one-level move to p=20.60. however, so don’t feel constrained from trying if you know how to keep theoretical risk down to $400 or less by applying ‘camouflage’ on the five-minute chart. ______ UPDATE (Aug 8, 11:35 p.m.) With an easy pop through p=20.54 today, and then a relaxed consolidation above it, September Silver looked terrific. If it closes higher on Tuesday, that would strongly imply the rally is destined for a minimum 21.62, the D target shown here. _______ UPDATE (Aug 11, 5:10 p.m.): A drop to x=20.00 would trigger an attractive ‘mechanical’ buy, stop 19.46. With about $2600 of initial risk per contract, the trade is recommended only to those familiar with ‘camo’ set-ups who can pare the theoretical risk down to $200 or so,

SIU22 – Sep Silver (Last:20.26)