The Morning Line

Soft Landing Fantasies

Those who think the wizards at the Fed have engineered a soft landing for the grotesquely pumped U.S. economy are in for a rude awakening. Strip out the “wealth effect” from mega-cap stocks driven mostly by hot air and short covering, and the economy is already in recessionary muck. Although yacht sales reportedly are still brisk and nearly every American has booked an exotic cruise, retail sales to the broad middle class have slipped so badly that even lowly Dollar Tree is struggling for air. Consumer confidence has begun to fall because wages are again losing ground to inflation. A look ahead is even more dispiriting with AI breathing down everyone’s neck, since it is potentially the biggest job-killer the global economy has ever faced. While work-saving innovations may have created more jobs than they’ve destroyed, it’s difficult to imagine how that will happen in an era where the machines themselves are capable of rooting out inefficiency more ruthlessly than any human could.

Tesla as Savior

So what would a soft landing imagined by Wall Street look like? It would probably start with a 10%-15% selloff in stocks– not quite a statistical bear market, just enough to allow investors to do some bargain-hunting ahead of the next big run-up. Car manufacturers would sink into genuine recession, but it would be cushioned by Tesla’s unique ability to ride out the storm with fabulous high-tech innovations yet to be imagined. Tesla shares have already fallen nearly 60% from their 2021 highs just above $400, so the worst, we’ll be told, may be past. The Street’s spinmeisters would also be fixated on the prospect of lower fuel prices, lower inflation and lower interest rates. The mainstream media, too stupid and lazy to deviate from the popular narrative, would give these fantasies a boost with headlines that see the bright side of, in this case, a slide into the deepest economic morass since 1973-74.

Market’s Insanity Is Tightly Scripted

Speaking of my fellow gurus, our switchboards have lit up to warn that something big is looming. Even the oddballs who think stocks are headed much higher seem to agree that a punitive correction is long overdue. And although each of us would like to believe that the arrival time of whatever dreadnought is coming will precisely match our individual forecasts, Friday’s Kabuki drama on Wall Street drove home the reality that none of us stands a chance of being exactly right.

What an extraordinary day it was — far freakier, even, than we have come to expect on a Friday. As the Dow Industrials steamed higher, Nasdaq stocks were getting savaged. The high-fliers in particular suffered a memorable drubbing, unable to lure buyers for most of the day. These behemoths have been egregiously misnamed The Magnificent Seven, but there is nothing magnificent about them at all; they are just flying pigs, bloated with enough hydrogen to levitate a million Hindenburgs. A cynic would say the zeppelin fleet’s smoking room is located in the Eccles Building.

Jackpotters Numbed

Call options went begging for bids on Friday as well, discouraging Rick’s Picks subscribers from even thinking about the ‘jackpot bets’ we sometimes make when stocks look ripe for a suddden mood change.

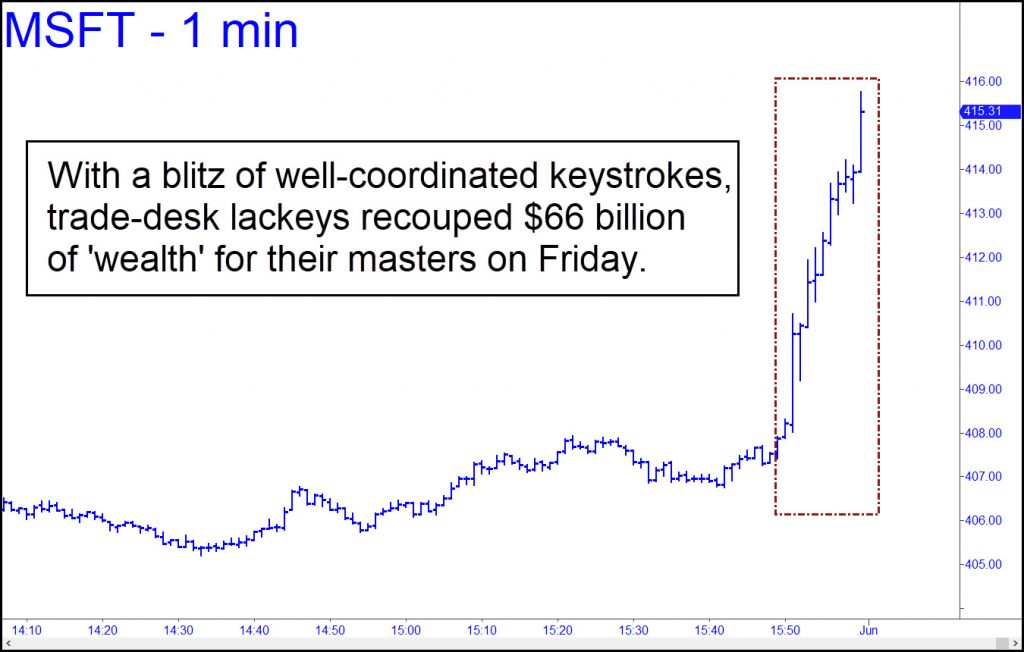

And then came the blitzkrieg! As the Dow rally went vertical, a thousand bogged-down stocks got caught in the vortex, rising like a spout to finish the day with miraculous, modest gains or little net change. The craziness was most intense in the final 30 minutes, demonstrating the remarkable agility of trade-desk lackeys who have mastered the tactic of rotating your hard-earned dollars from one flavor-of-the-day to the next.

Repo Man Thwarted

It was Microsoft, the world’s most valuable company, that had led the way down. The software giant got sacked for a 3.5% loss on Thursday and was down an additional 2.5% at mid-session on Friday. In wealth-effect terms, this represented a loss of about $180 billion. But before the repo man could seize a single yacht or Cessna Citation, Microsoft trampolined exuberantly off its lows, pushing the Nasdaq and virtually all the lunatic stocks into one of the steepest, broadest ascents in recent memory. Presto! The alarming divergence between the Dow and nearly everything else was cured. It all happened in the final trading moments of the month, tape-painting so brazen as to make a joke of the SEC and other supposed “regulators” of securities markets.

The stock market may in fact be in a topping process. However, it has already grown sufficiently complex and drawn-out to moot the bombast of swamis who would claim to have foreseen whatever is coming. Even the Wharton-educated thieves who manipulate the markets don’t really know, and any pretense of knowing is just hubris.

Do You Exit Now, or on Borrowed Time?

Is the bull market about to come crashing down, or will we have to wait until autumn when such disasters traditionally occur? I’m a traditionalist myself and expect the bear that’s looming to usher in America’s umpteenth panic and sixth full-blown depression. The hard times ahead will see the collapse of private and public pension systems, the triaging of Medicare, relentless waves of bankruptcies, and the rewriting of most mortgages so that the current occupants can stay on as tenants or sharecroppers. The dollar will be very strong, but not in the good way, since debtors will have to make payments unto death in hard currency. All of this is unavoidable no matter what you read; it is only a question of when.

There will always be optimists who think the bull market is never going to end, but they are obviously not paying attention. They have much in common with delusionists who still think the covid “vaccine” was a blessing even though it has killed millions and continues to stop athletes in particular dead in their tracks. Many still adore the pathological liar Fauci, and Facebook’s Zuckerberg, who financed enough ballot harvesting in 2020 to subvert the election. The true believers are so crazy they probably believe that Nvidia, having achieved a $3 trillion valuation, is about to double again in the next 12 months.

Wave Theorists ‘Divided’

So why do we think the bull market begun in 2009 still has a ways to go? For one, although Elliott Wave experts seem divided on whether the top is already in, some of the better ones (Walter Murphy, for one) have noted that market breadth — the percentage of stocks participating in the rally — has not gone sufficiently out-of-whack to set up the haymaker. Concerning seasonality, there was an interesting note posted in the Rick’s Picks chat room last week. It turns out that although investors are well-advised to “go away in May,” this isn’t because U.S. stocks are likely to collapse in the summer, which they have never done, but because they tend to turn sullen when the Masters of the Universe head for the Hamptons.

There is also the chart comparison we featured here recently between AI superstar Nvidia and RCA, investors’ must-own fave during the Roaring Twenties. Although the latter made a sensational high in the spring of 1929, it was the slightly higher high in October that mutated into disaster. To replicate this, NVDA would have to recede to around $900 from last week’s rabid leap to $1065, then rally to a marginal new all-time high in August/ September. IBM traced out a similar course in 2008, as a chart published here a few weeks ago showed. The point was that second-wind rallies to marginal new heights are not only seductive enough to cause bulls to go all-in, but also to create feverish short-covering spikes that are unlikely to be surpassed.

Bottom line: Even if the first scenario gives investors a few months to prepare for the worst, there are no guarantees. You must act now or face the possibility of getting trapped with no chance of escape. The alternative, grazing with the permabulls, does not look like a winning plan with the federal deficit growing by a trillion dollars every 100 days, every penny of which must eventually be repaid with interest. We keep hearing about how “strong” the economy is, but it would need to be growing at 10% a year to keep us from drowning in debt.

Silver Eager to Settle a Score

The white-collar thieves who manipulate bullion appear to be losing their grip. Silver bulls have long wondered how prices could languish even when demand for physical appeared to overwhelm dealer supplies. Blame paper proxies for precious metals, since many if not most investors would rather store and swap the stuff in virtual form than pay to insure it in a rented vault. Bullion bankers love it that way, since they can sit on actual bars and ingots, loaning them at interest, or borrowing them for next to nothing, while everyone else trades up a storm of near-gold and near-silver pledges and IOUs.

The white-collar thieves who manipulate bullion appear to be losing their grip. Silver bulls have long wondered how prices could languish even when demand for physical appeared to overwhelm dealer supplies. Blame paper proxies for precious metals, since many if not most investors would rather store and swap the stuff in virtual form than pay to insure it in a rented vault. Bullion bankers love it that way, since they can sit on actual bars and ingots, loaning them at interest, or borrowing them for next to nothing, while everyone else trades up a storm of near-gold and near-silver pledges and IOUs.

However, the steep price rise lately has threatened to upend this arrangement by increasing demand for actual bullion. Ordinarily, the thieves, a sleazy cabal that includes some of the biggest banks in the world, have relied on ‘Mr Slammy’ to rescue them. He appears on the scene whenever they pull their bids and let prices plunge to relative bargain levels. Within the last month, we’ve seen downdrafts in gold of $80 and $130 respectively, and similar moves in silver. Unfortunately for the bad guys, prices have rebounded too quickly in each instance to allow them to replenish their doubly hocked inventories on-the-cheap.

Short a Billion Ounces

Now it looks like they’re about to get creamed. Last week, July Silver broke out on the weekly chart with enough force to imply it will reach a minimum $37 an ounce. That would represent a 16% move on top of the already impressive 28% gain achieved since late March. The chart would seem to allow little respite for the bullion bankers. (If any of you ass-bandits are reading this, the ‘hidden’ resistance at 32.419 shown in the chart could be your last chance to get ’em back below $37. (Note: Just one player alone, Bank of America, is short a reported billion ounces).

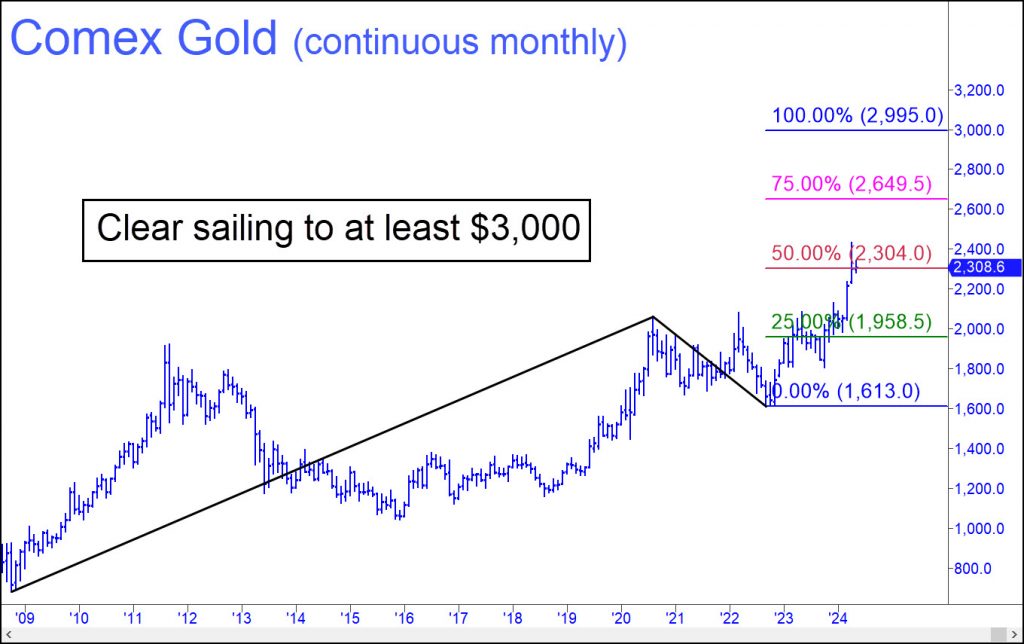

Gold’s chart differs significantly and suggests bulls could struggle at $2489, basis the June Comex contract. That is just $69, or 2.3%, above Friday’s close. Please be aware that if June Gold hits that ‘Hidden Pivot’ at the same time July Silver touches 32.42, it could spell trouble for bulls. However, my hunch is that silver’s more bullish chart will prevail, and that gold will enjoy further gains comparable to Silver’s expected 16%. That would put June Gold at $2807, exactly $388 above Friday’s settlement price. [Although gold stocks can be bought and held for the long-term, silver stocks are different. Read why by clicking here for a free, two-week trial subscription with instant access to the Rick’s Picks chat room. No credit is card necessary.]

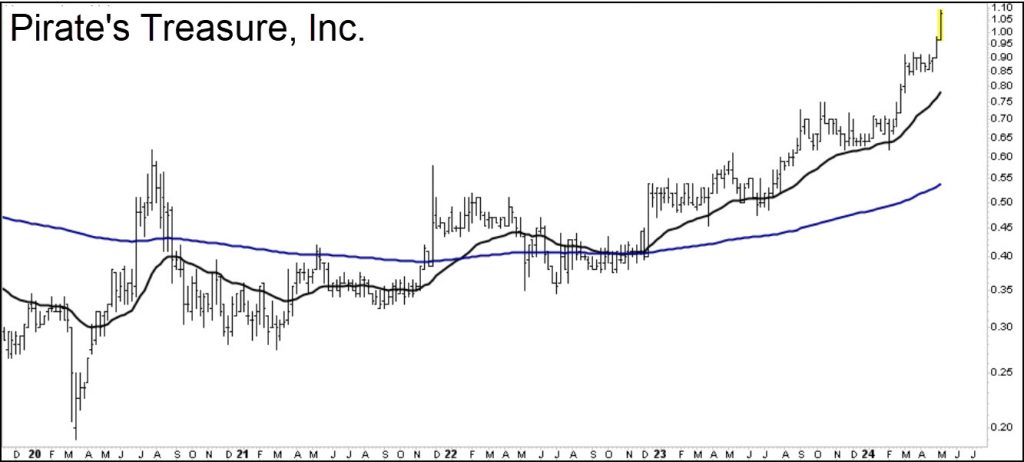

Don’t Be Fooled by Gold’s Stealth Bull

Although there is no publicly traded company called Pirate’s Treasure, the impressive price history displayed in the chart above is real enough. The Canadian company holds royalties to five gold mines that could conceivably rank among the largest in the world someday, according to ‘Spartacus’, a Rick’s Picks regular known for his street savvy, his encyclopedic knowledge of the mining world, and his insightful posts in the chat room. The stock is a classic ‘be right, sit tight’ winner, he says, and enviable profits will be made by investors patient enough to play the waiting game.

Although there is no publicly traded company called Pirate’s Treasure, the impressive price history displayed in the chart above is real enough. The Canadian company holds royalties to five gold mines that could conceivably rank among the largest in the world someday, according to ‘Spartacus’, a Rick’s Picks regular known for his street savvy, his encyclopedic knowledge of the mining world, and his insightful posts in the chat room. The stock is a classic ‘be right, sit tight’ winner, he says, and enviable profits will be made by investors patient enough to play the waiting game.

If you want to find out the real name of ‘Pirate’s Treasure’, and of similarly promising stocks that are routinely discussed in the chat room, click here. This will give you free access to all the features and amenities of Rick’s Picks, including provocative commentary and actionable ‘touts’ for such popular vehicles as the E-Mini S&Ps, crude oil, gold and silver futures, the Dollar Index, TLT, bitcoin, Microsoft and Apple. Put and call options are a specialty, with occasional ‘Friday jackpot bets’ intended to at least double or quadruple one’s stake in an hour or less. (Certain caveats apply, as noted in the disclaimer below.) There are also two chat rooms that draw some of the best traders in the blogosphere. One of them is devoted mainly to timely trading ideas; the other, a ‘coffee house’, to more freewheeling discussion.

Fahrenheit 430.58

Technical forecasts in the touts section are often precise-to-the-penny, but also intuitive. There is MSFT, for instance, which has served lately as our #1 bellwether for the bull market. We predicted in a headline last year that a 430.58 high in the stock could signal the end of the grandaddy of all bull markets. This forecast is still viable and could prove prescient, since MSFT topped at exactly 430.82 seven weeks ago and has yet to exceed that number, a major ‘Hidden Pivot resistance’.

The current topic du jour is the newly resurgent bull market in bullion. Unsurprisingly, some of the biggest skeptics are gold bugs who have grown used to having their hopes crushed by ‘Mr. Slammy’ whenever gold and silver stage a promising rally. It is predictable nonetheless that bullish sentiment will eventually carry the day, bolstered in no small part by Spartacus and other chat-room stalwarts who recognize the stealth character of the current phase of bullion’s long-term uptrend.

No Second Chances

“Regarding the idea that gold and silver were going to get crushed,” he notes, “I have been saying for two months that the pullbacks would be quick and shallow. That’s just what we have seen. The psychology of market sentiment was revealing the cards for us all to see. I watched a video this weekend of some British guy laying out in great detail the correction going down to $2.000-2,100. That’s just what everyone wants so they can get aboard. Sorry, but Mr. Market is not going to give them a second chance.”

For a free two-week pass to one of the liveliest threads in the trading world, click here — and be sure to introduce yourself when you enter the room for the first time. See ya there!

Gold, Oil and Putin’s Grand Plan

Some of you may remember Gary Liebowitz, a troll that I 86’d from the site years ago. He still harangues me now and then, and I am saddened to report that his rage has only worsened, especially where Trump is concerned. Here’s a pungent note from Gary that just plopped into my email box. I am reprinting it here because it casts him in a role he was born to play: useful idiot.

Your deflationary theory has already been proven wrong as the current market is careening towards a TOP as it and YOU ignore the real signs of a 40-year INFLATIONARY Cycle that has started. As predicted by Warren Buffet himself when discussing cycles. He acknowledged this pattern. The dollar is moving UP (WITH) rising Inflation. 10-year note will oblige. In an election year the FED will be FORCED to sit on its hand even if clear signs of inflation are seen.

Your refusal to accept the current reality matches you love of a fascist. From Rape, extortion, sedition, and treason there is no act Trump can commit that will allow you to change your mind. Rigid fanatical cult-like thinking is always a prescription for disaster. But since 50% of this nation believe as you, I can only conclude the recent fascist Hitler with his 12 year reign is more common and repetitive than anyone thought possible.

Millennials’ Burden

Gary hasn’t gotten everything wrong. I’d have to concede, for one, that I did not foresee the current round of inflation. However, I still believe that a catastrophic deleveraging — aka deflation — is the only mechanism through which public debts that long ago ceased to be repayable can be discharged. The inevitable bear market in stocks, postponed by fiscal and credit stimulus of almost unimaginable proportions for far longer than any of us gloom-and-doomers could have imagined, remains the most likely path to debt settlement and a Second Great Depression.

In the meantime, even as prices continue to rise, the quality of consumer goods and services is continuing to fall, deflating our standard of living. Kiosks and keypads are replacing humans everywhere, restaurants are serving cheaper cuts of meat, and telemedicine is being used increasingly to triage healthcare. Granted, Baby Boomers are still getting their artificial hips, knees and stents. But the inability of Millennials and Gen-xers to pay for them is rapidly eroding and will be laid bare in the next recession. ‘Deflation’ in goods and services will be a feature of our lives from now on, no matter what their price.

Which brings me to Tom Luongo‘s April edition of Gold, Goats ‘n Guns. (To read every insightful word of it, click here and subscribe for $125. His geopolitical analysis is in a class by itself. If you prefer provocative, outside-the-box thinking to the unmitigated swill we get from TV’s talking heads and the MSM, this will be money well-spent,) Luongo details how Vladimir Putin has cultivated alliances that are re-shaping the way we pay for energy. This can only erode the U.S. dollar’s hegemony over time. The Russian leader has put his money where his mouth is, selling off Russia’s $100B hoard of Treasury paper and inspiring other sovereign entities, including a few that are not explicitly hostile toward America, to follow suit.

Crap Dollars

This is moving the world toward an economic system in which gold will increasingly supplant dollars as a medium of exchange, says Luongo. I’ve always thought this unlikely, if not impossible, simply because it is so cheap and convenient for energy users to pay for it with debt-based, crap money — i.e., dollars that are effectively in infinite supply. Of course, OPEC and other producers have understood all along that they were being paid in snide for a commodity that is strategically and economically indispensable. But they were able to demand enough snide in return for their real stuff that no Saudi Arabian, Qatari or Kuwaiti prince has ever wanted for a garageful of Lamborghinis in every color of the rainbow.

The question is, will today’s profligate users of energy — i.e., all of us — be able to afford it if we have to pay for it with the hardest currency of them all, gold? We’ll see who blinks first in the next recession, when demand for crude falls. Regardless, the strong rise we have seen lately in gold’s price looks certain to continue. It will be boosted by the increasing success of Putin & Friends in creating alternative bullion markets that bypass the criminally rigged, paper-shuffling bourses of Chicago, London, Zurich and Hong Kong.

Paper-Shufflers

An additional question for Tom is whether there can ever be a substitute for the U.S. dollar as the world’s reserve currency. The shaky global banking system is vastly larger than energy markets, aggregating into the quadrillions of dollars, and the crooks who run it are far more numerous and devious than their colleagues in the oil and gas business. These commodities serve as the collateral for the world’s primary business, which is, by far, shuffling paper. Under the circumstances, it’s hard to see how the hyperleveraged derivatives markets that facilitate the conjuring of cosmic amounts of ‘wealth’ from thin air can be replaced without causing the collapse of the existing edifice. De-hypothecation will be the hallmark of the coming deflation, spiking short-term demand for actual dollars so that a currency that is fundamentally crap fleetingly becomes nearly as good as gold.

Red-Hot Nvidia Recalls RCA Mania of 1929

The chart above shows RCA’s spectacular climb to the Mother of All Tops in 1929. The larger chart that frames it shows what Nvidia shares would have to do to replicate the peaks and troughs that set up RCA’s plunge into hell. Notice that the stock’s final top (#4) was just marginally higher than one recorded six months earlier. NVDA’s chart would look nearly identical if the stock were to hit 1000 in May. It got a potential running start on this with last week’s 120-point leap to 877.35.

The chart above shows RCA’s spectacular climb to the Mother of All Tops in 1929. The larger chart that frames it shows what Nvidia shares would have to do to replicate the peaks and troughs that set up RCA’s plunge into hell. Notice that the stock’s final top (#4) was just marginally higher than one recorded six months earlier. NVDA’s chart would look nearly identical if the stock were to hit 1000 in May. It got a potential running start on this with last week’s 120-point leap to 877.35.

Nvidia is the dominant supplier of hardware and software for AI and makes a good comparison with RCA. The latter had a commanding position in one of the hottest games in town, home entertainment. The company’s console radios and record players provided a big step up from the days when a spinet piano in the parlor was the main source of music in the home.

How Hot Is Nvidia?

So how hot is Nvidia? Two months ago, it became the third company in U.S. history to achieve a $2 trillion valuation. Moreover, it reached that benchmark just 180 days after hitting the $1 trillion mark. That compares with 500 days for the two biggest companies, Apple and Microsoft. Nvidia is also regarded as one of the most exciting places to work in Silicon Valley at a time when many firms have been downsizing. Half of the firm’s workers reportedly made more than $228,000 last year.

The company’s hold on investors’ imagination of the future has produced a buying mania in the stock that is every bit as heated as the one that occurred in RCA nearly a century ago. Will their charts ultimately coincide, implying a bloodbath ahead? Quite possibly not, especially if the coincident charts become too widely observed in the weeks ahead. Even so, if a push above $1000 generates enough bullish hubris, that would be reason enough to take the similarities between the two charts seriously.

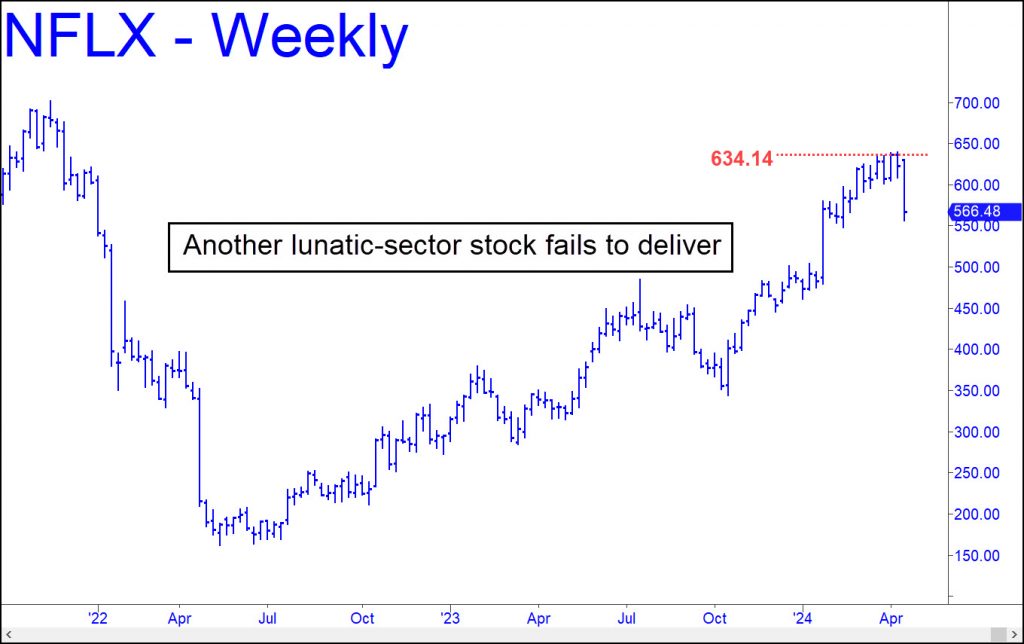

Prepare to Sell in May and Go Away

The portfolio managers who rig the markets appear to be losing their touch. Usually, they are able to short-squeeze stocks in the ‘lunatic sector’ — our label for the egregiously mis-named ‘Magnificent Seven’ — when earnings are announced after the close. This quasi-criminal manipulation can add hundreds of billions of dollars to the world’s ‘wealth effect’ in a literal blink of an eye when it occurs in a mega-cap stock such as NVDA or AAPL. But the greedy con-game conspicuously failed to ‘grow wealth’ on Friday after Netflix reported adding droves of new subscribers in the previous quarter. The good news supposedly caught dull-witted analysts by surprise, even though a half-smart chimpanzee could have seen it coming after Netflix put the screws to millions of viewers who had been using friends’ passwords. The stock should have vaulted into outer space, since, in a bull market, all earnings announcements are treated as wildly bullish regardless of whether the news is actually bullish. That’s how bull markets work.

Not This Time

Not this time, though, Instead of taking the obligatory short-squeeze leap into outer space, Netflix feebly head-faked to stop out a $640 peak from ten days earlier by a paltry $1. That peak and Friday’s slightly higher one merely dented a Hidden Pivot resistance at 634.14 that we’d told subscribers a couple of weeks ago could cap the bull-market. On Friday, if everything had gone according to the script after earning were announced, the stock should have begun to gyrate wildly, allowing DaBoyz to work the swings like killer whales herding dolphins. Lo, NFLX simply continued to fall, ending the day $90 below the fake-out high.

Ordinarily, we wouldn’t read too much into DaBoyz’ failure to hold NFLX aloft so that they could distribute millions of shares to widows, pensioners and orphans. But taken together with Microsoft’s month-long failure to surmount a $430.58 target we’ve been drum-rolling loudly since 2023, it suggests the 15-year-old bull market is struggling for air. Bottom line: If MSFT continues to pussyfoot beneath $430 and to fall further from the ‘Hidden Pivot’ with each selloff, investors had better prepare to pack up in May and go away.

Springtime for Bonds?

The devastating bear market in Treasury paper since 2020 may be nearing an end. I was pessimistic about this myself when TLT, an exchange-traded fund, that tracks the long bond, broke down last week. But a bigger picture saw this as occurring in the context of a market that may have bottomed last October. The bounce from that low triggered a theoretical ‘buy’ signal in bonds in mid-December when it touched the green line shown in the chart.

Don’t expect a meteoric rise, however, since it could take a while for T-Bonds to build a base for a sustained move higher. Assuming the 107^04 low holds, however, the worst may be over. That would imply that long-term rates, currently at 4.53% for 30-Year T-Bonds and 4.38% for the 10-Year Note, have peaked. In any event, I do not expect them to exceed the highs they achieved in October at, respectively, 4.99% and 5.15%.

Debt’s Real Cost

I should point out that this is not necessarily cause for jubilation, especially if recession causes asset values to deflate. That would return us to the financial environment of the 2007-08 Crash, when even 4% mortgages placed a crushing burden on homeowners whose property values had gone underwater. It is real rates — yield minus inflation — that ultimately matter, not nominal rates. Unfortunately, there is no escaping the debts we have amassed publicly and privately, and there are reasons to strongly doubt that those who owe will get to stiff creditors via hyperinflation or even sustained inflation. Regardless, and irrespective of the nominal level of rates, payback will exact a heavy toll on future production and our standard of living.

At Ringside for Another Freaky Friday

[Many readers of these weekly commentaries may not be aware that the focus of Rick’s Picks each day is on timely trading ideas. Below is chat room banter for a typical ‘freaky Friday’. The discussion includes several trades that were posted ahead of actionable opportunities in a few stocks, including McDonald’s, Tesla and Amazon. All the links are live, most of them displaying charts with the ABCD patterns we use to trade. Some display two key pieces of the pattern: Hidden Pivot midpoints (p) and targets (D). For some of you, the jargon might take a little getting used to. However, trade instructions are usually phrased so that even beginners can follow them. There is a separate chat room called the Coffee House for off-topic conversations where ‘anything goes’. IF you’d like to sample Rick’s Picks, click here for a free two-week trial subscription. RA ]

Microsoft’s Hat-Trick

8:55 Rick: MSFT setting up for a hat-trick of mechanical winners — or will it be a rare failure?

09:00 Formula382: Looks like a trampoline Rick. Ya need that energy to get the bouncy bounce.

09:52 Rick: I just sent out a tout update for MSFT that offers a perspective on the bounce.

10:03 Formula382: Anyone in here have any idea how nat gas sits in the dumpster while the pipelines have been quite good to own for example, KMI, OKE, KYN, FCG. I own them all, but that was based on the predication that “surely nat gas has to go up”, which it has not!

10:07 Spartacus: McDonald’s… A trouper

10:14 Rick: Here’s my MickeyD prognosis

10:22 Spartacus: Now Short NVDA and TSLA using Apr 12 puts

10:23 Spartacus: MCD Thanks Rick I think I will cover off of that chart

10:23 Ronbl: Gold is obviously going to go up but will bitcoin really do the same? Seems like bitcoin is following the market

10:25 Rick: Bid 0.55 for expiring MCD 267.50 calls to bottom-fish the 267.05 target. Order good till 11:00 a.m.

10:27 Spartacus: MCD Cover the MCD short by buying back the calls. Profit $11,900 Thanks for the help Rick. OK lets spec on the bounce

10:27 Rick: Ur welcome. Great trade, Sparty!

Did We Get Front-Run?

10:30 Spartacus: MCD 167.5 calls.. Did we get front run?

10:35 Rick: Not sure. The so-far low at 267.30 missed my target by 0.25, or less than 1/10 of one percent. Seems close enough for us to consider the target fulfilled, but I’ll leave the 0.55 bid in for the calls anyway. They expire tomorrow and are already melting away; that’s why I am lowballing my bid and time-limiting it. The offers are skittishly high, but I’d rather not buy the calls at all than pay up for them. That’s because their volatiity will get crushed if the stock does rally from my target.

10:41 Spartacus: TSLA grinding away at P level. Very sickly action. Still a short IMO with fresh money. I am holding short.

10:45 Spartacus: All the newbie nervous nellies (NNN) bailed on their big gains in the PM sector fearing losing the initial gains. But it’s powering higher.

10:49 Spartacus: MCD right there 167.1

10:53 Rick: Your question has been answered: The 267.05 target did get front-run. This is certain, given the way the stock played toe-sies with it for ten minutes. So many are evidently aware of the target that it is now predictable that it will be breached. Lower the bid for the calls to 0.40.

10:53 Spartacus: OK who is the spy in here?

10:56 Spartacus: I guess I need an education. Why if it got slightly front-run will it actually lead to it going lower?

10:56 Rick: The pattern would have generated a trampoline bounce in the past. However, the ability of dolts and riff-raff to read fairly gnarly patterns is continuing to evolve.

10:59 Rick: I am expecting more of a relapse based on the ‘gangs-all-here’ buying I was seeing just above the target. Bulls went all-in, leaving no one to buy MCD back up to 270. How much lower than 267.05 this impending relapse goes will tell us how big the crowd of village idiots was that were able to identify 267.05. // UPDATE 11:10 a.m.) It’s starting to look like a Village Idiots Convention at 267. I’m canceling the call bid. They will make money, but not enough, and it’s already been too much work. The goal is to buy the calls and have them go instantly in-the-black. These calls will struggle when the stock finally turns.

11:08 Spartacus: TSLA just cracked

Notice Gold’s Bounce…

11:13 Killington: Notice how gold bounced off Rick’s 2344 target.

11:14: Rick: That target was for the August contract. THE KEY NUMBER FOR THE JUNE IS 2356.90!

11:15 Rick: MCD now looks like it will turn from 266.53, a target that the riff-raff will NOT have figured out. // UPDATE: Sorry, but I cannot keep up with the new option-trading opportunities. Can’t post AND trade myself.

11:18 Henry608: GDXJ/NEM/GOLD all closing in on targets. When they trade like this it always brings doubt that the move could possibly stop. Begining to downsize positions. Just talking out loud.

11:21 Spartacus: Sold TSLA Apr 12 175 puts bought an hour ago.. Profit $8,000

11:26 Roxygroove: Which strike did you use for TSLA, Sparty?

11:28 Rick: Urgent update just mailed out re June Gold. Target, as noted above, 2356.90. This pattern is fairly gnarly and should be expected to work precisely.

11:29 Spartacus: See above: 175

11:40 Spartacus: Close in silver objective:…..

11:42 Spartacus: BOT 150 MCD 167.5 calls avg price 0.40… look at it run!

11:45 Rick: 150! I admire your patience and perspicacity.

11:46 Spartacus: I’m out of the MCD 167.5 calls. Excellent guidance Rick… Profit $4,500

11:46 Spartacus: But I sold too early… Way too early!!!!

11:50 Spartacus: Gave up on the NVDA puts. Sold and took a $2,200 loss

11:57 Roxygroove: Still impressed by your trading, Spart.

12:00 Spartacus: AYA Silver… breaking out. This one is a coffee-can keeper. (no trading, just hold)….

12:01 Spartacus: The the two MCD trades will buy a lot of Big Macs!

12:02 Henry608: Great call on NEM Rick. Didnt take the whole ride, but scalped a nice move in the middle.

12:08 Rick: Thanks for the upbeat report, Henry. Glad to have helped. . The stock has had quite a move — up $5, or 20%, in the last week. However, it is currently within 13 cents of the 39.33 target, so it’s time to take profits on at least half of any positions acquired at 34.80.

12:15 Rick: With NEM and June Gold just millimeters from compelling rally targets, the yellow flag is out on gold.

12:18 Spartacus: Sold another 10 Apr 19 AAPL 150 calls @ 20.7

12:21 Rick: Thanks for the timely heads-up, Sparty. Naked-shorting calls is the ticket in AAPL at the moment. The stock looks like a 95% shot of falling to 147.64, about 13% below the current 170.24.

Elation’s Downside

12:24 Henry608: I’m an old guy (67) and love your analysis. I have learned over the years that the more elated one is feeling, the more care needs to be taken. Today, for me, Gold up nearly $40, after already large moves. Elation all over. Can it break and keep going? Yep. Learned a long time ago not to worry about the 20% times that happens. Love your insight and small quips every now and then. Thanks.

12:24 Spartacus: WOW did I leave a lot of money on the table in those MCD calls…..$$$$ no guts no glory

12:25 Dan: MCD moving up , still holding a few april 12 170 calls

12:27 Baplg: Does it make any sense to buy AAPL puts at 165 strike for 4/12 or 19?

12:30 Rick: It almost NEVER makes sense to buy puts. This will still hold true when the bear market begins.

12:32 Baplg: Thx

12:33 Rick: You should buy them — and calls – only when you expect your position to go in-the-black immediately. The potential for this has just been signaled in AMZN, by the way. Give me a moment to figure out a strategy for…NOW.

12:33 KGS: To anyone interested: SIK 24 – 60m, choose an ‘A’ point at the 04/01/24 11:00 ET low with a ‘C’ @ yesterday’s 22:00 ET low suggests a run with momentum over the next 1 – 2 weeks to 29.001 if it breaks above the tout level at 27.55…

12:35 Spartacus: Puts require a good sense of market timing or trading sense. Plus a whole lot of luck and good fortune. I use the shorted calls as my core short and bulk up on purchased puts and calls when a move seems imminent. Today’s example of buying 15 TSLA puts and only had to hold them for an hour is a perfect example

Cashing out of MickeyD

12:38 Dan: Sold my MCD calls for small profit

12:42 Rick: Bid 0.48 for AMZN 12 April 180 puts, day order. Currently trading for 0.78. I may adjust this price before the close, so stay tuned. We really do want to buy ’em, based on this appealingly gnarly pattern in the underlying:

12:44 Rick: This one is for novices, too — especially if you’ve never made a profitable option trade.

12:44 Roxygroove: That’s the kind of advice that helps us newer traders, Spart. Very appreciated. RA has shared some things too. Knowing strategy of ‘what to use, and when to use it’ is valuable. I know you do in-the-money and out-of-the money strikes. maybe sometime you can elaborate on reasons behind that, too.

12:46 Roxygroove: RA, your AMZN tout very timely, I oopsed and went in too early on a short call. one small correction and I’m ok.

13:00 Baplg: NEM has surpassed the 39.33 target. I see where that number came from, but don’t quickly see another

13:01 Rick: Any next target must come from a bigger pattern. The only one available — it’s a beauty that will work for trading and forecasting — is this ‘reverse’ on the daily: a= 37.45 on 11/3. Today’s price action plotted on this pattern gives NEM a VERY good chance of hitting 47.38! First, let’s see if the stock can blast free of 39.33’s gravitational pull. Anyone who trades NEM should work through this pattern to see what a glow-in-the-dark opportunity in gold looks like.

13:05 MM18: Sold 1 Apr 19 AAPL 150 calls @20.45 as per Spartacus Bid 5 AMZN 12 April 180 PUTS @ .48 as per Rick

13:24 Rick: MSFT did in fact achieve the hat-trick that began this morning’s thread, bouncing $9 to reach p= 426.07 and record a third consecutive ‘mechanical’-trade winner. This is of course bullish, adding weight to the likelihood that the tedious masturbation since mid-March has been a consolidation. This matters a great deal, since the picture threatens to brush aside a crucial, 430.58 Hidden Pivot target that has held for nearly a month.

13:43 Philjr25: Bid in April 12 AMZN

14:09 Spartacus: I just came off margin in all of my PM stock portfolio. Still holding a chunk but no longer leveraged

14:15 Ronbl: thanks Spartacus

15:04 Bill: Thanks for the reco on NEM, Rick. It has worked well for me.

16:01 Roxygroove: AMZN tout helped me ride it down to afternoon lows. i had a very minimal loss after taking a early morning position that went sideways on me. tout very appreciated,

17:00 Lasker: Rick, I have arrived here late but over the weekend. If you have any way to project a target for June Gold on the downside should it turn at 2356.90 or thereabouts, please share. Would the ‘B-leg’ of the pattern charted give any clues about likely downside?

9:02 Dan: BTW, Spartacus, I followed you yesterday and made 5k. and that makes a difference for me. Thanks so much.

10:09 Jeff: Rick, thank you for your guidance in the room on Futures. Very much appreciated.

12:48 Dan: Yes, I want to say it as well: Many thanks for 150% you give us every day.

15:25 Kerrdog: This is the perfect place to be for any trader, seasoned or new there’s constant input and learning. Thanks to all.

18:07 Rick: Thanks for the encouraging words. Glad Rick’s Picks evidently is working for you. Looking ahead to next week, you should consider all three bullion touts out Sunday evening together. The resulting picture suggests that although the bullion vehicles I track regularly have stalled at daunting HP resistances, the odds of a powerful breakout are probably no worse than 50-50. I’ve included quite a few extra charts in this week’s updates to help you judge for yourself.

04:57 Artie: Anyone? July wheat futures A11/27/23@586 B12/6/23@666 C3/11/24@537. It is already through P if I have the chart correct. Calling for lot higher prices if war starts. Did it bottom?

9:20 Rick: The chart is calling for a possible 6% move to 617.75. The rally so far has triggered two profitable ‘mechanical’ buy signals. Why worry about whether it has bottomed, or whether war will turn out to have been the cause? No one can say, but it isn’t necessary to form an opinion about either to trade July Wheat profitably.