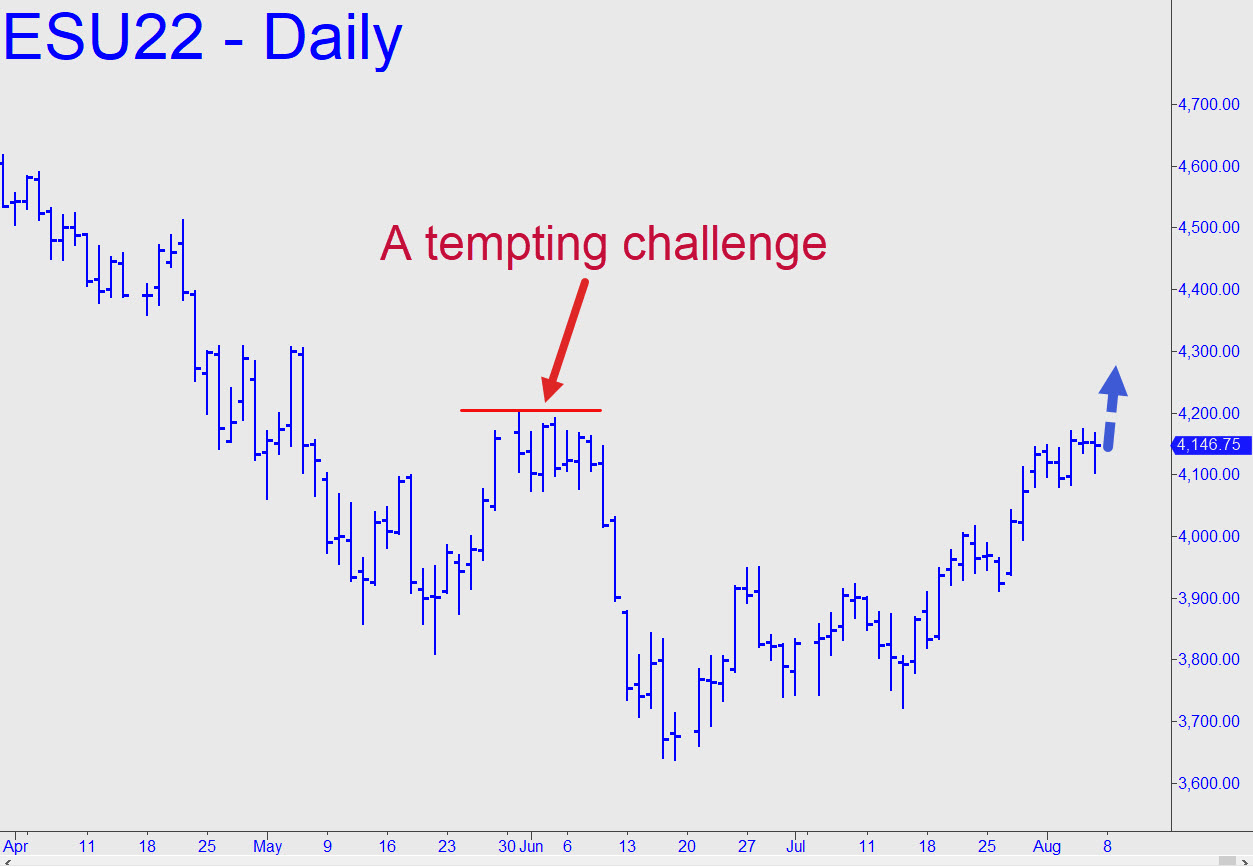

A shelf of resistance created back in June looks primed for a challenge. Short-covering bears have been the sole driver of this presumably doomed rally, now entering its ninth week. Much of it has occurred into airless gaps, with economic ‘news’ as the catalyst, and thin, off-hours markets offering almost no resistance. A push past early June’s thicket of supply looks all but certain, since the approach path has been a methodical, ratcheting process of stair-building that has consumed nearly two weeks. Once above the resistance, it’s anyone guess how far DaBoyz will be able to take this hoax. I’m going to drop a ‘c’ anchor for a reverse-pattern short near 4256, not because it’s a Hidden Pivot, but because it is in the middle of the ocean, so to speak, where bulls, bears and even chartists will be at their queasiest. ______ UPDATE (Aug 8, 11:21 p.m. ET): Dave Isham posted this pattern in the chat room today, with a bear-rally target that pessimists should keep well in mind. The D target at 4418.00 is 26.25 points higher than his, since I used a slightly different point ‘A’ low. In either case. the midpoint resistance got shredded so badly that ‘D’ should be regarded as an odds-on bet if the futures get past the middle-of-the-ocean number at 4256 noted above. _______ UPDATE (Aug 10, 7:54 p.m.): To get short, use this rABC pattern, anchoring the ‘C’ high in the range 4254.90 – 4257.70, with an implied trigger 15.73 points off a high falling within those numbers. If you get a chance to cover half 15.73 points below the price where the trade was initiated, you’ll be on your own. Please note that theoretical entry risk is about $800 per contract and that it is sufficiently cutting-edge to be labeled experimental. Spectate if you wish.

A shelf of resistance created back in June looks primed for a challenge. Short-covering bears have been the sole driver of this presumably doomed rally, now entering its ninth week. Much of it has occurred into airless gaps, with economic ‘news’ as the catalyst, and thin, off-hours markets offering almost no resistance. A push past early June’s thicket of supply looks all but certain, since the approach path has been a methodical, ratcheting process of stair-building that has consumed nearly two weeks. Once above the resistance, it’s anyone guess how far DaBoyz will be able to take this hoax. I’m going to drop a ‘c’ anchor for a reverse-pattern short near 4256, not because it’s a Hidden Pivot, but because it is in the middle of the ocean, so to speak, where bulls, bears and even chartists will be at their queasiest. ______ UPDATE (Aug 8, 11:21 p.m. ET): Dave Isham posted this pattern in the chat room today, with a bear-rally target that pessimists should keep well in mind. The D target at 4418.00 is 26.25 points higher than his, since I used a slightly different point ‘A’ low. In either case. the midpoint resistance got shredded so badly that ‘D’ should be regarded as an odds-on bet if the futures get past the middle-of-the-ocean number at 4256 noted above. _______ UPDATE (Aug 10, 7:54 p.m.): To get short, use this rABC pattern, anchoring the ‘C’ high in the range 4254.90 – 4257.70, with an implied trigger 15.73 points off a high falling within those numbers. If you get a chance to cover half 15.73 points below the price where the trade was initiated, you’ll be on your own. Please note that theoretical entry risk is about $800 per contract and that it is sufficiently cutting-edge to be labeled experimental. Spectate if you wish.

ESU22 – Sep E-Mini S&P (Last:4212.75)