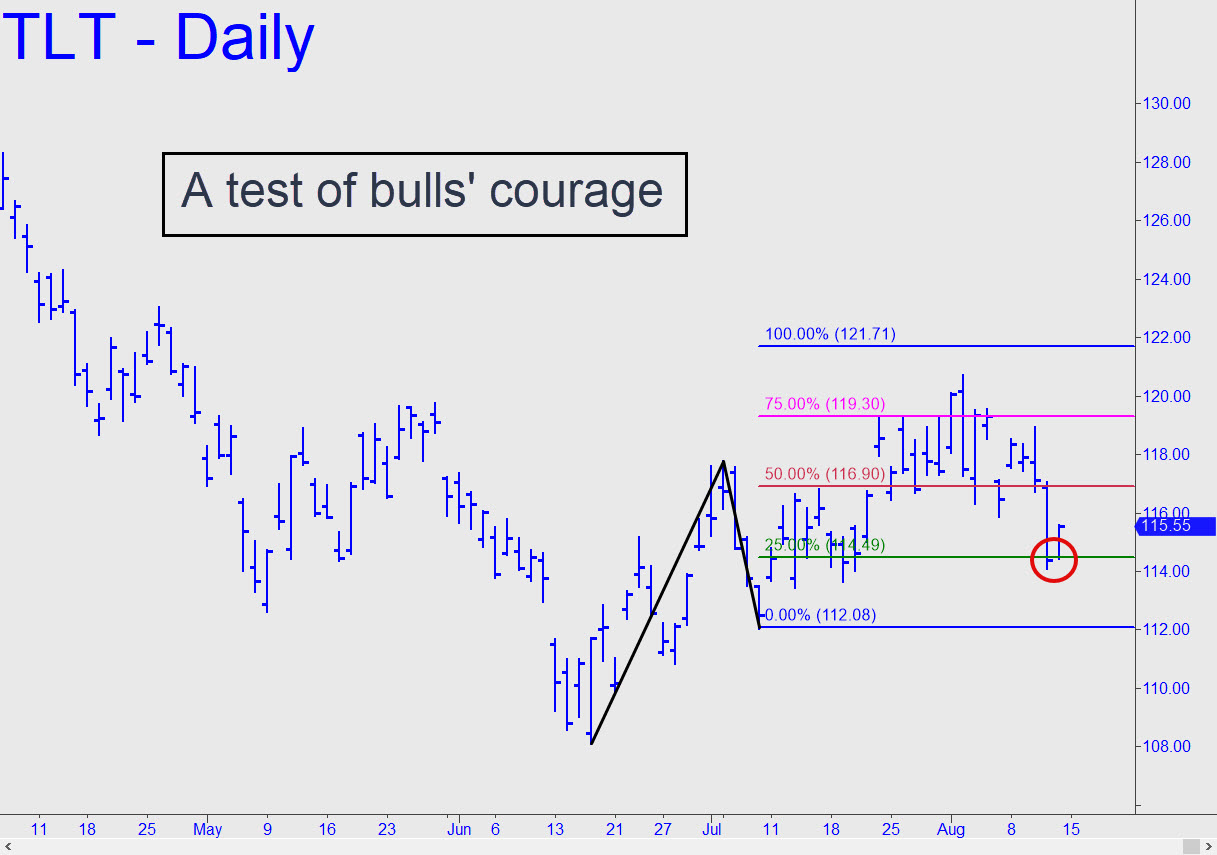

Last week’s steep fall to the green line from just shy of D will provide an interesting test of ‘mechanical’ set-ups, since they are designed to signal buying opportunities when one’s instincts shout ‘Flee for your life!’ Bulls must have been feeling like that on Thursday, when the downdraft reached a perhaps temporary bottom. It should be good enough to propel TLT to at least p=116.90, but I hadn’t recommended buying at x unless you are familiar with ‘camouflage’ set-ups that can pare entry risk by as much as 95%. Please let me know in the chat room if you took the trade and I’ll establish a tracking position if there are at least two of you. ______ UPDATE (Aug 15, 11:05 a.m. ET): The gap-up opening hit 116.75, so you should be out of half the position. I’ll use the current price of 116.17, well off the high, to establish a cost basis of 112.91 for the 200 shares that remain. Tie them to an impulsive stop-loss at 114.83 for now, o-c-o with an offer of 100 shares at 118.50 and another 100 at 119.30. _____ UPDATE (Aug 16, 5:27 p.m.): For those who actually did the trade, the stop would have taken you out today for a $384 gain. We got lucky, since this vehicle has been trading like garbage.

Last week’s steep fall to the green line from just shy of D will provide an interesting test of ‘mechanical’ set-ups, since they are designed to signal buying opportunities when one’s instincts shout ‘Flee for your life!’ Bulls must have been feeling like that on Thursday, when the downdraft reached a perhaps temporary bottom. It should be good enough to propel TLT to at least p=116.90, but I hadn’t recommended buying at x unless you are familiar with ‘camouflage’ set-ups that can pare entry risk by as much as 95%. Please let me know in the chat room if you took the trade and I’ll establish a tracking position if there are at least two of you. ______ UPDATE (Aug 15, 11:05 a.m. ET): The gap-up opening hit 116.75, so you should be out of half the position. I’ll use the current price of 116.17, well off the high, to establish a cost basis of 112.91 for the 200 shares that remain. Tie them to an impulsive stop-loss at 114.83 for now, o-c-o with an offer of 100 shares at 118.50 and another 100 at 119.30. _____ UPDATE (Aug 16, 5:27 p.m.): For those who actually did the trade, the stop would have taken you out today for a $384 gain. We got lucky, since this vehicle has been trading like garbage.

TLT – Lehman Bond ETF (Last:115.96)