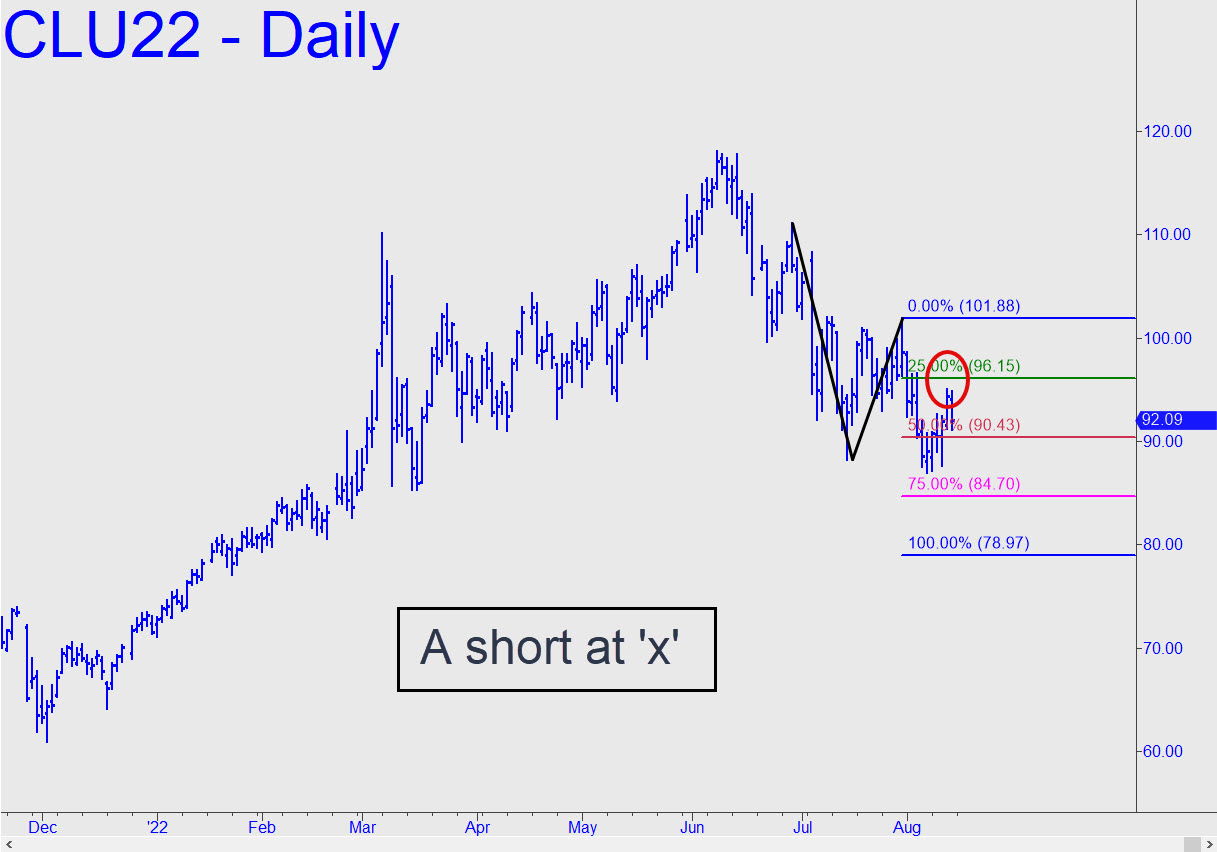

Crude would trigger a ‘mechanical’ short if it touches the green line x=96.15. However, because the impulse leg was such an agonizing slog, I can recommend this trade only to subscribers who know how to cut the implied theoretical entry risk of $23,000 on four contracts to perhaps a tenth of that. It would require close attention to ‘camouflage’ opportunities on the sub-15-minute charts, aka ‘camouflage. Merely spectating will have its rewards, since the next leg down should help snuff inflation at the pump as well as the unchecked greed of Big Oil. _______ UPDATE (Aug 15, 7:54 p.m.): Use the 81.79 target shown here as a minimum downside projection for the near term. If this Hidden Pivot support fails, the next step down would be to 78.93, calculated using A=111.14 from June 29. _______ UPDATE (Aug 18, 9:27): The failure of bears to reach p2=84.66 of the pattern shown in the thumbnail inset suggests it is on its way up to at least to the green line (x=96.11). It would trigger a ‘mechanical;’ short there, stop 101.85, but I am not recommending the trade because of the weakly erratic nature of the A-B impulse leg.

Crude would trigger a ‘mechanical’ short if it touches the green line x=96.15. However, because the impulse leg was such an agonizing slog, I can recommend this trade only to subscribers who know how to cut the implied theoretical entry risk of $23,000 on four contracts to perhaps a tenth of that. It would require close attention to ‘camouflage’ opportunities on the sub-15-minute charts, aka ‘camouflage. Merely spectating will have its rewards, since the next leg down should help snuff inflation at the pump as well as the unchecked greed of Big Oil. _______ UPDATE (Aug 15, 7:54 p.m.): Use the 81.79 target shown here as a minimum downside projection for the near term. If this Hidden Pivot support fails, the next step down would be to 78.93, calculated using A=111.14 from June 29. _______ UPDATE (Aug 18, 9:27): The failure of bears to reach p2=84.66 of the pattern shown in the thumbnail inset suggests it is on its way up to at least to the green line (x=96.11). It would trigger a ‘mechanical;’ short there, stop 101.85, but I am not recommending the trade because of the weakly erratic nature of the A-B impulse leg.

CLU22 – September Crude (Last:90.73)