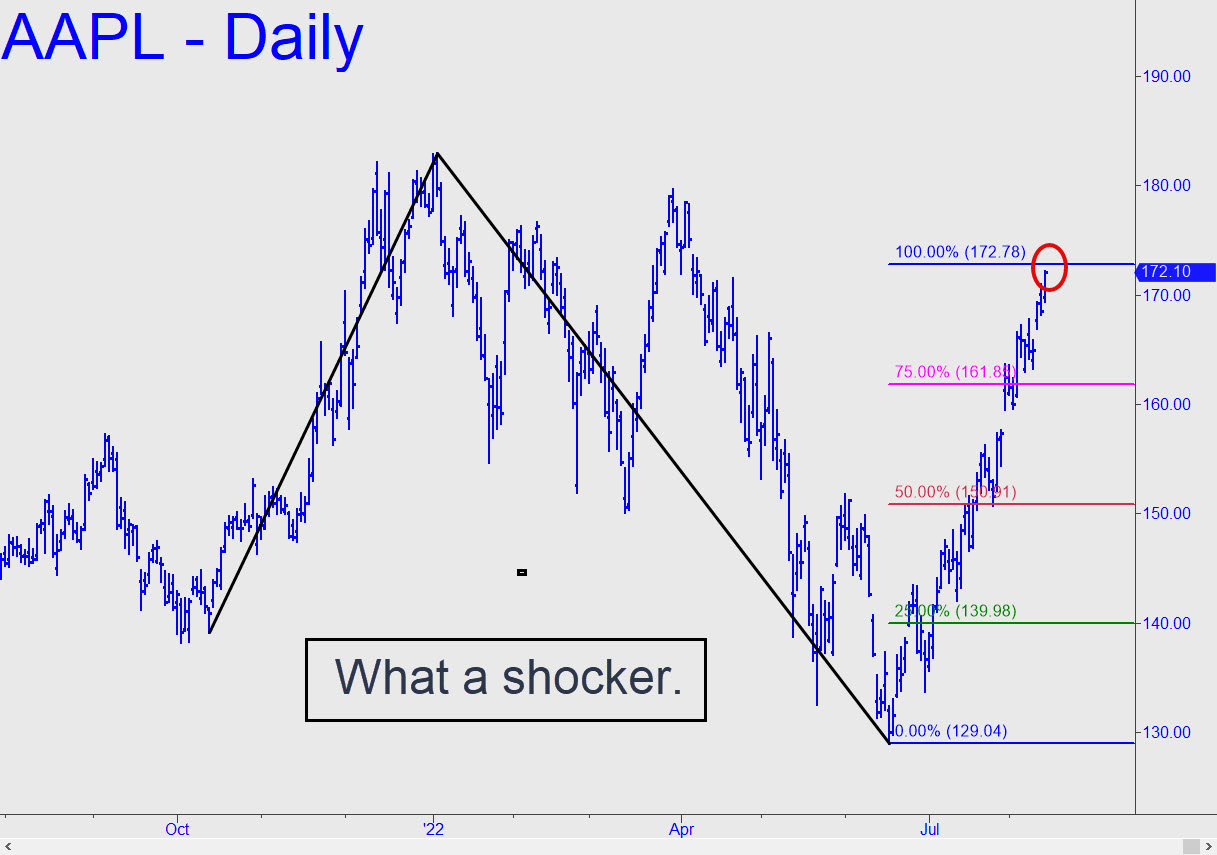

What a shocker. The no-decision monkeys who have lived off AAPL’s autopilot bull market have succeeded in levitating the stock to within a split hair of the 172.78 target I spotlighted here weeks ago. It was trading in the 140s then, and it seemed difficult to believe at the time that the stock could rise that much on punk earnings, a U.S. economy sinking into recession, and Apple Inc. unable to innovate its way out of a Glad bag. But just look at it! Another 6% and it’ll be in record territory. I’ve documented the short-squeeze tactics that were used to goose the world’s biggest-cap stock skyward with hardly any bullish buying or even cash outlays. It was a simple trick: Let the stock drop overnight until sellers are exhausted, then run it up shorts’ wazoos on the opening bell. The rally has been a fraud every inch of the way, but there’s no denying it worked. And now what? Can AAPL wait for the broad averages to catch up? Probably not, since the Nasdaq and even the FAANGs are trading closer to their bombed out lows than to their insane, all-time highs. It should be interesting to watch the DaBoyz try to vamp for a month or two while the U.S. economy continues to sink into the crapper. Stay tuned to this page and the chat room for the technical play-by-play. _____ UPDATE (Aug 15, 7:43 p.m. EDT): A feebler than usual short squeeze topped at 173.40, 0.3% above my target, so I recommended buying the expiring 165/160 put spread 16 times for 0.12. This is a 30-to-1 horse, so don’t get your hopes too high. Offer eight of them to close for 0.25, good through Wednesday and contingent on the stock trading 170.00 or higher. _______ UPDATE (Aug 17, 10:36 p.m.): Our horse is now a 90-to-1 shot, but I hope the $200 you blew on it saved you $$ thousands because you were less tempted to short the E-mini S&P futures instead. _______ UPDATE (Aug 18, 8:52 p.m.): DaBoyz were either indifferent or too lazy to try their usual short-squeeze shenanigans today, so the stock’s performance must be viewed as an honest reflection of underlying supply/demand. Since it performed poorly with an ‘inside day’ relative to the previous day’s elongated price bar, we should expect the stock to start roll down as the week ends, presumably setting a bearish tone for Sunday evening. We’ll book a $200 loss on the spread nonetheless.

What a shocker. The no-decision monkeys who have lived off AAPL’s autopilot bull market have succeeded in levitating the stock to within a split hair of the 172.78 target I spotlighted here weeks ago. It was trading in the 140s then, and it seemed difficult to believe at the time that the stock could rise that much on punk earnings, a U.S. economy sinking into recession, and Apple Inc. unable to innovate its way out of a Glad bag. But just look at it! Another 6% and it’ll be in record territory. I’ve documented the short-squeeze tactics that were used to goose the world’s biggest-cap stock skyward with hardly any bullish buying or even cash outlays. It was a simple trick: Let the stock drop overnight until sellers are exhausted, then run it up shorts’ wazoos on the opening bell. The rally has been a fraud every inch of the way, but there’s no denying it worked. And now what? Can AAPL wait for the broad averages to catch up? Probably not, since the Nasdaq and even the FAANGs are trading closer to their bombed out lows than to their insane, all-time highs. It should be interesting to watch the DaBoyz try to vamp for a month or two while the U.S. economy continues to sink into the crapper. Stay tuned to this page and the chat room for the technical play-by-play. _____ UPDATE (Aug 15, 7:43 p.m. EDT): A feebler than usual short squeeze topped at 173.40, 0.3% above my target, so I recommended buying the expiring 165/160 put spread 16 times for 0.12. This is a 30-to-1 horse, so don’t get your hopes too high. Offer eight of them to close for 0.25, good through Wednesday and contingent on the stock trading 170.00 or higher. _______ UPDATE (Aug 17, 10:36 p.m.): Our horse is now a 90-to-1 shot, but I hope the $200 you blew on it saved you $$ thousands because you were less tempted to short the E-mini S&P futures instead. _______ UPDATE (Aug 18, 8:52 p.m.): DaBoyz were either indifferent or too lazy to try their usual short-squeeze shenanigans today, so the stock’s performance must be viewed as an honest reflection of underlying supply/demand. Since it performed poorly with an ‘inside day’ relative to the previous day’s elongated price bar, we should expect the stock to start roll down as the week ends, presumably setting a bearish tone for Sunday evening. We’ll book a $200 loss on the spread nonetheless.

AAPL – Apple Computer (Last:174.15)