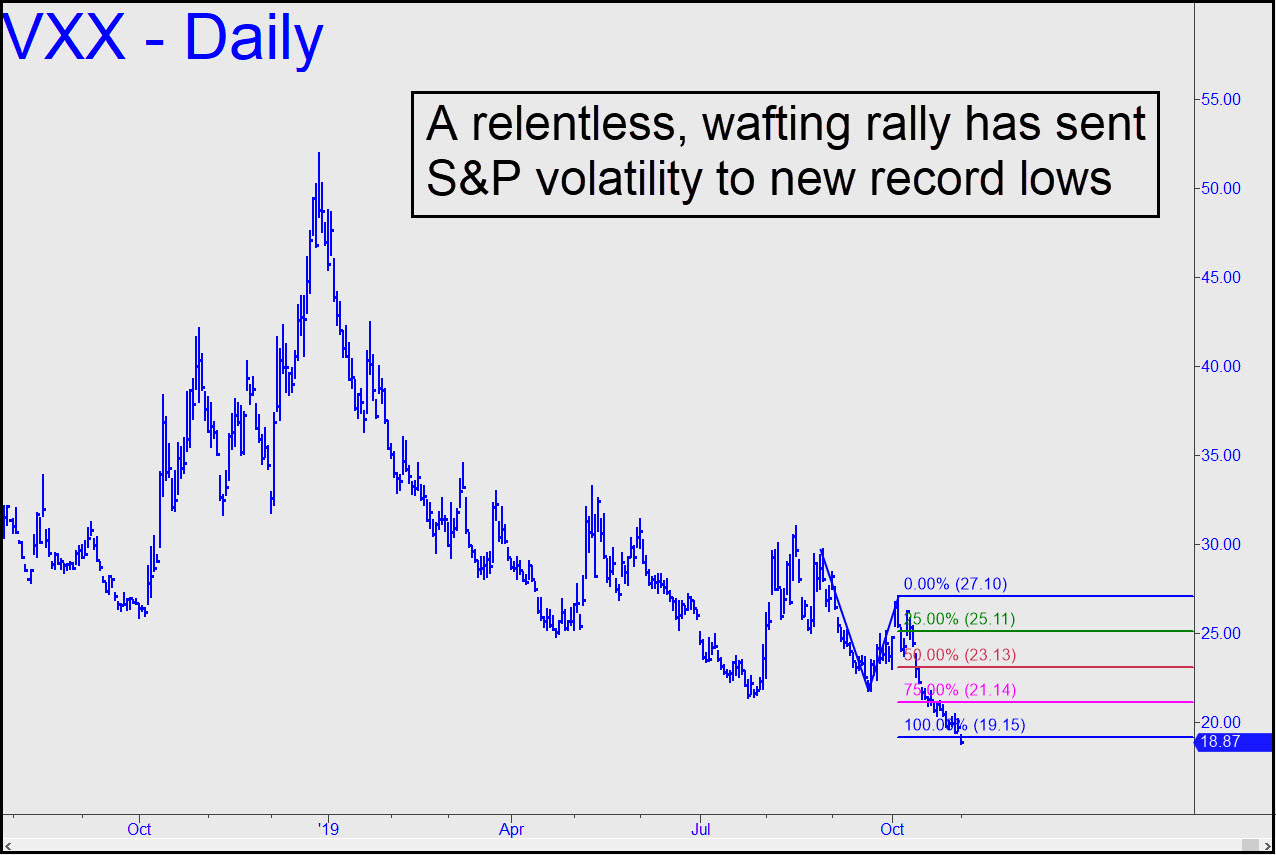

We took a small position in Nov8 21 calls Friday, paying 0.14 for four of them (or a multiple thereof). The trade was predicated on an expected turn from the 19.15 target shown. This Hidden Pivot support is not of the finest pedigree, since the A-B impulse leg from which it was derived has a point ‘B’ low that is about as sausage-y as they get. Even so, the target looks good enough to warrant a small, speculative bet, and it would be a little spooky if VXX doesn’t turn from somewhere near here by mid-week. The fact that it closed below the target, however, attests to the relentlessness of the wafting rally in the broad averages, including the S&P 500 index tracked by this vehicle. As with all option trades we do in VXX, you should have risked no more than you can afford to lose painlessly. _______ UPDATE (Nov 5, 5:52): VXX rose just enough to keep our calls alive. Offer half of them for 0.30 g-t-c, or slightly more than twice what we paid for them, as is our custom. I still don’t mind being long calls pegged to Friday’s expiration. I sure as hell would not be short them for 0.09. _______ UPDATE (Nov 6, 11:13 p.m.): I’ll suggest rolling into Nov 15 calls, again risking on this speculative bet no more than you can afford to lose comfortably.

We took a small position in Nov8 21 calls Friday, paying 0.14 for four of them (or a multiple thereof). The trade was predicated on an expected turn from the 19.15 target shown. This Hidden Pivot support is not of the finest pedigree, since the A-B impulse leg from which it was derived has a point ‘B’ low that is about as sausage-y as they get. Even so, the target looks good enough to warrant a small, speculative bet, and it would be a little spooky if VXX doesn’t turn from somewhere near here by mid-week. The fact that it closed below the target, however, attests to the relentlessness of the wafting rally in the broad averages, including the S&P 500 index tracked by this vehicle. As with all option trades we do in VXX, you should have risked no more than you can afford to lose painlessly. _______ UPDATE (Nov 5, 5:52): VXX rose just enough to keep our calls alive. Offer half of them for 0.30 g-t-c, or slightly more than twice what we paid for them, as is our custom. I still don’t mind being long calls pegged to Friday’s expiration. I sure as hell would not be short them for 0.09. _______ UPDATE (Nov 6, 11:13 p.m.): I’ll suggest rolling into Nov 15 calls, again risking on this speculative bet no more than you can afford to lose comfortably.

VXX – S&P VIX Short-Term (Last:19.12)