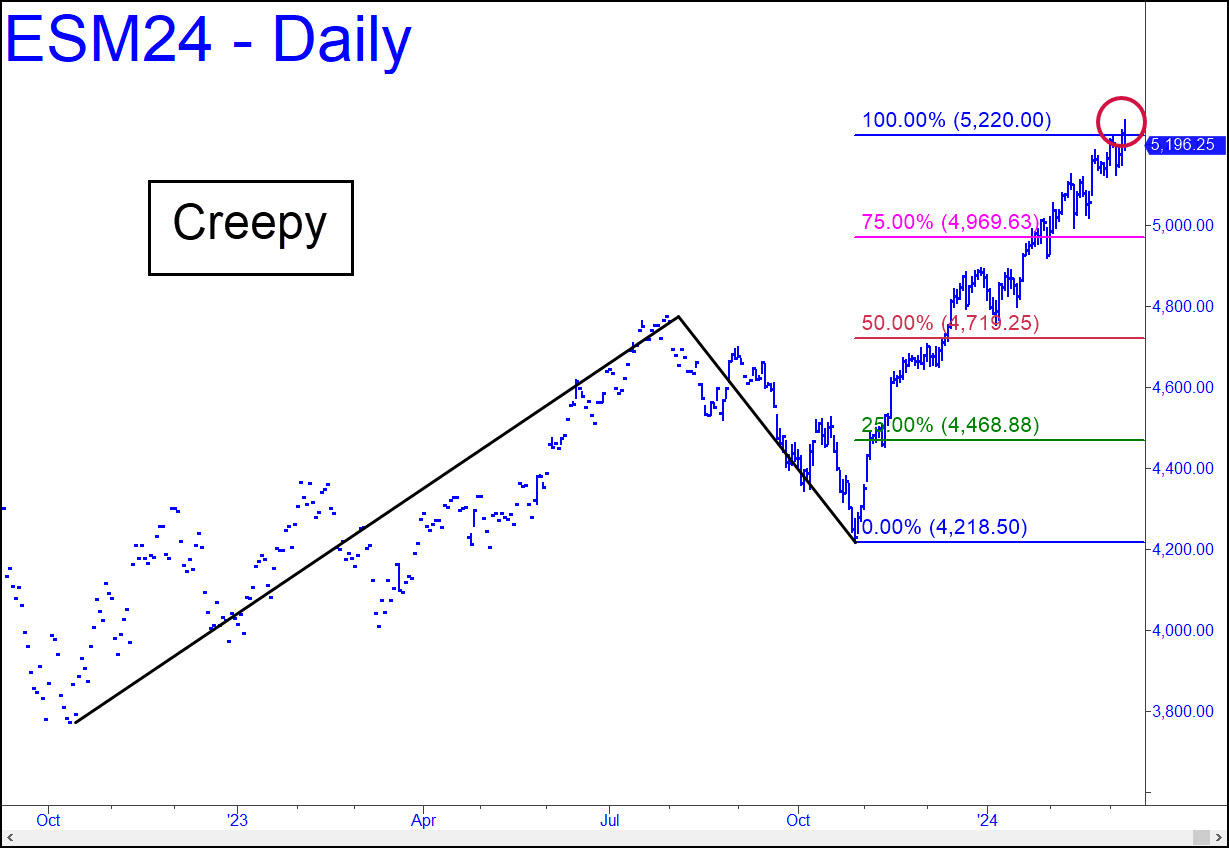

Even though last week’s extension of bull-mania exceeded the 5220.00 target shown by only a smidgen, it’s still creepy. The ‘hidden’ resistance should have held, if for no other reason than that the pattern is too gnarly to be common knowledge. Granted, the point ‘B’ high is pork sausage, as noted here last week. But that’s still not a good reason for its target to have been exceeded so easily. The rally did reverse to produce a close beneath the target, so it’s still possible we’ll see rationality reassert itself in the week ahead with a persuasive plunge. Unfortunately, SPY failed by two points to achieve a corresponding target at 520.54 before the sell-off began, so we took no short position with puts. _______ UPDATE (March 13, 11:03 a.m. EDT): The minor rally pattern shown has already produced two ‘mechanical’ winners while becoming increasingly gnarly, so expect it to produce a third profitable trade: shorting D=5287.25 when the futures get there. A small reverse pattern should be suitable for this purpose, but be sure to take a small partial profit if it works. You could also buy a pullback to p2=5204.00 ‘mechanically,’ stop 5176.25.

Even though last week’s extension of bull-mania exceeded the 5220.00 target shown by only a smidgen, it’s still creepy. The ‘hidden’ resistance should have held, if for no other reason than that the pattern is too gnarly to be common knowledge. Granted, the point ‘B’ high is pork sausage, as noted here last week. But that’s still not a good reason for its target to have been exceeded so easily. The rally did reverse to produce a close beneath the target, so it’s still possible we’ll see rationality reassert itself in the week ahead with a persuasive plunge. Unfortunately, SPY failed by two points to achieve a corresponding target at 520.54 before the sell-off began, so we took no short position with puts. _______ UPDATE (March 13, 11:03 a.m. EDT): The minor rally pattern shown has already produced two ‘mechanical’ winners while becoming increasingly gnarly, so expect it to produce a third profitable trade: shorting D=5287.25 when the futures get there. A small reverse pattern should be suitable for this purpose, but be sure to take a small partial profit if it works. You could also buy a pullback to p2=5204.00 ‘mechanically,’ stop 5176.25.

ESM24 – June E-Mini S&Ps (Last:5233.00)