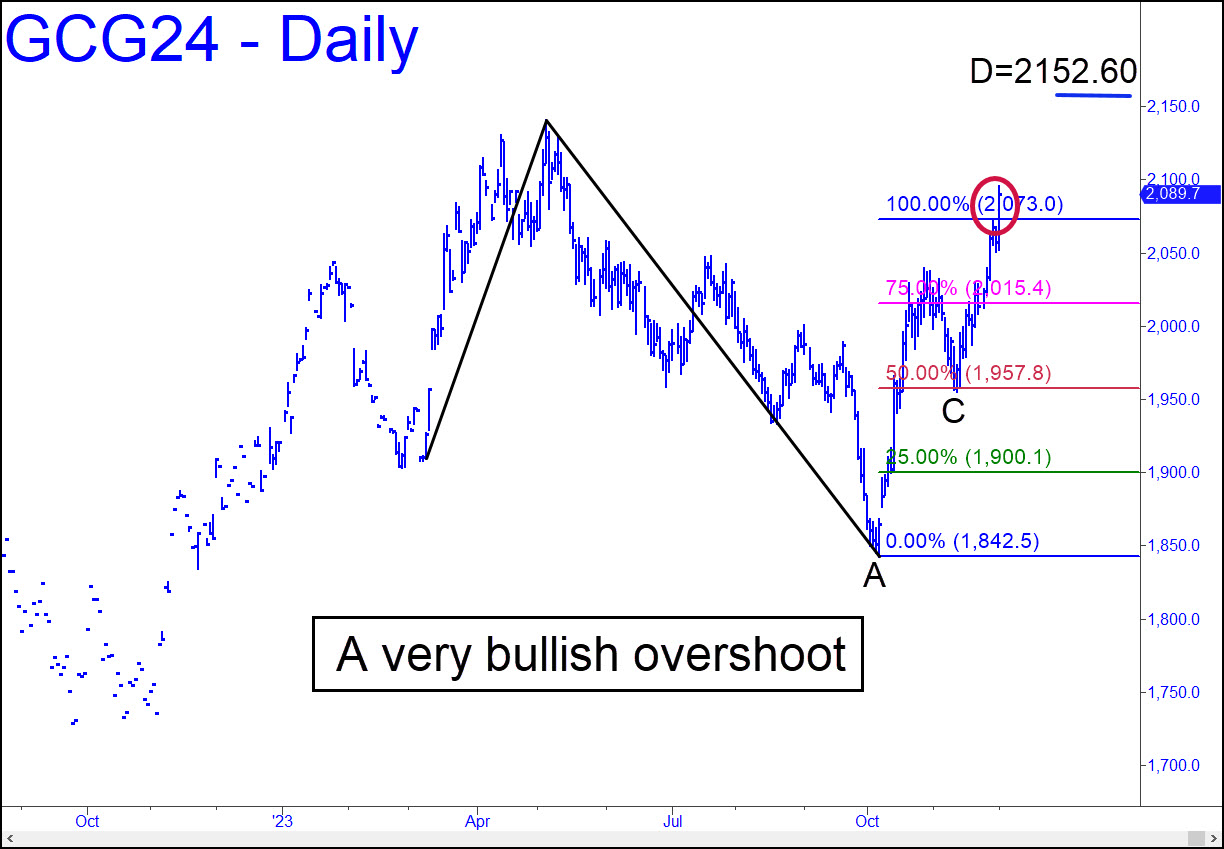

Buyers impaled the 2073.00 target of the reverse pattern shown, implying the futures are on their way to at least 2152.60, the D target of a lesser pattern whose A & C coordinates are shown in the chart. Given the way bulls consolidated above the smaller pattern’s midpoint pivot, the probability is high that D will be achieved with little ado. Since the futures by then will have broken free of gravity at $2,000, we should expect a relatively quick move from 2152 to 2,200, the first round number resistance above the soon-to-be-obliterated one at $2,100. _______ UPDATE (Dec 8, 11:47 a.m.): I’ll bet our old friend Andy Maguire had a thing or two to say about Monday’s psychopathic, whoopee cushion reversal in gold. He has noted that the pond scum who cause these takedowns have a risk cushion of as much as $90 in the arb against unlimited paper gold. Although they are obviously still able to squash gold down to $2000 practically at will, DaScumballs are going to find in increasingly difficult to fool investors into thinking gold deserves to be significantly lower than that. For now, the February contract is headed down to the 2001.50 target shown in this chart — a good place to attempt tightly stopped bottom-fishing. Any lower would indicate 1986.90, an even better bet for bottom-fishing if it is achieved.

Buyers impaled the 2073.00 target of the reverse pattern shown, implying the futures are on their way to at least 2152.60, the D target of a lesser pattern whose A & C coordinates are shown in the chart. Given the way bulls consolidated above the smaller pattern’s midpoint pivot, the probability is high that D will be achieved with little ado. Since the futures by then will have broken free of gravity at $2,000, we should expect a relatively quick move from 2152 to 2,200, the first round number resistance above the soon-to-be-obliterated one at $2,100. _______ UPDATE (Dec 8, 11:47 a.m.): I’ll bet our old friend Andy Maguire had a thing or two to say about Monday’s psychopathic, whoopee cushion reversal in gold. He has noted that the pond scum who cause these takedowns have a risk cushion of as much as $90 in the arb against unlimited paper gold. Although they are obviously still able to squash gold down to $2000 practically at will, DaScumballs are going to find in increasingly difficult to fool investors into thinking gold deserves to be significantly lower than that. For now, the February contract is headed down to the 2001.50 target shown in this chart — a good place to attempt tightly stopped bottom-fishing. Any lower would indicate 1986.90, an even better bet for bottom-fishing if it is achieved.

GCZ23 – December Gold (Last:2020.00)