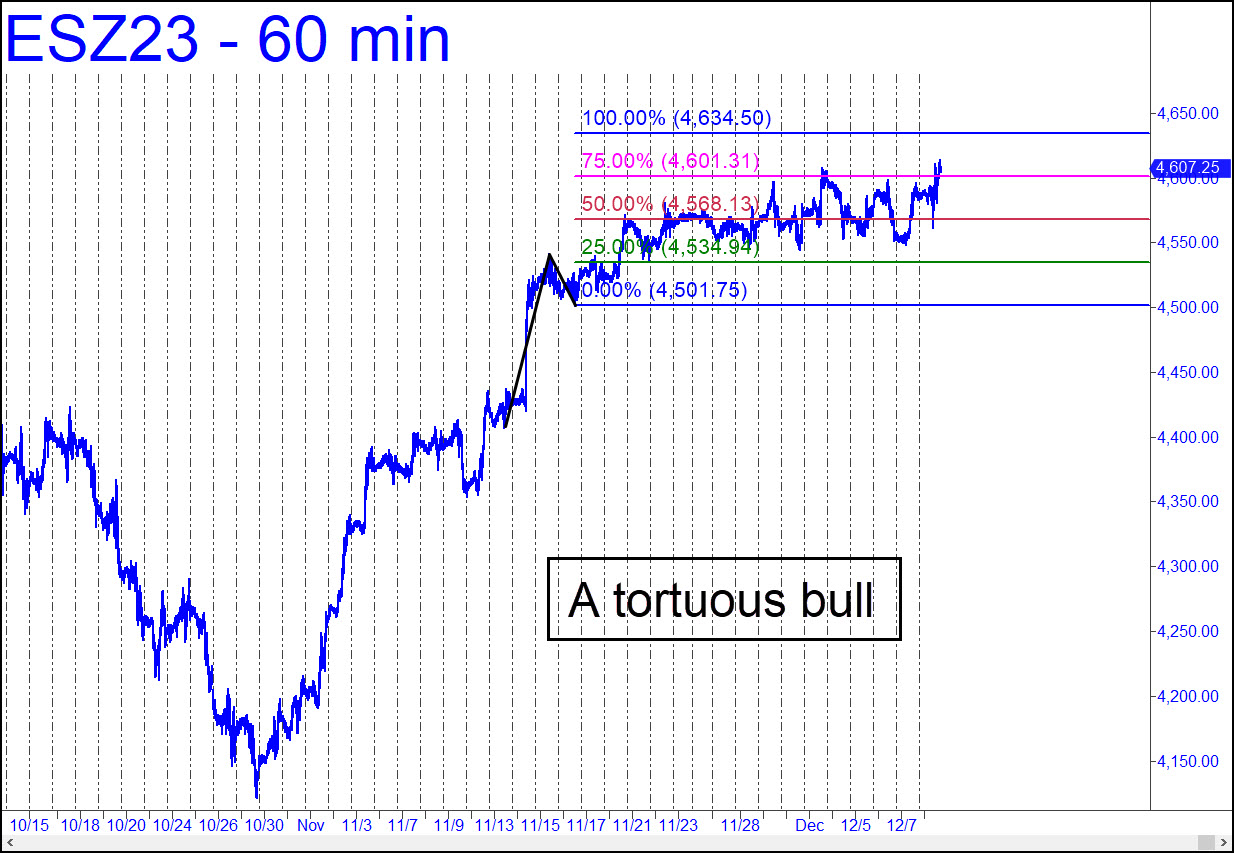

The futures continued their tortuous slog toward the 4634.50 rally target shown, defying a growing chorus of prognosticators who believe, not without good reason, that the stock market is overdue for a rest. It has been moving relentlessly higher since October 30, driven mainly by short-covering and airy, gap-up openings in a handful of Nasdaq stocks, particularly MSFT and AAPL. Any progress above the target given above would indicate more upside to 4687.00 [corrected upward), but the lower number cries out to be shorted. This is notwithstanding its non-public appearance on the Rick’s Picks home page. _______ UPDATE (Dec 13, 10:43 p.m.): When criminally manipulated rallies turn silly, as this one has, we are fortunate to have Hidden Pivots to make tradable sense of them. The pattern shown looks too wacky to be reliable for nailing an important top, but the 4804.00 target shown should work nonetheless as a lodestar for bull trades as well as a place to get short using a tight ‘reverse pattern’. The pattern in progress should also work nicely for ‘mechanical’ bids on any one- or two-level pullbacks from no higher than around 4770.

The futures continued their tortuous slog toward the 4634.50 rally target shown, defying a growing chorus of prognosticators who believe, not without good reason, that the stock market is overdue for a rest. It has been moving relentlessly higher since October 30, driven mainly by short-covering and airy, gap-up openings in a handful of Nasdaq stocks, particularly MSFT and AAPL. Any progress above the target given above would indicate more upside to 4687.00 [corrected upward), but the lower number cries out to be shorted. This is notwithstanding its non-public appearance on the Rick’s Picks home page. _______ UPDATE (Dec 13, 10:43 p.m.): When criminally manipulated rallies turn silly, as this one has, we are fortunate to have Hidden Pivots to make tradable sense of them. The pattern shown looks too wacky to be reliable for nailing an important top, but the 4804.00 target shown should work nonetheless as a lodestar for bull trades as well as a place to get short using a tight ‘reverse pattern’. The pattern in progress should also work nicely for ‘mechanical’ bids on any one- or two-level pullbacks from no higher than around 4770.

ESZ23 – Dec E-Mini S&Ps (Last:4722.75)