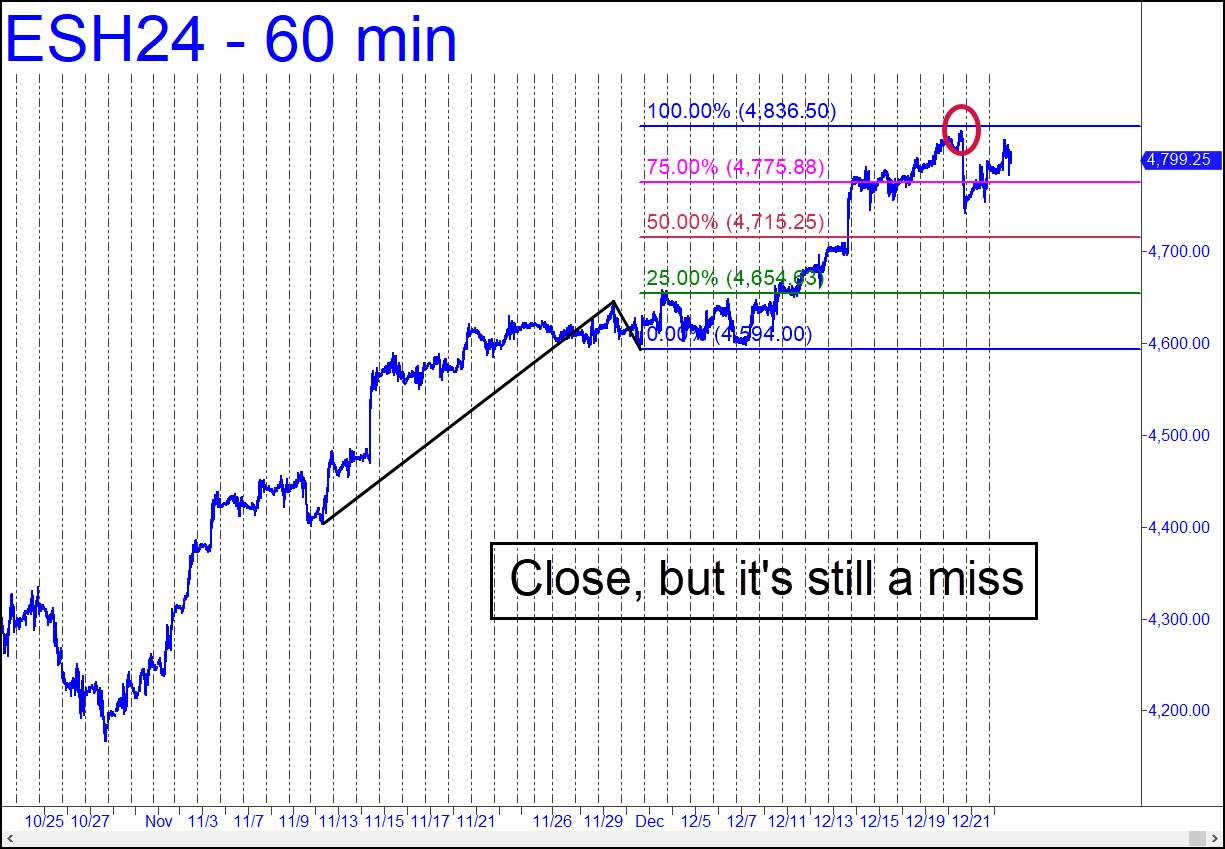

It may seem churlish for me to point this out, but the apex of last week’s rally did not quite achieve the 4836.50 target shown in the chart. It fell 5.75 points shy — enough in the context of so subtly perfect a pattern to temporarily cast doubt on the bullish enterprise, such as it is. A fist-pump through the target on Tuesday or Wednesday would put bulls back on track with more short-covering, the sustaining force behind a run-up begun in October that long ago exceeded the threshold of sanity. Assuming stocks head lower when trading resumes after Christmas, expect the March contract to fall to at least 4778.50, and thence to 4735.25 if any lower. You can bottom-fish at the latter number provided you know how to chisel the risk down to relative pocket change with a ‘camouflage’ trigger. The numbers are, respectively, the p and Hidden Pivots of the small reverse pattern shown here. It worked nicely on Friday, producing a gain of as much as $5,000 on four contracts for any subscriber who shorted at 4811.50 on the way down as I explicitly advised in the chat room.

It may seem churlish for me to point this out, but the apex of last week’s rally did not quite achieve the 4836.50 target shown in the chart. It fell 5.75 points shy — enough in the context of so subtly perfect a pattern to temporarily cast doubt on the bullish enterprise, such as it is. A fist-pump through the target on Tuesday or Wednesday would put bulls back on track with more short-covering, the sustaining force behind a run-up begun in October that long ago exceeded the threshold of sanity. Assuming stocks head lower when trading resumes after Christmas, expect the March contract to fall to at least 4778.50, and thence to 4735.25 if any lower. You can bottom-fish at the latter number provided you know how to chisel the risk down to relative pocket change with a ‘camouflage’ trigger. The numbers are, respectively, the p and Hidden Pivots of the small reverse pattern shown here. It worked nicely on Friday, producing a gain of as much as $5,000 on four contracts for any subscriber who shorted at 4811.50 on the way down as I explicitly advised in the chat room.

ESH24 – March E-Mini S&Ps (Last:4799.25)