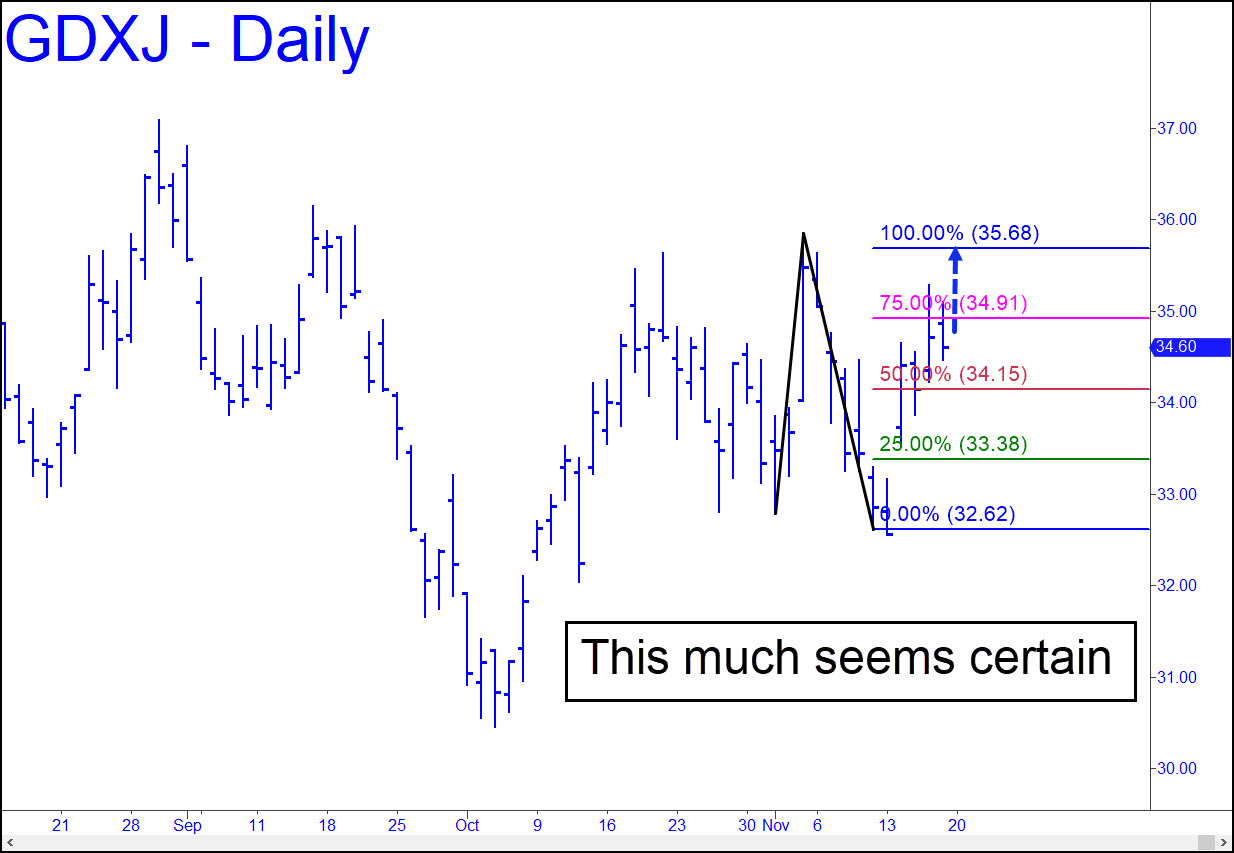

More progress to at least 35.68, the Hidden Pivot target of the reverse pattern shown, seems all but certain, but it’s what happens after that that can help us gauge the strength of the uptrend begun in early October from around 30. The first peak lies at 36.85, an ‘internal’ high just 17 cents above the target. The second, an ‘external’ that should offer more resistance, is at 36.14. It is important because a push past it would generate the most powerful impulse leg we’ve seen in this vehicle since early spring. That would set up a likely test of the 39.70 peak from mid-July and thence a possible run-up into the low-to-mid-40s. ________ UPDATE (Nov 24): A push past the 36.14 peak note above appears imminent. However, I will be paying close attention to whether the rally stalls at 36.61, a voodoo number that is shortable with a reverse-pattern trigger interval of 50 cents. _______ UPDATE (Nov 28, 4:42 p.m.): GDXJ has blown past the p=36.28 midpoint resistance of this pattern with such force that the 42.09 rally target I first identified here six weeks ago in mid-October should now be viewed as all but certain to be achieved.

More progress to at least 35.68, the Hidden Pivot target of the reverse pattern shown, seems all but certain, but it’s what happens after that that can help us gauge the strength of the uptrend begun in early October from around 30. The first peak lies at 36.85, an ‘internal’ high just 17 cents above the target. The second, an ‘external’ that should offer more resistance, is at 36.14. It is important because a push past it would generate the most powerful impulse leg we’ve seen in this vehicle since early spring. That would set up a likely test of the 39.70 peak from mid-July and thence a possible run-up into the low-to-mid-40s. ________ UPDATE (Nov 24): A push past the 36.14 peak note above appears imminent. However, I will be paying close attention to whether the rally stalls at 36.61, a voodoo number that is shortable with a reverse-pattern trigger interval of 50 cents. _______ UPDATE (Nov 28, 4:42 p.m.): GDXJ has blown past the p=36.28 midpoint resistance of this pattern with such force that the 42.09 rally target I first identified here six weeks ago in mid-October should now be viewed as all but certain to be achieved.

GDXJ – Junior Gold Miner ETF (Last:38.19)