Like most rallies, last week’s dubious surge drew its power almost entirely from short covering. When war broke out the previous weekend, few traders came to their desks Sunday evening eager to buy stocks. Since there was no institutional selling — there never is, except for the last few days of each quarter — it was left to Joe Sixpack and the usual village idiots to dump index futures into a void that the smart money had thoughtfully prepared for them. Sellers were spent by the opening bell, and when stocks failed to go lower on scary news from Gaza, disappointed bears began a short-covering spree that didn’t peter out until Thursday’s opening. Things went steeply downhill after that, achieving a low on Friday precisely at the top of Sunday’s gap. It was a typical week in which sound and fury ultimately signified nothing. Looking ahead, expect stocks to fall in earnest, since the only buyers in town — panicky bears — have been decimated. Most immediately, this should produce a test of the 4236.00 low recorded on October 4. _______ UPDATE (Oct 18, 9:23 p.m.): Far from being decimated, it would appear bears have been tortured sufficiently to reinvigorate their worst instincts. Short-covering all day long was painful to watch, let alone experience, and even though the futures finished lower, the rally looks like it’s about to get second wind. Use this pattern, with a 4461.75 target, to get a tradeable handle on the futures. The first ‘mechanical’ trigger off our sweet spot seems likely to produce a winner.

Like most rallies, last week’s dubious surge drew its power almost entirely from short covering. When war broke out the previous weekend, few traders came to their desks Sunday evening eager to buy stocks. Since there was no institutional selling — there never is, except for the last few days of each quarter — it was left to Joe Sixpack and the usual village idiots to dump index futures into a void that the smart money had thoughtfully prepared for them. Sellers were spent by the opening bell, and when stocks failed to go lower on scary news from Gaza, disappointed bears began a short-covering spree that didn’t peter out until Thursday’s opening. Things went steeply downhill after that, achieving a low on Friday precisely at the top of Sunday’s gap. It was a typical week in which sound and fury ultimately signified nothing. Looking ahead, expect stocks to fall in earnest, since the only buyers in town — panicky bears — have been decimated. Most immediately, this should produce a test of the 4236.00 low recorded on October 4. _______ UPDATE (Oct 18, 9:23 p.m.): Far from being decimated, it would appear bears have been tortured sufficiently to reinvigorate their worst instincts. Short-covering all day long was painful to watch, let alone experience, and even though the futures finished lower, the rally looks like it’s about to get second wind. Use this pattern, with a 4461.75 target, to get a tradeable handle on the futures. The first ‘mechanical’ trigger off our sweet spot seems likely to produce a winner.

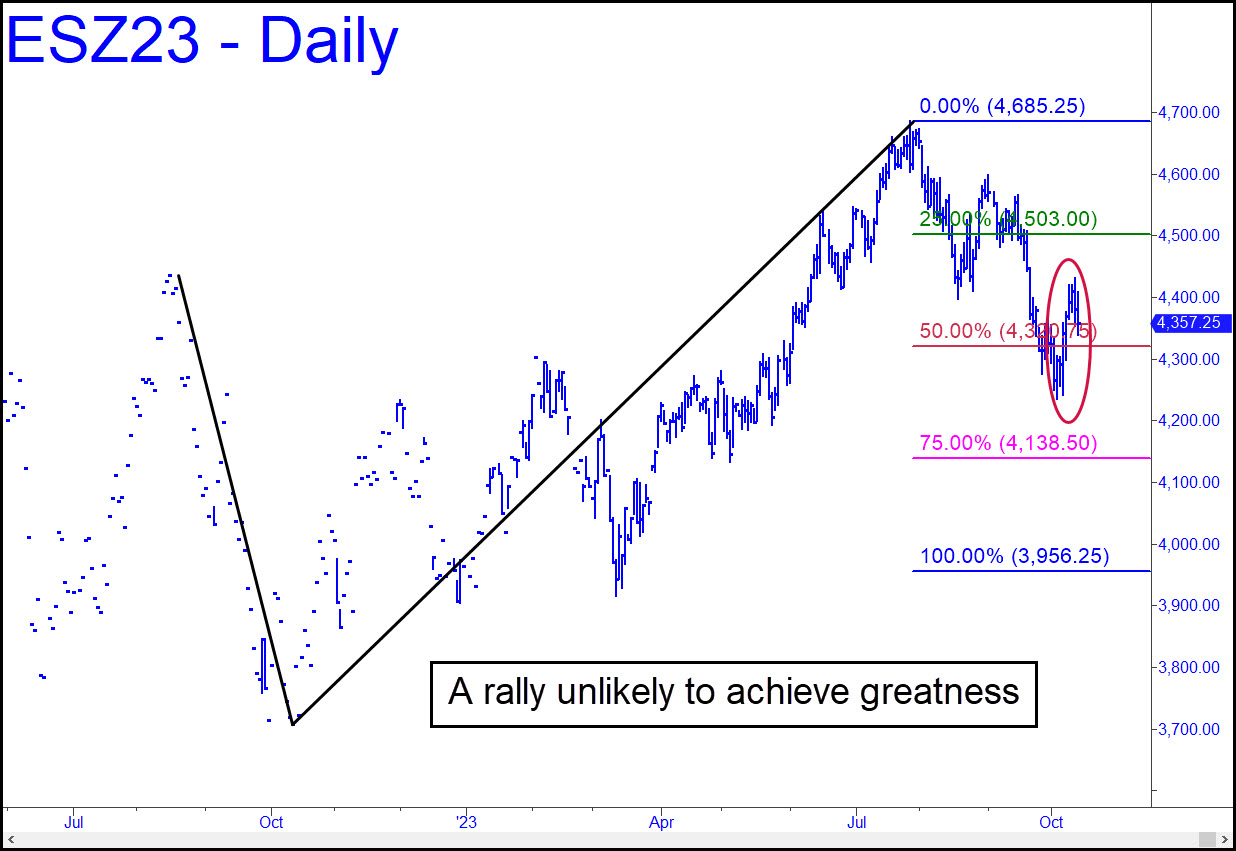

ESZ23 – Dec E-Mini S&Ps (Last:4347.50)