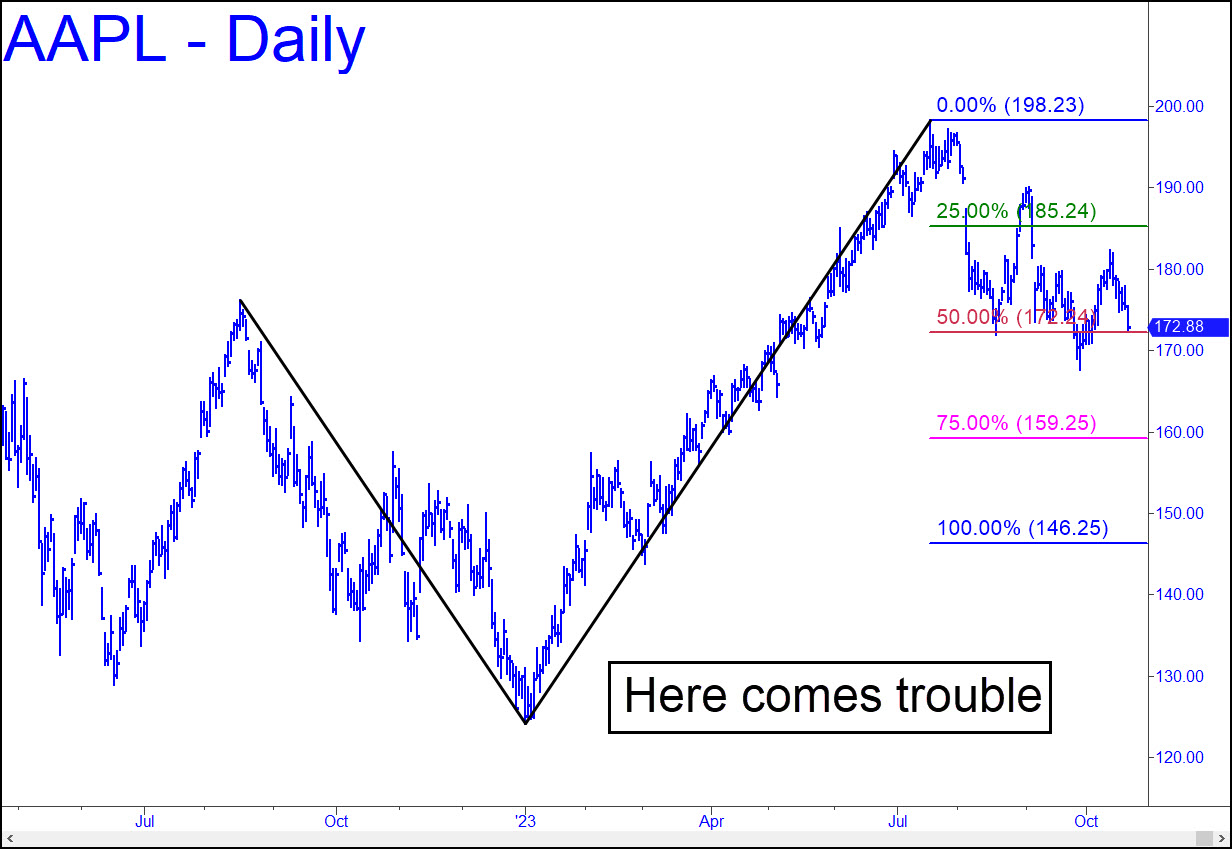

Although AAPL ended the week in the same precarious place as the E-Mini S&Ps, we shouldn’t forget that it wears a wing suit for such occasions. The stock’s institutional sponsors let it fall only when it suits their needs — in this case a presumptive eagerness to load up at p2=159.25, nearly $14 below the current price. They’ve had more than two months to distribute Apple shares in preparation for this maneuver, so let’s not feel sorry for them if their holdings deflate precipitously for a little while. The speed at which the stock falls will tell us how successfully they’ve been and how eager they are to run the stock back up to some insane height. The news backdrop features a nasty decline in iPhone sales in China, one reason we can be confident the bear market begun in mid-July from 198.11 will eventually find its way down to at least 146.13.

Although AAPL ended the week in the same precarious place as the E-Mini S&Ps, we shouldn’t forget that it wears a wing suit for such occasions. The stock’s institutional sponsors let it fall only when it suits their needs — in this case a presumptive eagerness to load up at p2=159.25, nearly $14 below the current price. They’ve had more than two months to distribute Apple shares in preparation for this maneuver, so let’s not feel sorry for them if their holdings deflate precipitously for a little while. The speed at which the stock falls will tell us how successfully they’ve been and how eager they are to run the stock back up to some insane height. The news backdrop features a nasty decline in iPhone sales in China, one reason we can be confident the bear market begun in mid-July from 198.11 will eventually find its way down to at least 146.13.

AAPL – Apple Computer (Last:172.88)