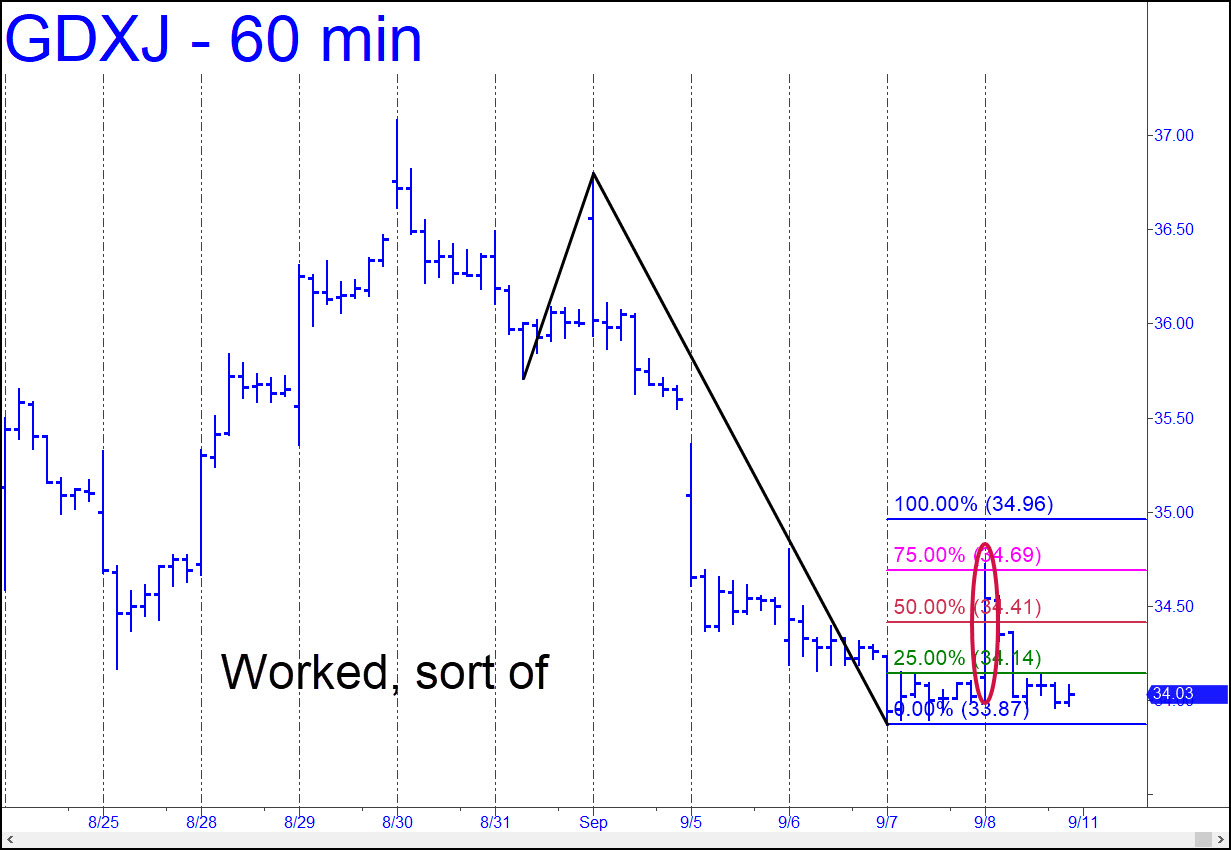

This vehicle served up a profitable dollop of dreck on Friday’s opening bar, triggering a reverse-pattern entry at 34.14 that was spelled out in my tout. Making actual money on the trade would have been fairly easy, since GDXJ pulled back to the green line where the trade triggered after busting through it in the first minutes of the session. The surge got past p2=34.69, implying you could have been out of 3/4 of the position before the rally succumbed to gravity. The plunge was so relentless and dispiriting that we can only infer that still lower prices impend. A hidden Pivot support at 33.79 is the closest target. Since it is but an inch beneath last week’s low, we might expect a tradeable reaction with a ‘counterintuitive’ (i.e., rABC) trigger interval of 0.23. The pattern yielding the 33.79 target starts on the 30-minute chart with A=34.80 on 9/6 at 10:00 a.m.

This vehicle served up a profitable dollop of dreck on Friday’s opening bar, triggering a reverse-pattern entry at 34.14 that was spelled out in my tout. Making actual money on the trade would have been fairly easy, since GDXJ pulled back to the green line where the trade triggered after busting through it in the first minutes of the session. The surge got past p2=34.69, implying you could have been out of 3/4 of the position before the rally succumbed to gravity. The plunge was so relentless and dispiriting that we can only infer that still lower prices impend. A hidden Pivot support at 33.79 is the closest target. Since it is but an inch beneath last week’s low, we might expect a tradeable reaction with a ‘counterintuitive’ (i.e., rABC) trigger interval of 0.23. The pattern yielding the 33.79 target starts on the 30-minute chart with A=34.80 on 9/6 at 10:00 a.m.

GDXJ – Junior Gold Miner ETF (Last:34.03)