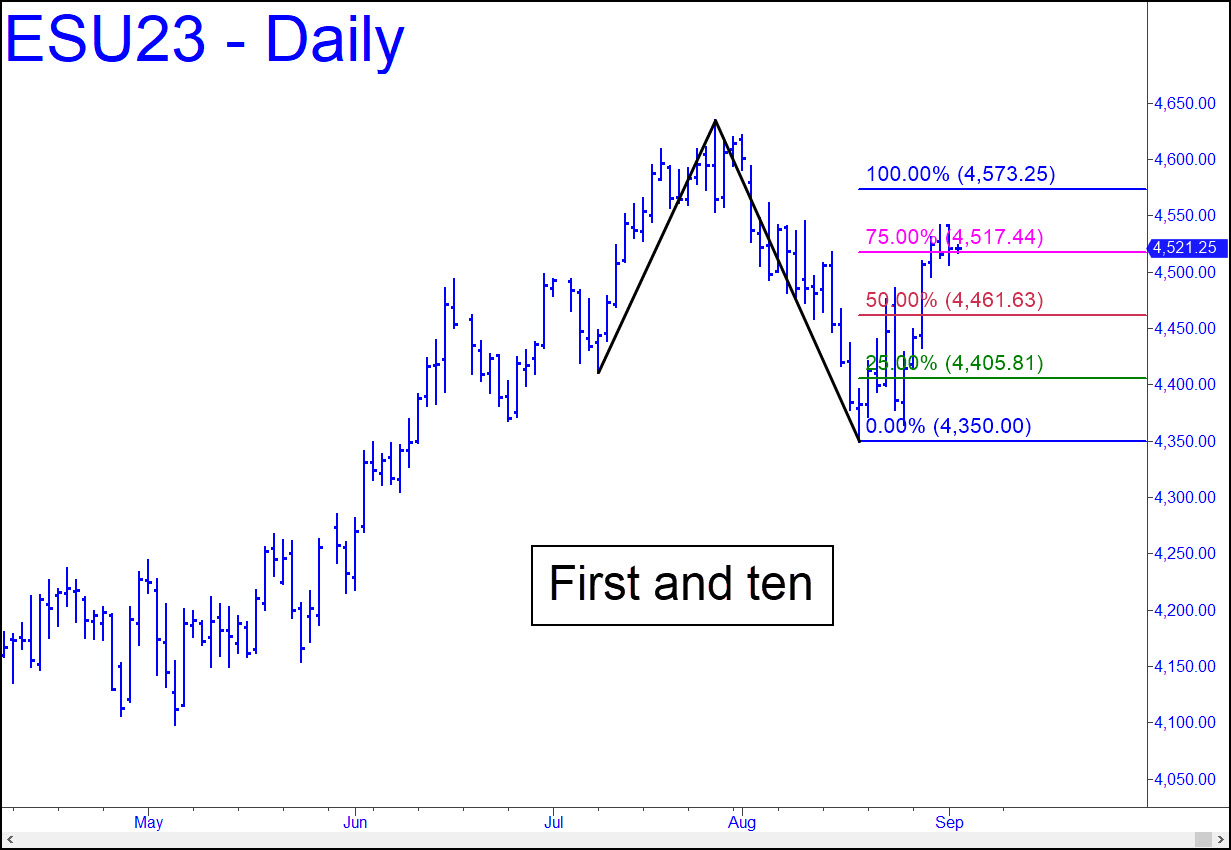

The bullish pattern shown, with a 4573.25 rally target, will likely control price movement as the new week begins . It has already produced a profitable ‘mechanical’ buy on the pullback to the green line (x=4405.81), and we could see an equally opportune short materialize when the target is reached. This looks very likely, given the way buyers stabbed through p=4461.63 at the start of last week. The move accounted for most of the week’s gains, illustrating yet again how volumeless gaps and short-covering are responsible for most of the bull market’s orchestrated rise. Since the short would require a 30-point trigger interval, we’ll look for our opportunity on the lesser charts when the time comes. For now, though, your bias should be bullish and allow for the possibility of a drop to p=4461.63 to trigger a ‘mechanical’ buy, stop 4424.25. The earlier in the week this occurs, if it does, the more attractive the trade. ______ UPDATE (Sep 6, 6:30 p.m.): We’ll need to remind ourselves when ES plummets to the green line (x=4405.81), leaving many traders terror-stricken, that we are being gifted with a fairly attractive ‘mechanical’ buying opportunity. It won’t be a back-up-the-truck event, since the relatively long B-C leg will have dissipated some of the bullish energy of the nicely impulsive A-B. But I do expect a one-level gain at least, implying a bounce to the red line (p=4461.63). A trend failure at that point could be fatal, so we’ll be on our guard.

The bullish pattern shown, with a 4573.25 rally target, will likely control price movement as the new week begins . It has already produced a profitable ‘mechanical’ buy on the pullback to the green line (x=4405.81), and we could see an equally opportune short materialize when the target is reached. This looks very likely, given the way buyers stabbed through p=4461.63 at the start of last week. The move accounted for most of the week’s gains, illustrating yet again how volumeless gaps and short-covering are responsible for most of the bull market’s orchestrated rise. Since the short would require a 30-point trigger interval, we’ll look for our opportunity on the lesser charts when the time comes. For now, though, your bias should be bullish and allow for the possibility of a drop to p=4461.63 to trigger a ‘mechanical’ buy, stop 4424.25. The earlier in the week this occurs, if it does, the more attractive the trade. ______ UPDATE (Sep 6, 6:30 p.m.): We’ll need to remind ourselves when ES plummets to the green line (x=4405.81), leaving many traders terror-stricken, that we are being gifted with a fairly attractive ‘mechanical’ buying opportunity. It won’t be a back-up-the-truck event, since the relatively long B-C leg will have dissipated some of the bullish energy of the nicely impulsive A-B. But I do expect a one-level gain at least, implying a bounce to the red line (p=4461.63). A trend failure at that point could be fatal, so we’ll be on our guard.

ESU23 – Sep E-Mini S&Ps (Last:4468.50)