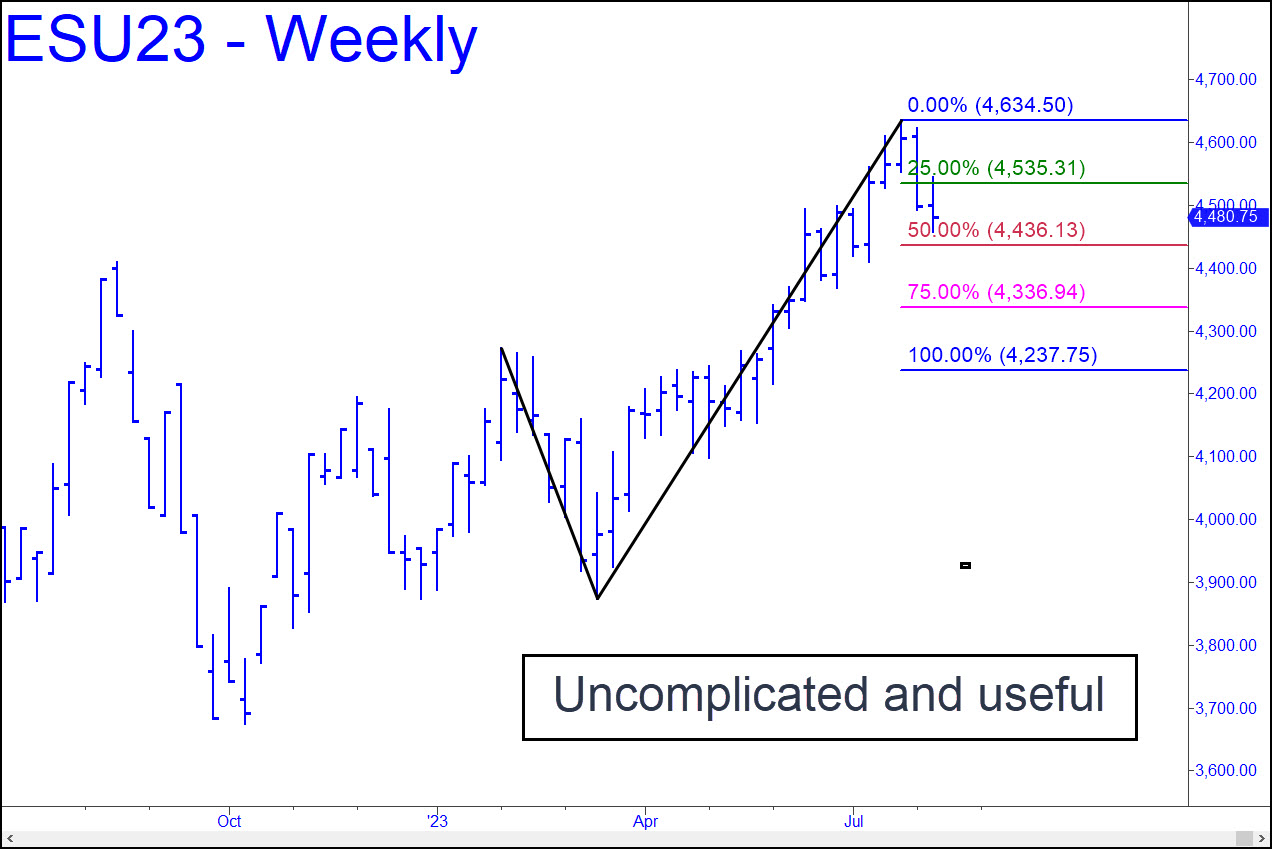

The simple picture shown is similar to the one accompanying the current AAPL tout, and I am confident it won’t let us down. That means, for starters, that the correction begun from late July’s 4634.50 high will come down to at least p=4436.00 before sellers ease up, perhaps only temporarily. The tradeable bounce I expect from p will provide an excellent opportunity to bottom-fish with a tight stop-loss, but if the bounce sputters out, that would be warning of more slippage to as low as D=4237.75. I broached this number earlier, and it would equate to an 8.5% correction from the top. The pattern also has the potential to deliver an epic ‘mechanical’ short, but I will pinpoint it for you behind closed doors if and when the opportunity develops.

The simple picture shown is similar to the one accompanying the current AAPL tout, and I am confident it won’t let us down. That means, for starters, that the correction begun from late July’s 4634.50 high will come down to at least p=4436.00 before sellers ease up, perhaps only temporarily. The tradeable bounce I expect from p will provide an excellent opportunity to bottom-fish with a tight stop-loss, but if the bounce sputters out, that would be warning of more slippage to as low as D=4237.75. I broached this number earlier, and it would equate to an 8.5% correction from the top. The pattern also has the potential to deliver an epic ‘mechanical’ short, but I will pinpoint it for you behind closed doors if and when the opportunity develops.

ESU23 – Sep E-Mini S&Ps (Last:4480.75)