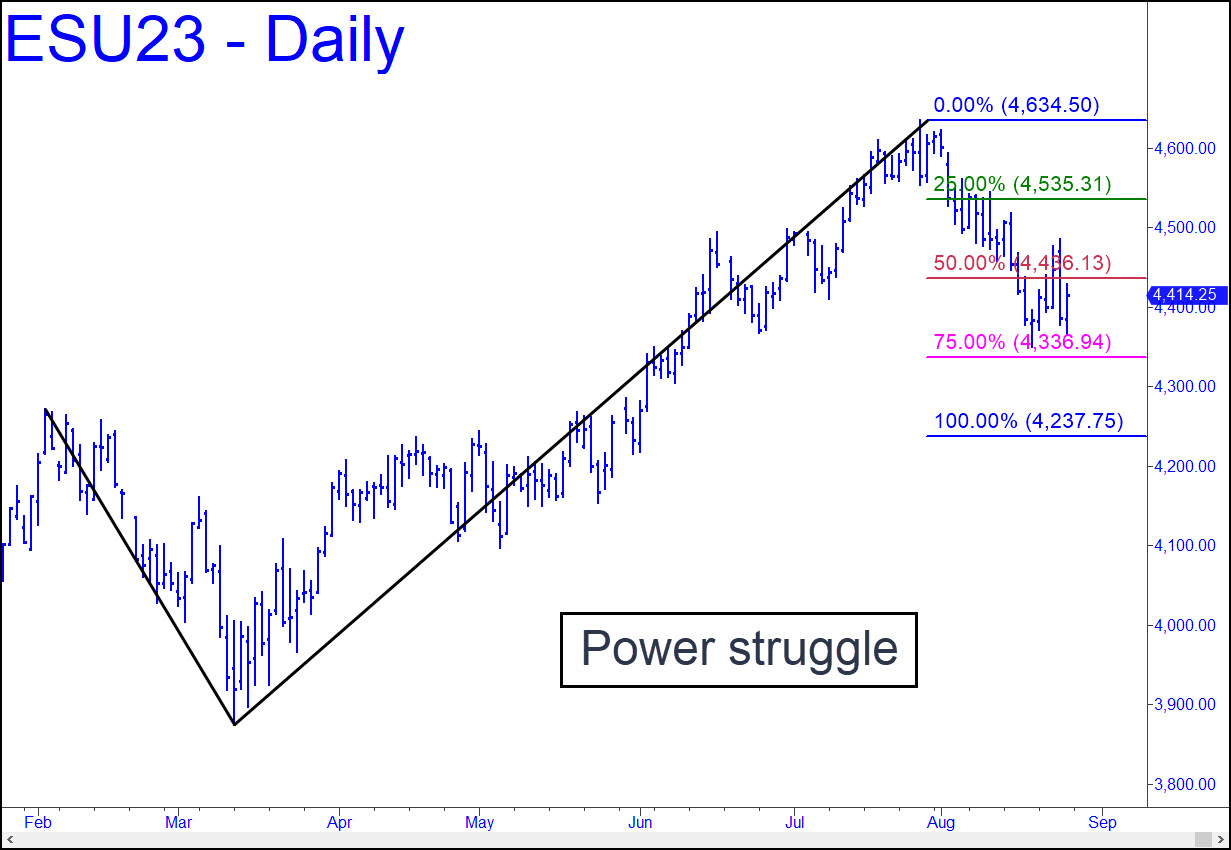

Bears gave it their all last week but couldn’t close this gas-bag beneath either the secondary Hidden Pivot support at 4336.94 or even the structurally supportive low at 4368.50 recorded on June 26. The latter is considered crucial by some gurus, but it could just as easily become a springboard to higher prices if it stops out bulls on a theatrical feint lower. The downside ‘D’ target at 4237.75 remains technically in play nonetheless, and a run-up to x=4535.31 should be viewed as an opportunity to get short ‘mechanically’. The futures are likely to remain easily tradeable in any event, so stay tuned to the chat room for real-time guidance. _______ UPDATE (Aug 28, 6:21 p.m.): Forty-five minutes before the opening, I posted this chart, with a 4478.50 target. The futures spent the entire day between p and p2 screwing the pooch, but the target remains viable as a minimum upside objective. _______ UPDATE (Aug 29, 9:06 p.m.): Today’s wilding spree pushed the futures to within inches of a tempting ‘mechanical’ short at the green line (x=4535). The best such set-ups are supposed to look and feel scary, and this one surely qualifies. I’ll recommend paper-trading it, but FYI, the textbook trigger interval once x is hit would be 30.00 points, implying initial theoretical risk of $1500 per contract. _______ UPDATE (Aug 31, 8:43 p.m.): Buyers looked so punk that I’ve lowered the A-B pairing a notch to produce a less ambitious target at 4579.00. First let’s see if they can convert the attractive ‘mechanical’ buy triggered by the drop to the green line (4516.94) into a trading profit. That would take a run-up to at least p=4537.63. _______ UPDATE (Sep 1, 8:41 a.m.): And so they did, impaling p=4537.63 ahead of the opening with sufficient force to suggest that the D target at 4579.00 will be reached. The ‘attractive mechanical’ trade could have been worth as much as $1400 per contract so far, but it would have required tending the position overnight or, if permissible, setting an o-c-o order with a stop-loss and profit target.

Bears gave it their all last week but couldn’t close this gas-bag beneath either the secondary Hidden Pivot support at 4336.94 or even the structurally supportive low at 4368.50 recorded on June 26. The latter is considered crucial by some gurus, but it could just as easily become a springboard to higher prices if it stops out bulls on a theatrical feint lower. The downside ‘D’ target at 4237.75 remains technically in play nonetheless, and a run-up to x=4535.31 should be viewed as an opportunity to get short ‘mechanically’. The futures are likely to remain easily tradeable in any event, so stay tuned to the chat room for real-time guidance. _______ UPDATE (Aug 28, 6:21 p.m.): Forty-five minutes before the opening, I posted this chart, with a 4478.50 target. The futures spent the entire day between p and p2 screwing the pooch, but the target remains viable as a minimum upside objective. _______ UPDATE (Aug 29, 9:06 p.m.): Today’s wilding spree pushed the futures to within inches of a tempting ‘mechanical’ short at the green line (x=4535). The best such set-ups are supposed to look and feel scary, and this one surely qualifies. I’ll recommend paper-trading it, but FYI, the textbook trigger interval once x is hit would be 30.00 points, implying initial theoretical risk of $1500 per contract. _______ UPDATE (Aug 31, 8:43 p.m.): Buyers looked so punk that I’ve lowered the A-B pairing a notch to produce a less ambitious target at 4579.00. First let’s see if they can convert the attractive ‘mechanical’ buy triggered by the drop to the green line (4516.94) into a trading profit. That would take a run-up to at least p=4537.63. _______ UPDATE (Sep 1, 8:41 a.m.): And so they did, impaling p=4537.63 ahead of the opening with sufficient force to suggest that the D target at 4579.00 will be reached. The ‘attractive mechanical’ trade could have been worth as much as $1400 per contract so far, but it would have required tending the position overnight or, if permissible, setting an o-c-o order with a stop-loss and profit target.

ESU23 – Sep E-Mini S&Ps (Last:4543.50)