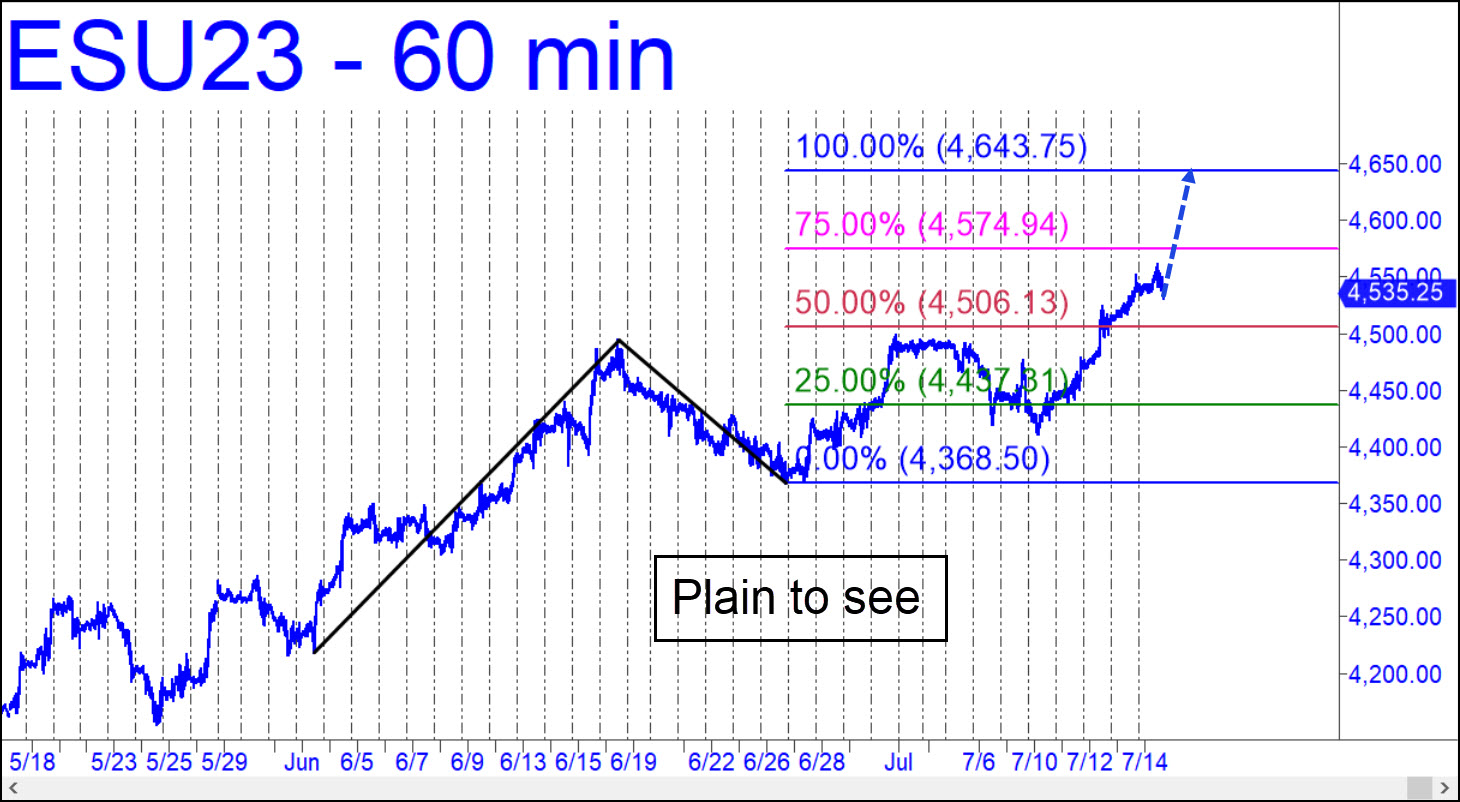

Friday’s saggy performance promised to burden the night shift when trading resumes Sunday night. If selling should snowball early in the week, sending the futures plummeting 100 points to the green line (x=4437), treat it is an excellent opportunity to bottom-fish with a ‘mechanical’ bid. Entry risk on four contracts would be nearly $14,000, so the trade should be attempted only with a ‘reverse-pattern’ trigger that cuts the theoretical risk down to $800 or less. It may be possible to narrow down the details, so stay tuned to the chat room for timely guidance. _______ UPDATE (Jul 18, 12:03 a.m.): No respite for bears! Use this bullish pattern, with a 4643.75 target, to get a precise handle on this vehicle, get long ‘mechanically or short at D. _______ UPDATE (Jul 19, 11:42 p.m.): Use a ‘reverse pattern’ trigger and a 1.50-point interval to bottom-fish the 4579 midpoint Hidden Pivot shown here. The trade is recommended for Wednesday-tutorial regulars. ______ UPDATE (Jul 21, 12:10 a.m.): The trade was worth as much as $2700 to anyone who followed my instructions. The futures subsequently relapsed, but we had already neutralized their ability to give us anxiety, never mind pain.

Friday’s saggy performance promised to burden the night shift when trading resumes Sunday night. If selling should snowball early in the week, sending the futures plummeting 100 points to the green line (x=4437), treat it is an excellent opportunity to bottom-fish with a ‘mechanical’ bid. Entry risk on four contracts would be nearly $14,000, so the trade should be attempted only with a ‘reverse-pattern’ trigger that cuts the theoretical risk down to $800 or less. It may be possible to narrow down the details, so stay tuned to the chat room for timely guidance. _______ UPDATE (Jul 18, 12:03 a.m.): No respite for bears! Use this bullish pattern, with a 4643.75 target, to get a precise handle on this vehicle, get long ‘mechanically or short at D. _______ UPDATE (Jul 19, 11:42 p.m.): Use a ‘reverse pattern’ trigger and a 1.50-point interval to bottom-fish the 4579 midpoint Hidden Pivot shown here. The trade is recommended for Wednesday-tutorial regulars. ______ UPDATE (Jul 21, 12:10 a.m.): The trade was worth as much as $2700 to anyone who followed my instructions. The futures subsequently relapsed, but we had already neutralized their ability to give us anxiety, never mind pain.

ESU23 – Sep E-Mini S&Ps (Last:4568)