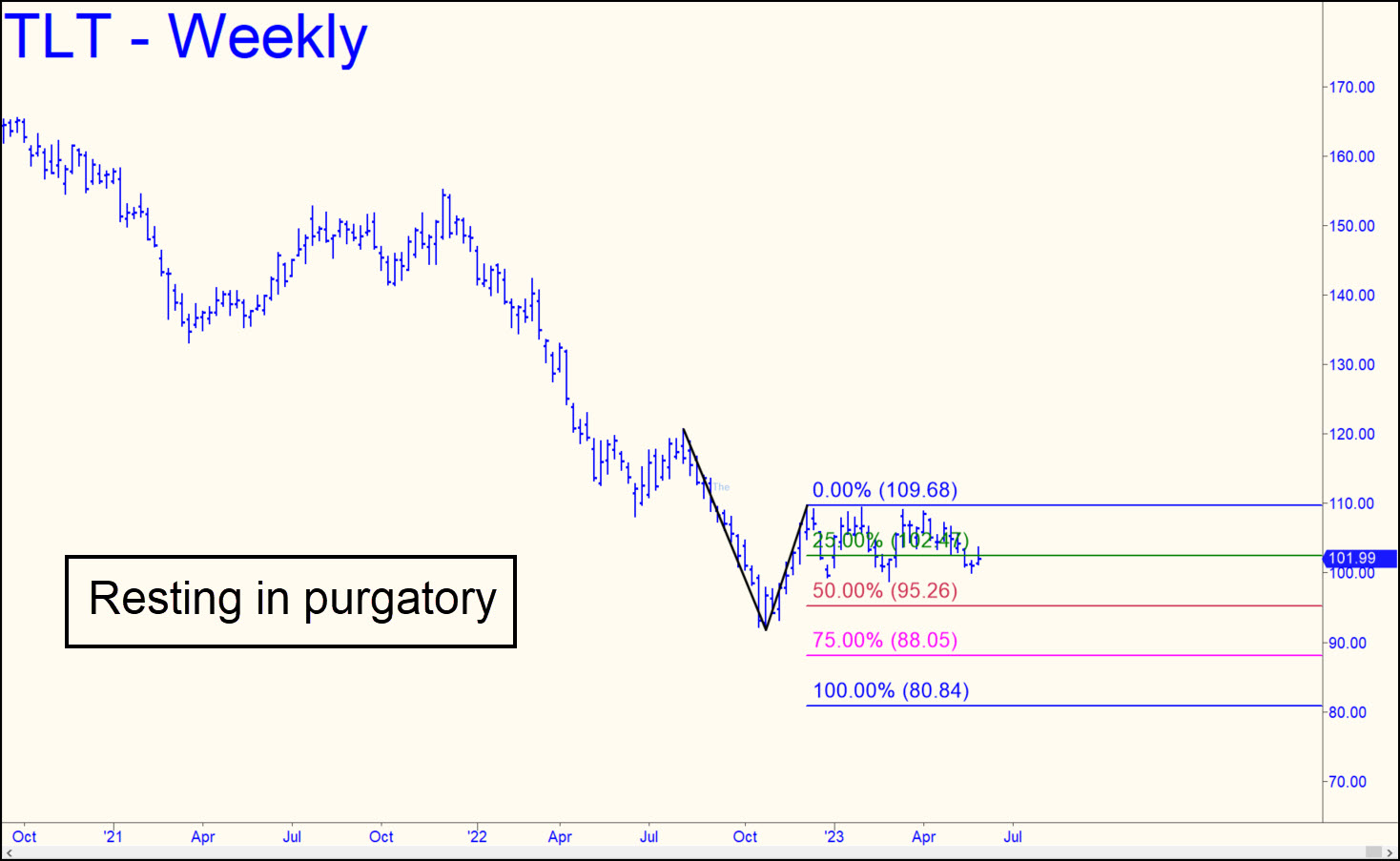

This ETF proxy for long-dated T-Bonds has looked like hell for so long that its sideways slide since December has seemed like a relative vacation in purgatory. A drop below the distribution zone it has traversed during that time seems all but inevitable, however, and we should expect TLT to hit p=95.26 at a minimum. That’s a midpoint Hidden Pivot support and well located to set up an opportune buy against the long-term trend. We may be able to accomplish this with entry risk held to as little as 3 or 4 ticks, so stay tuned to the chat room if you care. Be sure to check ‘Notifications’ on your account dashboard as well. ______ UPDATE (Jun 10): It’s nothing to celebrate, at least not yet, but this glue horse created a bullish impulse leg on the daily chart last week that should be noted. The rally appears bound for p=102.60 at least, but an easy pop through the pivot would imply more upside potential over the near term to D=104.41. Both numbers should work for day traders looking to get short with ‘camouflage’ on the lesser charts, and ‘mechanical’ buys should provide easy wins as well.

This ETF proxy for long-dated T-Bonds has looked like hell for so long that its sideways slide since December has seemed like a relative vacation in purgatory. A drop below the distribution zone it has traversed during that time seems all but inevitable, however, and we should expect TLT to hit p=95.26 at a minimum. That’s a midpoint Hidden Pivot support and well located to set up an opportune buy against the long-term trend. We may be able to accomplish this with entry risk held to as little as 3 or 4 ticks, so stay tuned to the chat room if you care. Be sure to check ‘Notifications’ on your account dashboard as well. ______ UPDATE (Jun 10): It’s nothing to celebrate, at least not yet, but this glue horse created a bullish impulse leg on the daily chart last week that should be noted. The rally appears bound for p=102.60 at least, but an easy pop through the pivot would imply more upside potential over the near term to D=104.41. Both numbers should work for day traders looking to get short with ‘camouflage’ on the lesser charts, and ‘mechanical’ buys should provide easy wins as well.

TLT – Lehman Bond ETF (Last:101.92)