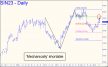

The rally from May 26’s 22.78 low would become an enticing ‘mechanical’ short if it touches the green line (x=25.19), as seems likely. Initial risk would be a little more than $4000 per contract, so the trade is recommended only to those of you who know how to cut that by at least 90% using a ‘camouflage’ trigger. If there is sufficient interest in the chat room, I will provide guidance in real time. We would be shooting not for a drop to ‘D’, but for a single-level profit predicated on exiting at p=23.946. A fall to D=21.46 would still be a theoretical possibility, however. ______ UPDATE (Jun 16): Yet another week of excruciating tedium told us nothing we didn’t know a month ago. Even the crime syndicate that manipulates bullion futures seems too bored to bother. The analysis above can stand as given.

The rally from May 26’s 22.78 low would become an enticing ‘mechanical’ short if it touches the green line (x=25.19), as seems likely. Initial risk would be a little more than $4000 per contract, so the trade is recommended only to those of you who know how to cut that by at least 90% using a ‘camouflage’ trigger. If there is sufficient interest in the chat room, I will provide guidance in real time. We would be shooting not for a drop to ‘D’, but for a single-level profit predicated on exiting at p=23.946. A fall to D=21.46 would still be a theoretical possibility, however. ______ UPDATE (Jun 16): Yet another week of excruciating tedium told us nothing we didn’t know a month ago. Even the crime syndicate that manipulates bullion futures seems too bored to bother. The analysis above can stand as given.

SIN23 – July Silver (Last:24.12)