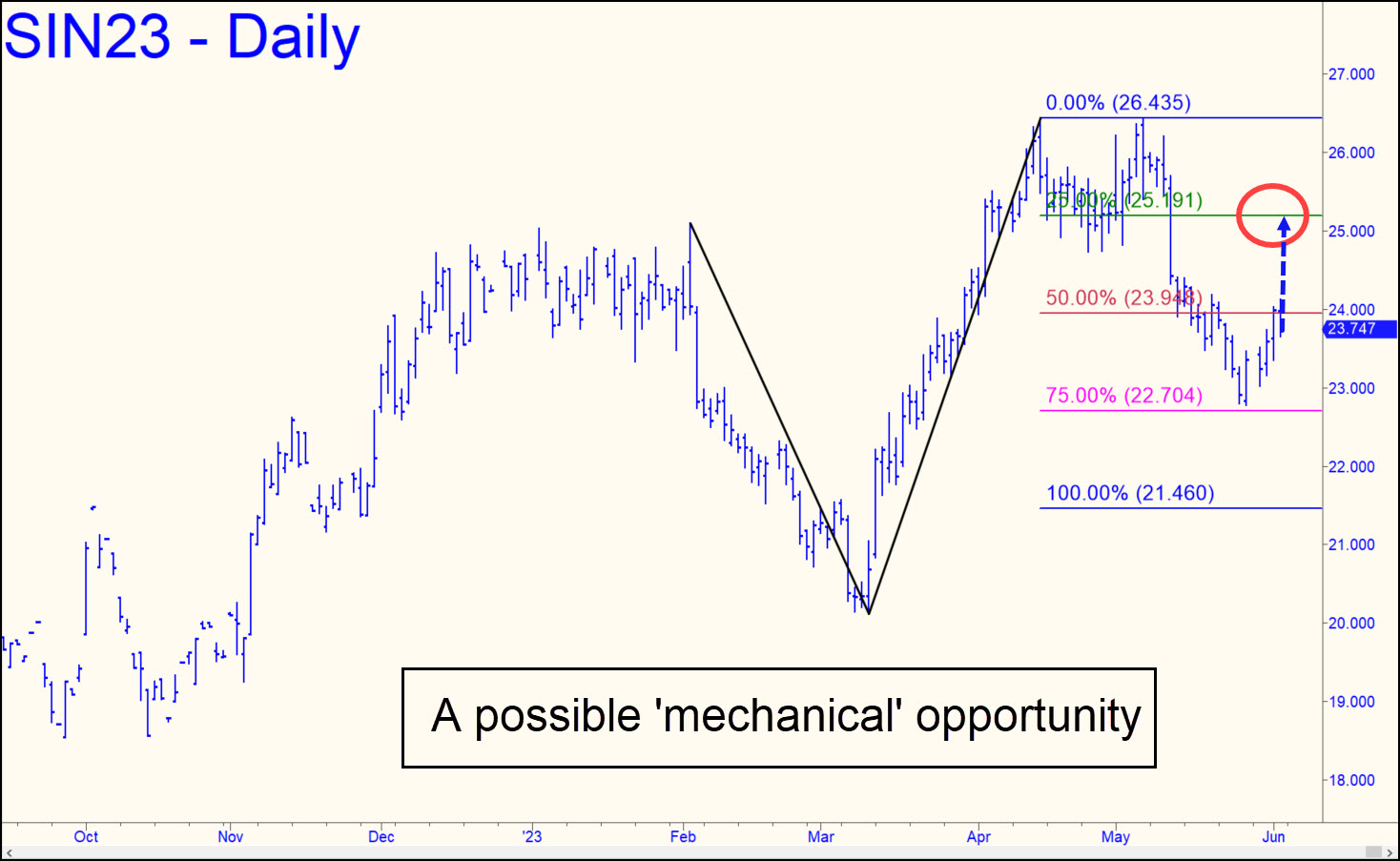

Silver looks likely to fall to a D target at 21.46 that’s equivalent to one in gold that seems somewhat out of reach. On balance, I lean toward a bearish resolution, but we’ll monitor this symbol closely in any case. A rally to the green line (x=25.19) would trigger an enticing ‘mechanical’ short, but because the entry risk would be more than $6000 per contract, we should plan on doing the trade with a camouflage trigger that can cut that to $600 or less. If the futures instead fall, bottom-fishing at D would be attractive, although the pattern looks too obvious to deliver a precise low at the Hidden Pivot.

Silver looks likely to fall to a D target at 21.46 that’s equivalent to one in gold that seems somewhat out of reach. On balance, I lean toward a bearish resolution, but we’ll monitor this symbol closely in any case. A rally to the green line (x=25.19) would trigger an enticing ‘mechanical’ short, but because the entry risk would be more than $6000 per contract, we should plan on doing the trade with a camouflage trigger that can cut that to $600 or less. If the futures instead fall, bottom-fishing at D would be attractive, although the pattern looks too obvious to deliver a precise low at the Hidden Pivot.

SIN23 – July Silver (Last:23.74)