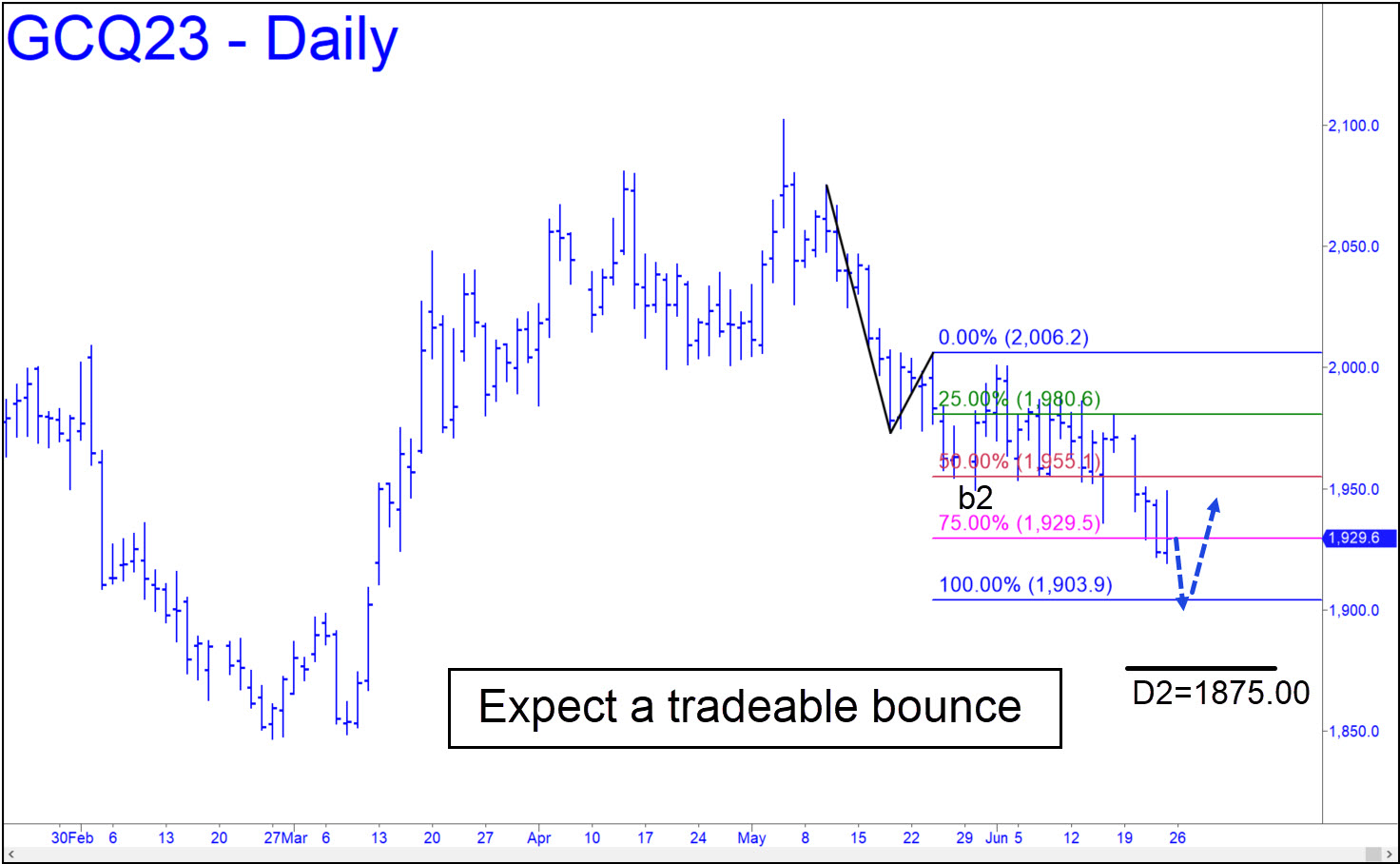

August Gold looks bound for a minimum 1903.90, but if that Hidden Pivot support gives way, look for the downtrend to continue to at least 1875.00. (A related p2 support at 1906.40 could also engender a precise, tradeable bounce). Both of those numbers can be bottom-fished with ‘reverse’ patterns and a theoretical trigger interval of $11. Since that would imply entry risk of more than $4000 on four contracts, you should initiate the trade only via an rABC set-up on the 15-minute chart or less and initial risk held to no more than $200 per contract.

August Gold looks bound for a minimum 1903.90, but if that Hidden Pivot support gives way, look for the downtrend to continue to at least 1875.00. (A related p2 support at 1906.40 could also engender a precise, tradeable bounce). Both of those numbers can be bottom-fished with ‘reverse’ patterns and a theoretical trigger interval of $11. Since that would imply entry risk of more than $4000 on four contracts, you should initiate the trade only via an rABC set-up on the 15-minute chart or less and initial risk held to no more than $200 per contract.

GCQ23 – August Gold (Last:1929.60)