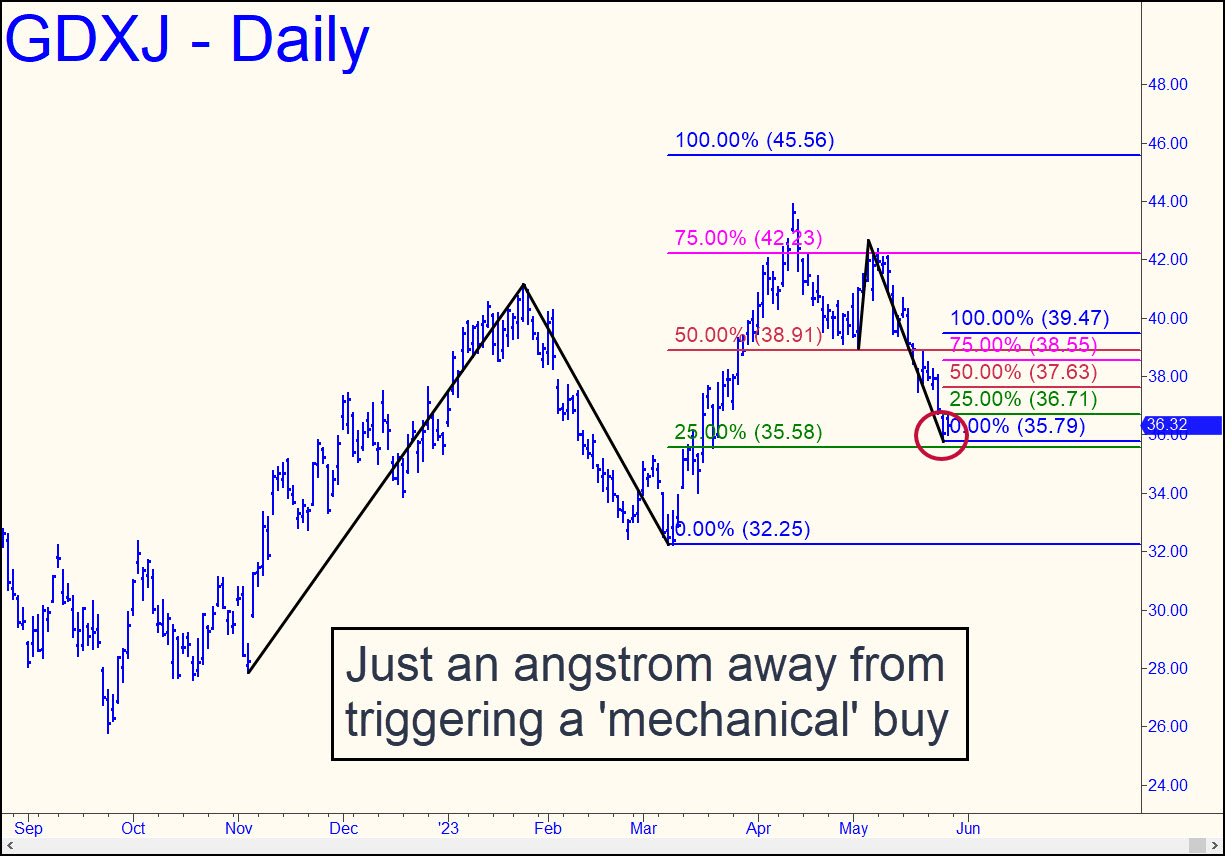

GDXJ missed triggering a ‘mechanical’ buy last week by just 21 cents, but if it follows through to the downside and hits the green line (x=35.59), the trade would be a ‘go’. From that point forward you could get long on a buy-stop following any rally of $1.12. That’s how much entry risk you’d be taking per share, but it would be predicated on a potential profit of as much $2.75 per share. You could cut that down to as little as 0.34 per share by triggering yourself into the trade on a rally of at least 35 cents from C or lower, and although taking that approach looks like it has a good chance of producing a profit, it would not necessarily get you to the 45.56 target of the big pattern.

GDXJ missed triggering a ‘mechanical’ buy last week by just 21 cents, but if it follows through to the downside and hits the green line (x=35.59), the trade would be a ‘go’. From that point forward you could get long on a buy-stop following any rally of $1.12. That’s how much entry risk you’d be taking per share, but it would be predicated on a potential profit of as much $2.75 per share. You could cut that down to as little as 0.34 per share by triggering yourself into the trade on a rally of at least 35 cents from C or lower, and although taking that approach looks like it has a good chance of producing a profit, it would not necessarily get you to the 45.56 target of the big pattern.

GDXJ – Junior Gold Miner ETF (Last:36.32)