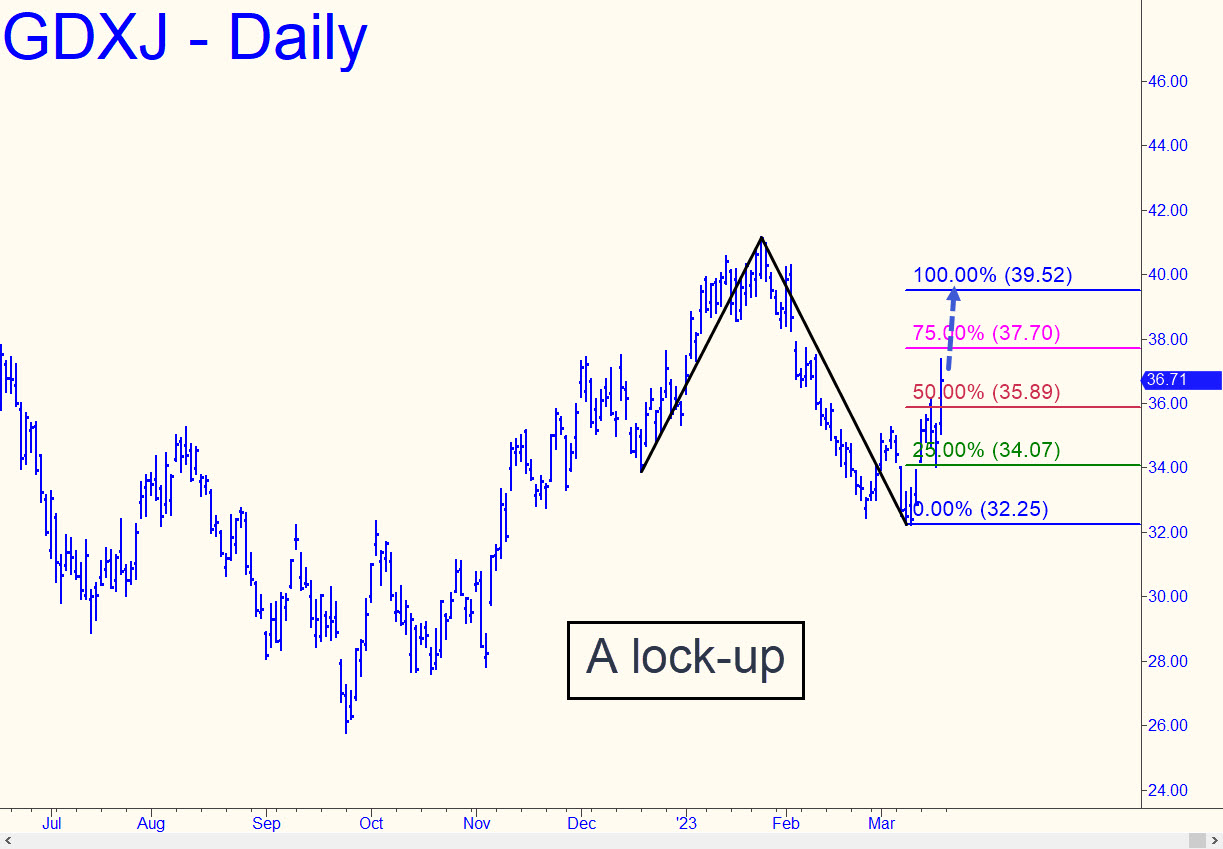

Friday’s explosive rally ended GDXJ’s doldrums decisively, all but guaranteeing more upside in the days ahead to the 39.52 Hidden Pivot target shown. It followed an opportune dip to the green line that supported a ‘mechanical’ buy if you were nimble enough to catch the low, which exceeded x by a microscopic three cents. Any additional one-level swoons, however unlikely, can be used to bottom-fish with a tight stop-loss appropriate to your entry method. As always, a decisive push past a ‘D’ resistance would be telegraphing the continuation of the uptrend. _______ UPDATE (Mar 20, 8:23 p.m. EDT): This pattern tripped a profitable ‘mechanical’ buy today on the pullback to the green line. It projects to 38.04, a possible resting spot enroute to 39.52. _______ UPDATE (Mar 21, 5:12 p.m.): A wrenching fall from p2 may have made the day unpleasant, but seen in the perspective of this hourly chart, the damage was not too bad. If the swoon continues to x=34.07, it would trigger an opportune ‘mechanical’ buy. A red-line buy at 35.89, stop 34.68, is also possible, but I am not recommending it explicitly.

Friday’s explosive rally ended GDXJ’s doldrums decisively, all but guaranteeing more upside in the days ahead to the 39.52 Hidden Pivot target shown. It followed an opportune dip to the green line that supported a ‘mechanical’ buy if you were nimble enough to catch the low, which exceeded x by a microscopic three cents. Any additional one-level swoons, however unlikely, can be used to bottom-fish with a tight stop-loss appropriate to your entry method. As always, a decisive push past a ‘D’ resistance would be telegraphing the continuation of the uptrend. _______ UPDATE (Mar 20, 8:23 p.m. EDT): This pattern tripped a profitable ‘mechanical’ buy today on the pullback to the green line. It projects to 38.04, a possible resting spot enroute to 39.52. _______ UPDATE (Mar 21, 5:12 p.m.): A wrenching fall from p2 may have made the day unpleasant, but seen in the perspective of this hourly chart, the damage was not too bad. If the swoon continues to x=34.07, it would trigger an opportune ‘mechanical’ buy. A red-line buy at 35.89, stop 34.68, is also possible, but I am not recommending it explicitly.

GDXJ – Junior Gold Miner ETF (Last:35.91)