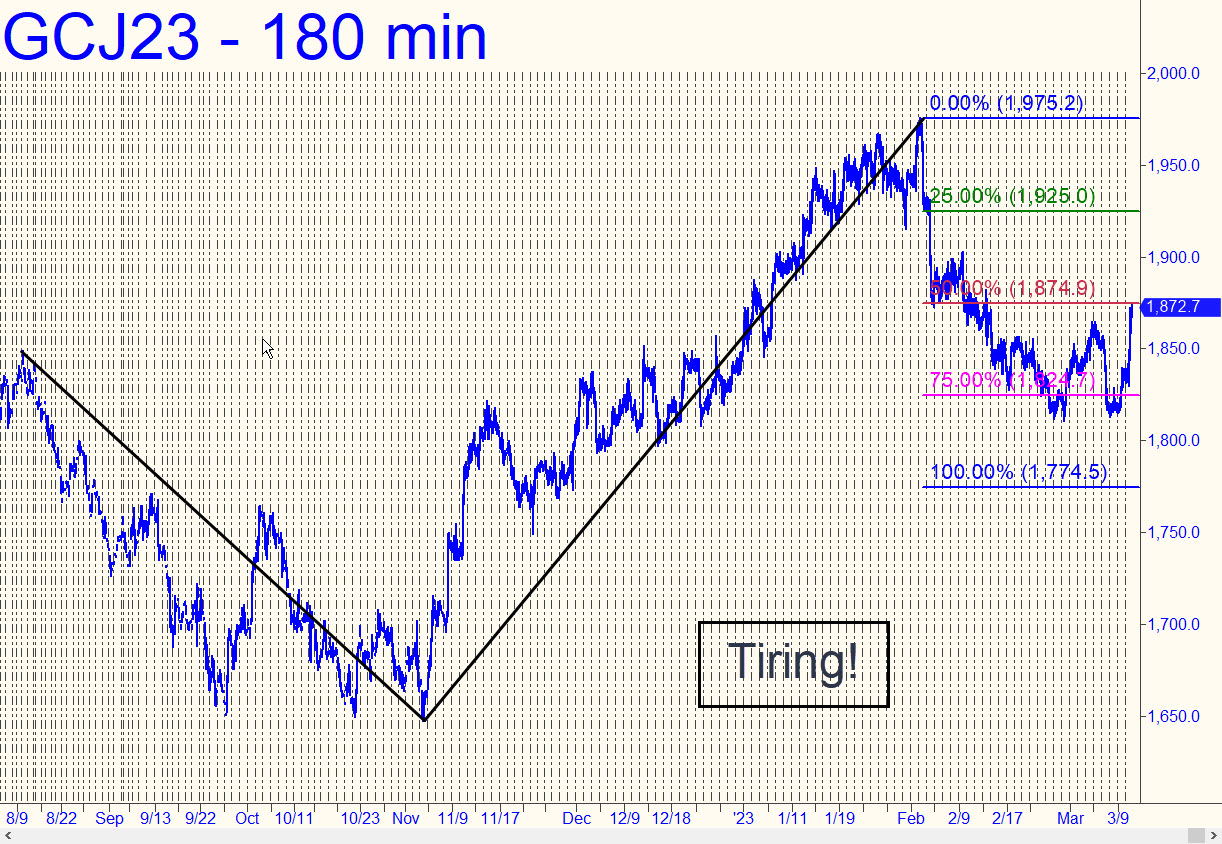

Gold’s gratuitous feints in both directions have become tiresome, and so I’m not going to get too heavily invested in the opportunistic leap it took Friday on dollar weakness. The pattern shown says a ‘mechanical’ short would trigger at x=1925.00, but I would not be especially enthused about laying out a few contracts there, since the bearish energy of the A-B leg has had a lot of time to diffuse. The short can be attempted nonetheless, provided we use a ‘camouflage’ trigger to initiate the trade. In any event, the 1774.50 downside target that was first signaled on February 2 remains theoretically viable, if no longer compelling. _______ UPDATE (Mar 13, 10:27 p.m.): This should be interesting now that the flight to safety that has followed SVB’s collapse is looking more like a buying panic. The ‘mechanical’ short at 1925 still looks enticing, but I’ll suggest paper trading it unless you know how to set up a ‘camouflage’ trigger near the green line. This implies doing the trade on the five-minute chart (or less) when x is hit. _______ UPDATE (Mar 15, 9:44 a.m.): Buyers impaled x=1925 without triggering any shorts (other than a ‘conventional’-type entry at x that we never use). Price action within the pattern is still interesting for what it seems to predict — i.e., that a one-level relapse to p=1874.90 that would make the short profitable is still more likely than a rally exceeding C=1975.20. _______ UPDATE (Mar 16, 11:31 p.m.): When April Gold punches through the midpoint resistance at 1938.00, it’ll be bound (exactly) for D=1964.50 of this pattern.

Gold’s gratuitous feints in both directions have become tiresome, and so I’m not going to get too heavily invested in the opportunistic leap it took Friday on dollar weakness. The pattern shown says a ‘mechanical’ short would trigger at x=1925.00, but I would not be especially enthused about laying out a few contracts there, since the bearish energy of the A-B leg has had a lot of time to diffuse. The short can be attempted nonetheless, provided we use a ‘camouflage’ trigger to initiate the trade. In any event, the 1774.50 downside target that was first signaled on February 2 remains theoretically viable, if no longer compelling. _______ UPDATE (Mar 13, 10:27 p.m.): This should be interesting now that the flight to safety that has followed SVB’s collapse is looking more like a buying panic. The ‘mechanical’ short at 1925 still looks enticing, but I’ll suggest paper trading it unless you know how to set up a ‘camouflage’ trigger near the green line. This implies doing the trade on the five-minute chart (or less) when x is hit. _______ UPDATE (Mar 15, 9:44 a.m.): Buyers impaled x=1925 without triggering any shorts (other than a ‘conventional’-type entry at x that we never use). Price action within the pattern is still interesting for what it seems to predict — i.e., that a one-level relapse to p=1874.90 that would make the short profitable is still more likely than a rally exceeding C=1975.20. _______ UPDATE (Mar 16, 11:31 p.m.): When April Gold punches through the midpoint resistance at 1938.00, it’ll be bound (exactly) for D=1964.50 of this pattern.

GCJ23 – April Gold (Last:1932.60)