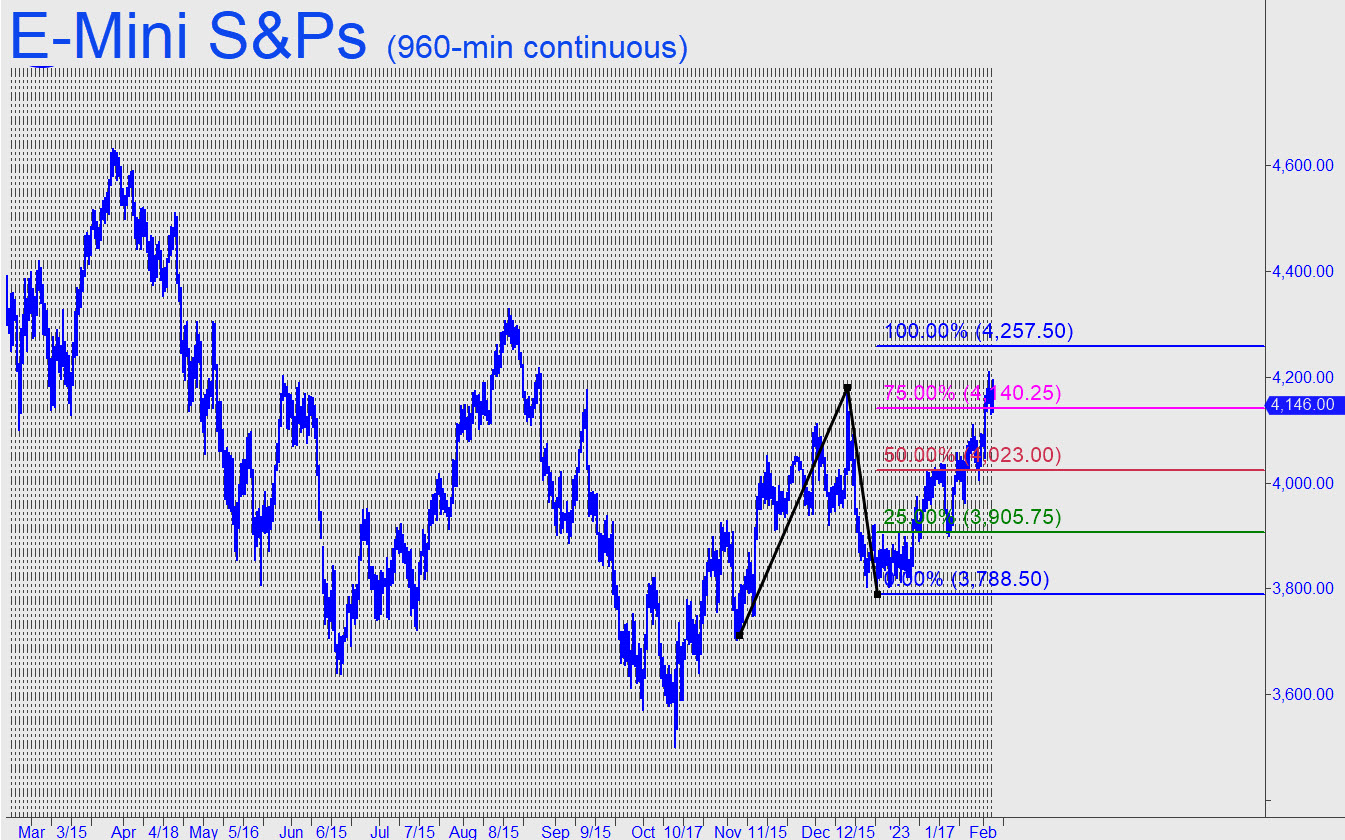

The chart shown is experimental. It is continuous, meaning that it blends highs and lows from different contract months to produce a 4257.50 rally target. The A, B and C coordinates are related, but only as cousins, not siblings. Will the ‘D’ target still work? The ‘p’ midpoint certainly did, precisely containing the C-D rally leg, albeit not for long. We’ve been using the 4233.50 target of the same pattern, except derived ‘organically’ from the March contract. Last week’s short squeeze got within 0.5% of it, but my gut feeling is that the futures have consolidated enough already to blow past 4233.50 on the next upthrust. That target can be used nevertheless to get short with a tightly compressed rABC pattern, but I’m going to suggest using 4257.50 as well, if and when the futures get there. Incidentally, it is ‘backstopped’ by a ‘voodoo resistance’ at 4252 that could also be used to anchor an rABC short.

The chart shown is experimental. It is continuous, meaning that it blends highs and lows from different contract months to produce a 4257.50 rally target. The A, B and C coordinates are related, but only as cousins, not siblings. Will the ‘D’ target still work? The ‘p’ midpoint certainly did, precisely containing the C-D rally leg, albeit not for long. We’ve been using the 4233.50 target of the same pattern, except derived ‘organically’ from the March contract. Last week’s short squeeze got within 0.5% of it, but my gut feeling is that the futures have consolidated enough already to blow past 4233.50 on the next upthrust. That target can be used nevertheless to get short with a tightly compressed rABC pattern, but I’m going to suggest using 4257.50 as well, if and when the futures get there. Incidentally, it is ‘backstopped’ by a ‘voodoo resistance’ at 4252 that could also be used to anchor an rABC short.

ESH23 – March E-Mini S&Ps (Last:4146.00)