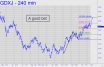

Having topped last week a penny below a longstanding Hidden Pivot target at 41.17, GDXJ presumably will need a little rest for the next upthrust. When this mining ETF takes flight, the 43.49 Hidden Pivot shown in the chart can serve as a minimum price objective. The pattern is less than ideal, since B is a ‘sausage’ peak that failed to surpass some external peaks well to the left. However, the subsequent dance so close to p= 38.71 has made up for the typical sausage drawbacks of unreliability and inaccuracy. Moreover, it’s hard to imagine GDXJ lacking the power to reach D no matter how illegitimate the pattern. A vicious swoon to x=36.31 would trigger a screaming ‘mechanical’ buy. In this case, however, given the relentless persistence of the trend, it can be attempted on a pullback to p=38.71 with a stop-loss at 37.11. Paper-trade this one if you still need persuading that the preponderance of ‘mechanical’ trades posted here and in the chat room are winners. _______ UPDATE (Feb 3, 11:37 a.m. EST): If this unusually vicious takedown continues, X=36.31 should be bought ‘mechanically’, stop 33.92. A ‘camo’ trigger should be used to reduce entry risk by perhaps 90%. This gambit is ‘textbook’, but paper-trade it if you are not yet comfortable with ‘mechanical’ set-ups.

Having topped last week a penny below a longstanding Hidden Pivot target at 41.17, GDXJ presumably will need a little rest for the next upthrust. When this mining ETF takes flight, the 43.49 Hidden Pivot shown in the chart can serve as a minimum price objective. The pattern is less than ideal, since B is a ‘sausage’ peak that failed to surpass some external peaks well to the left. However, the subsequent dance so close to p= 38.71 has made up for the typical sausage drawbacks of unreliability and inaccuracy. Moreover, it’s hard to imagine GDXJ lacking the power to reach D no matter how illegitimate the pattern. A vicious swoon to x=36.31 would trigger a screaming ‘mechanical’ buy. In this case, however, given the relentless persistence of the trend, it can be attempted on a pullback to p=38.71 with a stop-loss at 37.11. Paper-trade this one if you still need persuading that the preponderance of ‘mechanical’ trades posted here and in the chat room are winners. _______ UPDATE (Feb 3, 11:37 a.m. EST): If this unusually vicious takedown continues, X=36.31 should be bought ‘mechanically’, stop 33.92. A ‘camo’ trigger should be used to reduce entry risk by perhaps 90%. This gambit is ‘textbook’, but paper-trade it if you are not yet comfortable with ‘mechanical’ set-ups.

GDXJ – Junior Gold Miner ETF (Last:39.51)