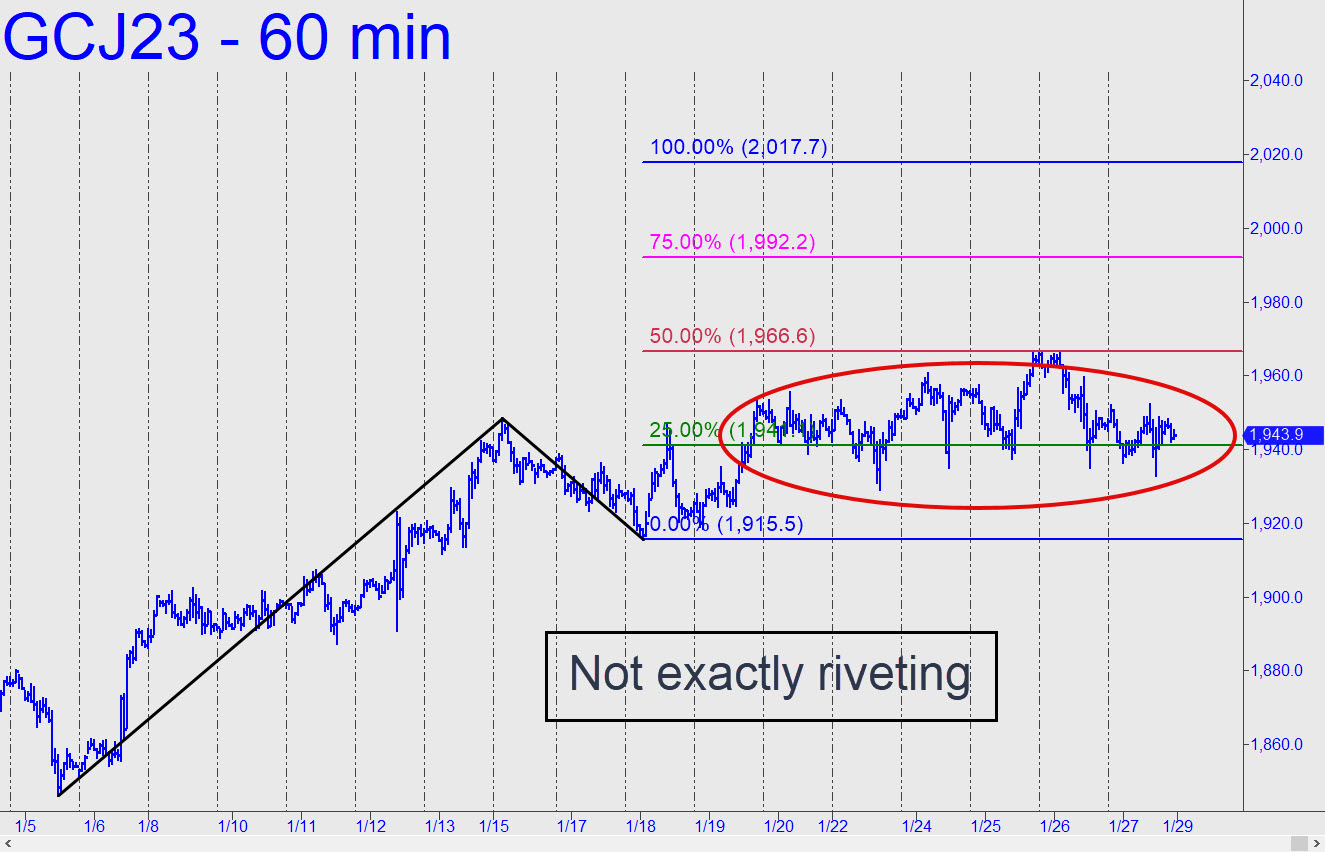

I still think this is the pattern that will usher gold futures above $2,000 for the fist time since since April — just not on our schedule. It did nothing as the week ended to monetize the ‘mechanical’ buy triggered on Thursday, although the position was showing a slight gain at the closing bell. I cannot ‘guarantee’ D=2017.70 will be reached, since buying died precisely at the 1966.60 midpoint Hidden Pivot resistance (p was a decent speculative short, actually, for subscribers who trade this vehicle aggressively). If the futures dip below the green line and you hold no position, try bottom fishing at 1921.2 with a stop-loss at 1920.80. This is a speculative play based on the 60-minute chart where a= 1966.10 on 1/26 and b=1935.10. _______ UPDATE (Jan 31, 6:42 a.m.): Last week’s stall at the p midpoint pivot of D=2017.70 is about to have consequences, with the futures poised to negate the pattern noted above with a marginal dip (or worse) below C=1915.50. They’ll come down to around 1900 if they slip any lower, or possibly even to 1891.10 to test an important low recorded there on January 12. _______ UPDATE (Jan 31, 10:23 p.m.): Ha ha very funny. The futures’ dive on the opening bar failed by a tick to stop out the bullish pattern and its 2017.70 target. If the April contract hits p=1966.6 and then falls again to x=1941.10, that’s would trip a ‘mechanical’ buy that I’d recommend, subject to the usual caveats. _______ UPDATE (Feb 1, 6:26 pm.): The drop from just shy of 1966 only came down to 1955.40, so there was no trade. It left this pattern, with a short-term target at 1982.30. The pattern looks opportune for a ‘mechanical’ buy following a one-level pullback to either p=1968.90 or x=1962.10. Attempt the trade only if you have no questions concerning my instruction. _____ UPDATE (Feb 2, 8:49 p.m.): More ha-ha stuff, clown-like antics mixed with psychosis.

I still think this is the pattern that will usher gold futures above $2,000 for the fist time since since April — just not on our schedule. It did nothing as the week ended to monetize the ‘mechanical’ buy triggered on Thursday, although the position was showing a slight gain at the closing bell. I cannot ‘guarantee’ D=2017.70 will be reached, since buying died precisely at the 1966.60 midpoint Hidden Pivot resistance (p was a decent speculative short, actually, for subscribers who trade this vehicle aggressively). If the futures dip below the green line and you hold no position, try bottom fishing at 1921.2 with a stop-loss at 1920.80. This is a speculative play based on the 60-minute chart where a= 1966.10 on 1/26 and b=1935.10. _______ UPDATE (Jan 31, 6:42 a.m.): Last week’s stall at the p midpoint pivot of D=2017.70 is about to have consequences, with the futures poised to negate the pattern noted above with a marginal dip (or worse) below C=1915.50. They’ll come down to around 1900 if they slip any lower, or possibly even to 1891.10 to test an important low recorded there on January 12. _______ UPDATE (Jan 31, 10:23 p.m.): Ha ha very funny. The futures’ dive on the opening bar failed by a tick to stop out the bullish pattern and its 2017.70 target. If the April contract hits p=1966.6 and then falls again to x=1941.10, that’s would trip a ‘mechanical’ buy that I’d recommend, subject to the usual caveats. _______ UPDATE (Feb 1, 6:26 pm.): The drop from just shy of 1966 only came down to 1955.40, so there was no trade. It left this pattern, with a short-term target at 1982.30. The pattern looks opportune for a ‘mechanical’ buy following a one-level pullback to either p=1968.90 or x=1962.10. Attempt the trade only if you have no questions concerning my instruction. _____ UPDATE (Feb 2, 8:49 p.m.): More ha-ha stuff, clown-like antics mixed with psychosis.

GCJ23 – April Gold (Last:1931.60)