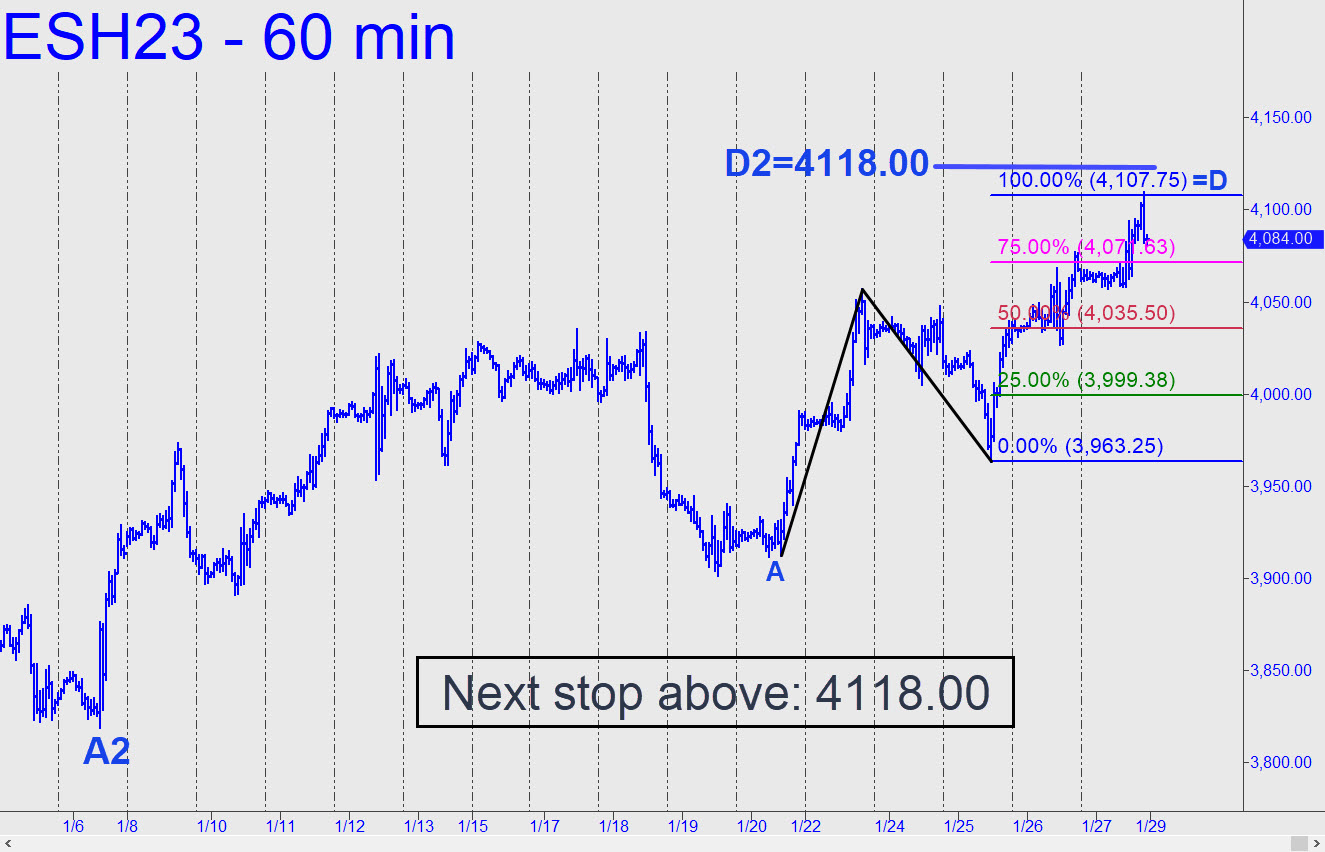

I’d said shorting 4118.00 would be a no-brainer on Friday — except that the futures didn’t get there. Instead, they topped almost exactly at the ‘D’ target of the lesser pattern shown in the chart (inset). Bears shouldn’t get their hopes too high however, since I expect the futures to reverse Sunday night or Monday and reach D=4118.00. It can be shorted with a very tight stop-loss — preferably with a tight ‘camo’ set-up on a lesser chart — but we’ll need to pay close attention in any case to how the rally interacts with a D resistance that has been three weeks in coming. There are no ‘mechanical’ buys left in the pattern no matter how hard ES falls, since it is spent. ______ UPDATE (Jan 30, 9:36 a.m. EST): Like many of you, I don’t trust my lying eyes when I see the bear market rally fall precipitously ahead of the opening, as it is doing today. Usually that means DaBoyz are fixing to exhaust sellers, the better to short-squeeze stocks an hour later. We should know shortly if their scheme is doomed and the bear rally begun in October has ended, since the decline has triggered a textbook ‘mechanical’ buy at 4053, stop 4027. If the stop is hit and no sharp rally follows immediately after, that would suggest that the heavily engineered celebration on Wall Street since mid-October is over. As of Friday, ES had not quite reached a juicy target at 4118 where I’d suggested getting short. The top actually occurred nine points below it, at the exact ‘D’ target of a lesser pattern noted at the time. Stocks supposedly fell overnight because earnings announcements due out this week from four behemoths — Apple, Amazon, Google and Facebook — might have to acknowledge deepening (albeit still officially denied) U.S. and global recessions. The downturn was bound to come in a way that left bears skittish about getting short at just the right time, and Friday’s vicious short-squeeze did the trick. In retrospect, if there was a good reason to suspect the bear rally would not challenge December’s 4180 high, let alone the August peak at 4361, it was the failure of the 4180 peak itself to ‘impulse’ above mid-September’s peak at 4194. This chart shows it all. _______ UPDATE (Jan 30, 7:43 p.m.): Bulls flunked two tests today, telegraphing more weakness ahead. For one, DaBoyz couldn’t squeeze much of a rally from the oversold condition they engineered ahead of the opening bell. And for two, a textbook ‘mechanical’ buy that I detailed above and in the chat room produced only a one-level profit to (almost) p rather than going all the way to D. Expect the impending plunge to test support at last Wednesday’s low, 3963.25, and to fail because of its obviousness. I’ll be looking to buy with a tight rABC set-up in a voodoo zone near 3940, but if it too fails, expect a washout down to billboard lows nearer 3900 recorded two weeks ago.

I’d said shorting 4118.00 would be a no-brainer on Friday — except that the futures didn’t get there. Instead, they topped almost exactly at the ‘D’ target of the lesser pattern shown in the chart (inset). Bears shouldn’t get their hopes too high however, since I expect the futures to reverse Sunday night or Monday and reach D=4118.00. It can be shorted with a very tight stop-loss — preferably with a tight ‘camo’ set-up on a lesser chart — but we’ll need to pay close attention in any case to how the rally interacts with a D resistance that has been three weeks in coming. There are no ‘mechanical’ buys left in the pattern no matter how hard ES falls, since it is spent. ______ UPDATE (Jan 30, 9:36 a.m. EST): Like many of you, I don’t trust my lying eyes when I see the bear market rally fall precipitously ahead of the opening, as it is doing today. Usually that means DaBoyz are fixing to exhaust sellers, the better to short-squeeze stocks an hour later. We should know shortly if their scheme is doomed and the bear rally begun in October has ended, since the decline has triggered a textbook ‘mechanical’ buy at 4053, stop 4027. If the stop is hit and no sharp rally follows immediately after, that would suggest that the heavily engineered celebration on Wall Street since mid-October is over. As of Friday, ES had not quite reached a juicy target at 4118 where I’d suggested getting short. The top actually occurred nine points below it, at the exact ‘D’ target of a lesser pattern noted at the time. Stocks supposedly fell overnight because earnings announcements due out this week from four behemoths — Apple, Amazon, Google and Facebook — might have to acknowledge deepening (albeit still officially denied) U.S. and global recessions. The downturn was bound to come in a way that left bears skittish about getting short at just the right time, and Friday’s vicious short-squeeze did the trick. In retrospect, if there was a good reason to suspect the bear rally would not challenge December’s 4180 high, let alone the August peak at 4361, it was the failure of the 4180 peak itself to ‘impulse’ above mid-September’s peak at 4194. This chart shows it all. _______ UPDATE (Jan 30, 7:43 p.m.): Bulls flunked two tests today, telegraphing more weakness ahead. For one, DaBoyz couldn’t squeeze much of a rally from the oversold condition they engineered ahead of the opening bell. And for two, a textbook ‘mechanical’ buy that I detailed above and in the chat room produced only a one-level profit to (almost) p rather than going all the way to D. Expect the impending plunge to test support at last Wednesday’s low, 3963.25, and to fail because of its obviousness. I’ll be looking to buy with a tight rABC set-up in a voodoo zone near 3940, but if it too fails, expect a washout down to billboard lows nearer 3900 recorded two weeks ago.

ESH23 – March E-Mini S&Ps (Last:4040.25)