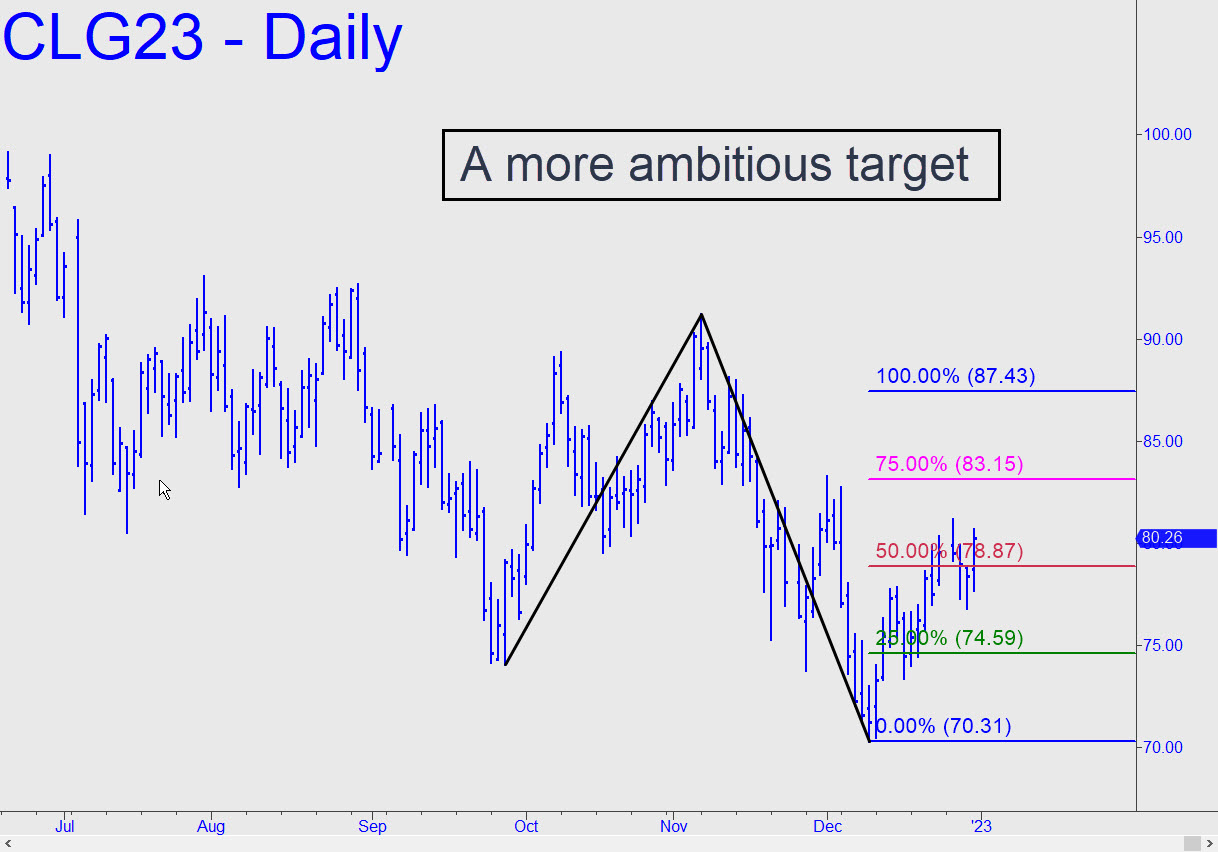

Bulls have so boldly ignored the deepening global recession that I’ve switched to a bigger ‘reverse’ pattern with a higher rally target at 87.43. Don’t expect the March contract to get there any time soon, though, since it has already spent more than a week head-butting a midpoint Hidden Pivot resistance at 78.87. In the meantime, a sharp relapse to the green line (x=74.59) should be used to get long with a ‘mechanical’ bid, stop 70.31. This one’s for subscribers who know how to cut entry risk down to size by using a micro-pattern to initiate the trade. This is what we call ‘camouflage’ trading, and it is much easier than you might imagine. Ask in the chat room if you’re curious. _______ UPDATE (Jan 4, 7:16 p.m.): In the chat room today I suggested buying 13th Jan 67.5-70.0 vertical call spreads for 0.25 to 0.49, day order. However, you can bid 0.25-0.30 for them on Thursday, provided the futures are trading 73.00 or higher. Please let me know if you bought any spreads so that I can determine whether to provide a tracking position. ______ UPDATE (Jan 5, 11:45 p.m.): No one said a word, so I won’t be updating with further guidance.

Bulls have so boldly ignored the deepening global recession that I’ve switched to a bigger ‘reverse’ pattern with a higher rally target at 87.43. Don’t expect the March contract to get there any time soon, though, since it has already spent more than a week head-butting a midpoint Hidden Pivot resistance at 78.87. In the meantime, a sharp relapse to the green line (x=74.59) should be used to get long with a ‘mechanical’ bid, stop 70.31. This one’s for subscribers who know how to cut entry risk down to size by using a micro-pattern to initiate the trade. This is what we call ‘camouflage’ trading, and it is much easier than you might imagine. Ask in the chat room if you’re curious. _______ UPDATE (Jan 4, 7:16 p.m.): In the chat room today I suggested buying 13th Jan 67.5-70.0 vertical call spreads for 0.25 to 0.49, day order. However, you can bid 0.25-0.30 for them on Thursday, provided the futures are trading 73.00 or higher. Please let me know if you bought any spreads so that I can determine whether to provide a tracking position. ______ UPDATE (Jan 5, 11:45 p.m.): No one said a word, so I won’t be updating with further guidance.

CLG23 – Feb Crude (Last:73.38)