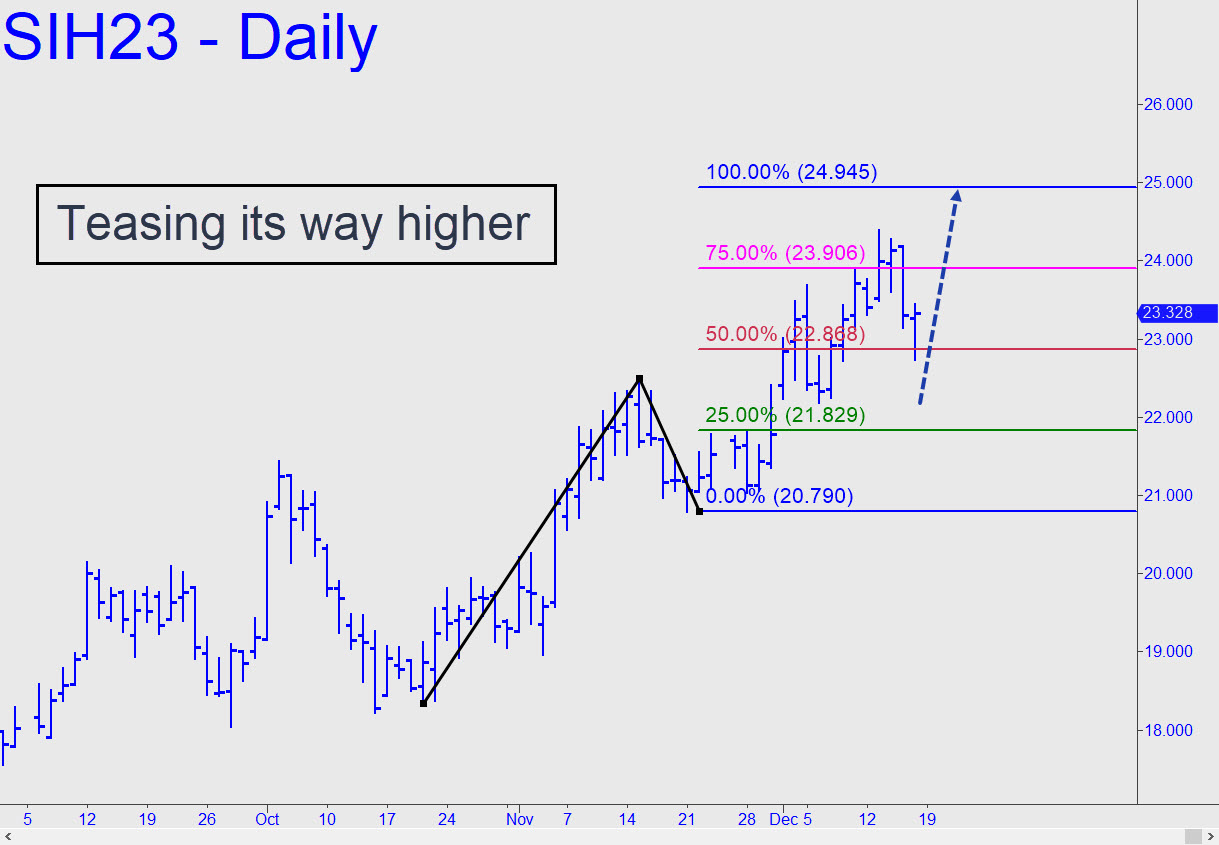

There is more enthusiasm pushing silver than gold, although both are likely to hit their respective ‘D’ targets more or less simultaneously. (March Silver’s lies at 24.95.) That makes a ‘mechanical’ buy at the red line (p=22.86) somewhat riskier, since the required stop-loss at 22.16 might tempt silver’s handlers to drift their way down to it if gold’s sluggish behavior continues. A scarier plunge to the green line (x=21.83) would paradoxically offer a better ‘mechanical’ buying opportunity, but we should plan on initiating the trade with a ‘camouflage’ trigger so that the implied entry risk, which would exceed $20,000 on four contracts, is not so terrifying. _______ UPDATE (Dec 23): The futures made a marginal new high last week that fell 42 cents short of my 24.94 target. It remains valid nonetheless and can be played via a ‘mechanical’ buy at the red line (22.86), stop 22.17. Nudge me in the chat room for real-tie guidance that can help cut entry risk by 90% or more.

There is more enthusiasm pushing silver than gold, although both are likely to hit their respective ‘D’ targets more or less simultaneously. (March Silver’s lies at 24.95.) That makes a ‘mechanical’ buy at the red line (p=22.86) somewhat riskier, since the required stop-loss at 22.16 might tempt silver’s handlers to drift their way down to it if gold’s sluggish behavior continues. A scarier plunge to the green line (x=21.83) would paradoxically offer a better ‘mechanical’ buying opportunity, but we should plan on initiating the trade with a ‘camouflage’ trigger so that the implied entry risk, which would exceed $20,000 on four contracts, is not so terrifying. _______ UPDATE (Dec 23): The futures made a marginal new high last week that fell 42 cents short of my 24.94 target. It remains valid nonetheless and can be played via a ‘mechanical’ buy at the red line (22.86), stop 22.17. Nudge me in the chat room for real-tie guidance that can help cut entry risk by 90% or more.

SIH23 – March Silver (Last:23.92)