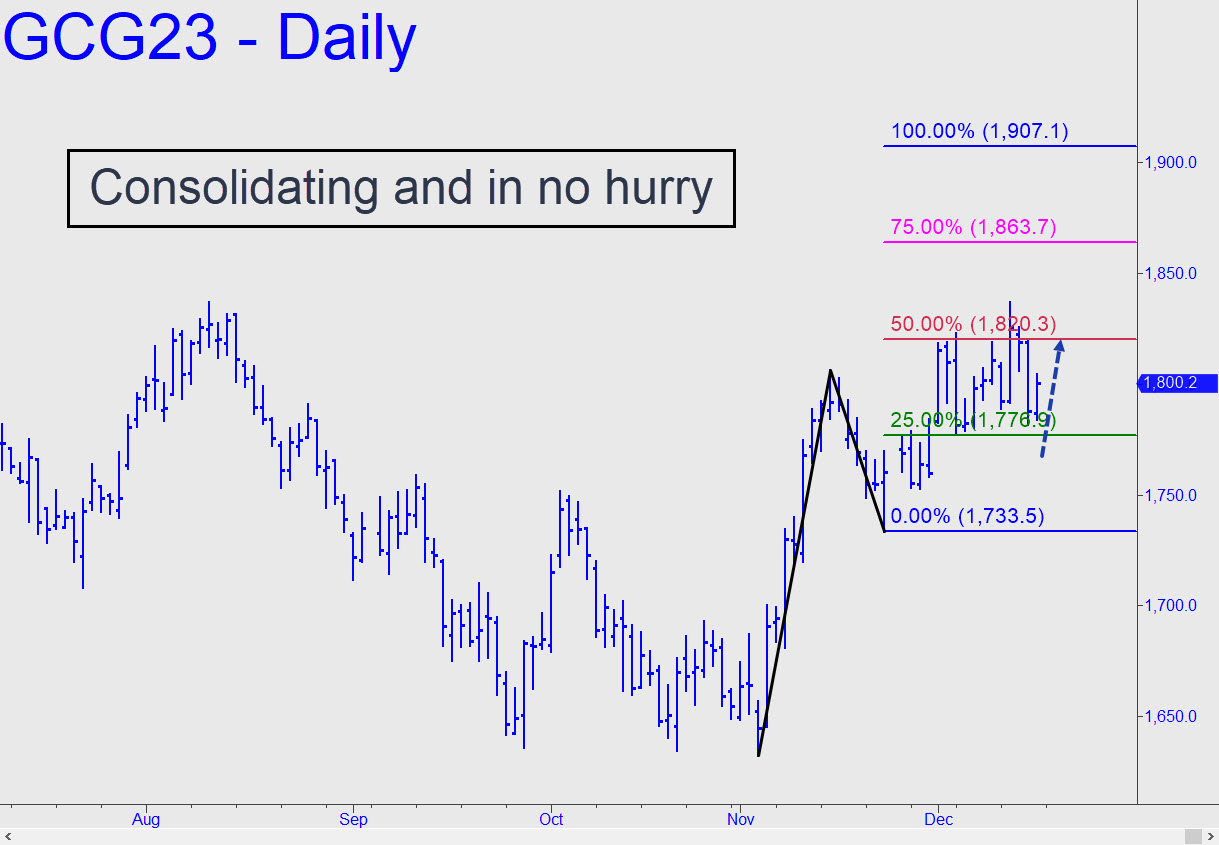

Nearly three weeks of consolidation may have doused the flames from November’s volcanic eruption, but the labored ups and downs over that period haven’t diminished the odds that the next bull leg will hit 1907.10. The target, a Hidden Pivot resistance of daily-chart degree, is shown in the inset. It became no worse than an even-odds bet to be reached last week when the futures briefly poked above the midpoint resistance (p) at 1820.30. They subsequently missed triggering a mechanical buy at the green line (x-1776.90), but the trade will still be viable when trading resumes Sunday evening. With implied entry risk of around $17,000 on four contracts, this one is for subscribers who know how to cut that to $1500 or less using ‘camouflage’. The green line should not be construed as a support or a target; it is just a reference point we use to do certain types of trades. _______ UPDATE (Dec 23): The ‘mechanical’ buy at 1776.90 noted above is still valid and carries the same caveats. _______ UPDATE (Dec 27, 10:27 p.m.): The C-D leg has become so labored and punitive that I am no longer recommending a ‘mechanical’ buy on a pullback to x. The 1907.10 target remains theoretically viable nonetheless.

Nearly three weeks of consolidation may have doused the flames from November’s volcanic eruption, but the labored ups and downs over that period haven’t diminished the odds that the next bull leg will hit 1907.10. The target, a Hidden Pivot resistance of daily-chart degree, is shown in the inset. It became no worse than an even-odds bet to be reached last week when the futures briefly poked above the midpoint resistance (p) at 1820.30. They subsequently missed triggering a mechanical buy at the green line (x-1776.90), but the trade will still be viable when trading resumes Sunday evening. With implied entry risk of around $17,000 on four contracts, this one is for subscribers who know how to cut that to $1500 or less using ‘camouflage’. The green line should not be construed as a support or a target; it is just a reference point we use to do certain types of trades. _______ UPDATE (Dec 23): The ‘mechanical’ buy at 1776.90 noted above is still valid and carries the same caveats. _______ UPDATE (Dec 27, 10:27 p.m.): The C-D leg has become so labored and punitive that I am no longer recommending a ‘mechanical’ buy on a pullback to x. The 1907.10 target remains theoretically viable nonetheless.

GCG23 – February Gold (Last:1819.60)