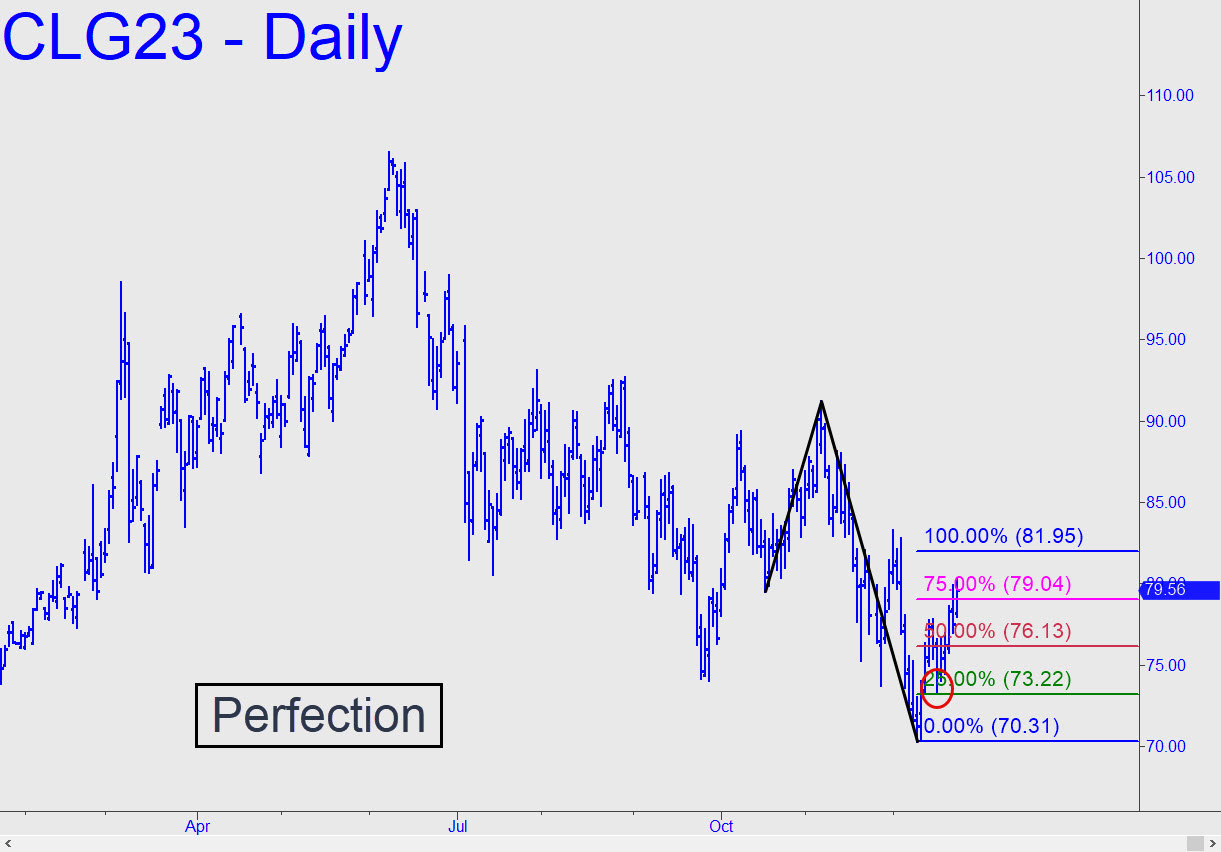

We’ll use the pattern shown, with an 81.95 rally target, since it has already produced a picture-perfect ‘mechanical buy at the green line and would signal yet another on a pullback to the red line (p=76.13, stop 74.19). There is nearly $2000 of entry risk per contract on this trade, so we’ll need to use a ‘camo’ trigger to initiate it. That would entail switching to the five-minute chart or less if and when the Feb contract touches 76.13, then setting up a mico-abcd pattern with commensurate initial risk. Also, the D target at 81.95 is shortable with a tight stop-loss that can be fashioned from a small rABC (i.e., reverse) pattern.

We’ll use the pattern shown, with an 81.95 rally target, since it has already produced a picture-perfect ‘mechanical buy at the green line and would signal yet another on a pullback to the red line (p=76.13, stop 74.19). There is nearly $2000 of entry risk per contract on this trade, so we’ll need to use a ‘camo’ trigger to initiate it. That would entail switching to the five-minute chart or less if and when the Feb contract touches 76.13, then setting up a mico-abcd pattern with commensurate initial risk. Also, the D target at 81.95 is shortable with a tight stop-loss that can be fashioned from a small rABC (i.e., reverse) pattern.

CLG23 – Feb Crude (Last:79.56)