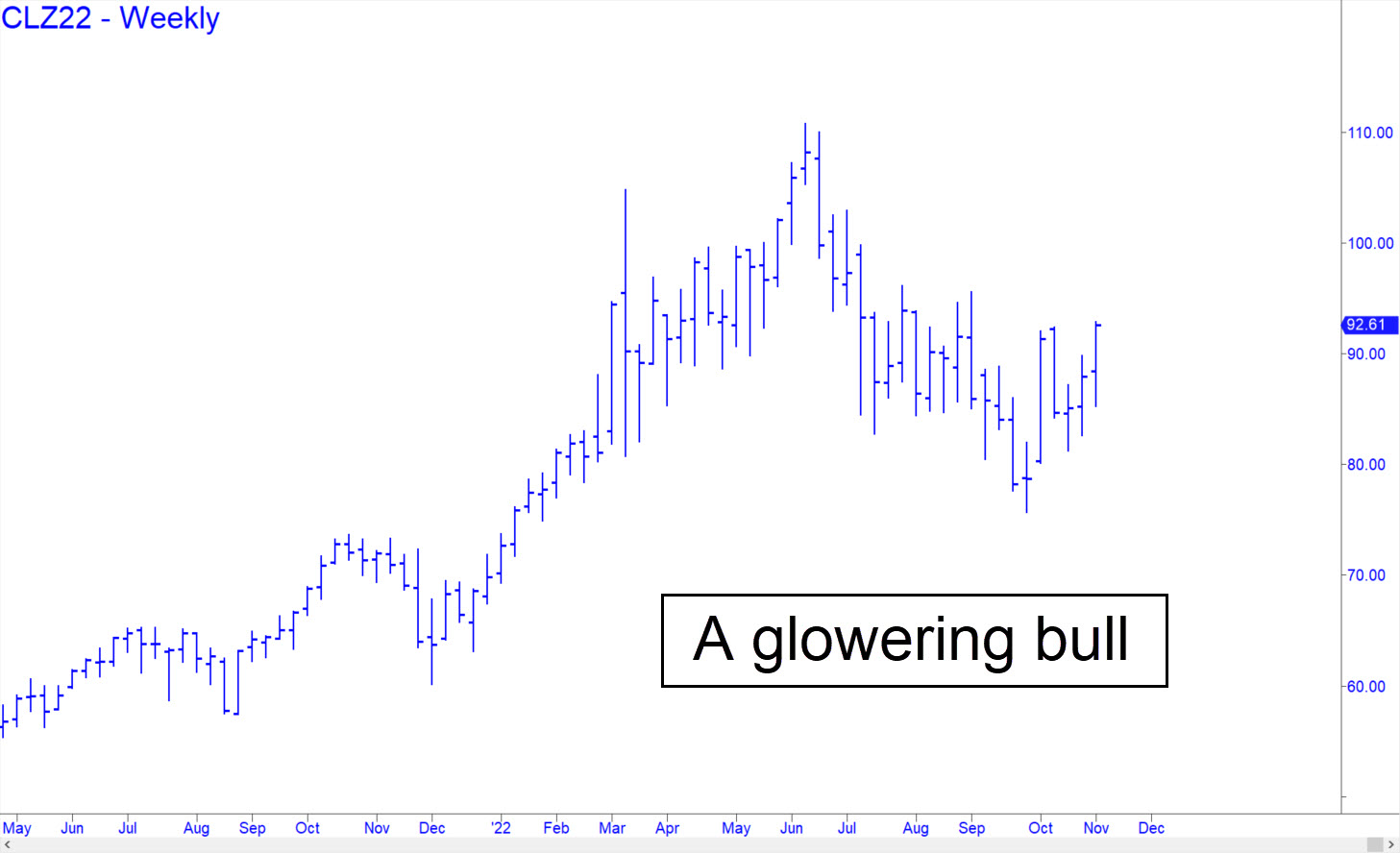

This week’s chart would seem to hold little encouragement for the many who have been praying for fuel price to come down. Unfortunately, December Crude appears to be basing for a run-up to as high as 123.34, but at least to 99.52. The lower target somewhat exceeds the 95.28 target of a smaller pattern we’ve been using to keep us on the right side of the market. Although I expect a tradeable pullback from there, I doubt it will get very far. I can also see opportunities for shorting successfully on the way up, but going with the trend, as always, will be more difficult. The prospect of fuel prices going even higher as winter encroaches is scary. A relapse in the price of December Crude to beneath the September low at 75.70 looks possible, but sellers would first have to take out a prior low on the weekly chart to make it happen. The nearest lies at 81.30. _______ UPDATE (Nov 9, 6:53 p.ml.): The rally died in an interesting place, just pennies shy of a ‘voodoo’ number and well short of the key high at 95.55 recorded in late August. This leaves me more open-minded to the possibility of a plunge to as low as 79.89, an event that I could understand more easily than sky-high targets with the global economy sinking into recession-or-worse. Here’s the target pattern — and yes, you can us p=83.82 to anchor a reverse-pattern trigger to bottom-fish there.

This week’s chart would seem to hold little encouragement for the many who have been praying for fuel price to come down. Unfortunately, December Crude appears to be basing for a run-up to as high as 123.34, but at least to 99.52. The lower target somewhat exceeds the 95.28 target of a smaller pattern we’ve been using to keep us on the right side of the market. Although I expect a tradeable pullback from there, I doubt it will get very far. I can also see opportunities for shorting successfully on the way up, but going with the trend, as always, will be more difficult. The prospect of fuel prices going even higher as winter encroaches is scary. A relapse in the price of December Crude to beneath the September low at 75.70 looks possible, but sellers would first have to take out a prior low on the weekly chart to make it happen. The nearest lies at 81.30. _______ UPDATE (Nov 9, 6:53 p.ml.): The rally died in an interesting place, just pennies shy of a ‘voodoo’ number and well short of the key high at 95.55 recorded in late August. This leaves me more open-minded to the possibility of a plunge to as low as 79.89, an event that I could understand more easily than sky-high targets with the global economy sinking into recession-or-worse. Here’s the target pattern — and yes, you can us p=83.82 to anchor a reverse-pattern trigger to bottom-fish there.

CLZ22 – December Crude (Last:85.72)