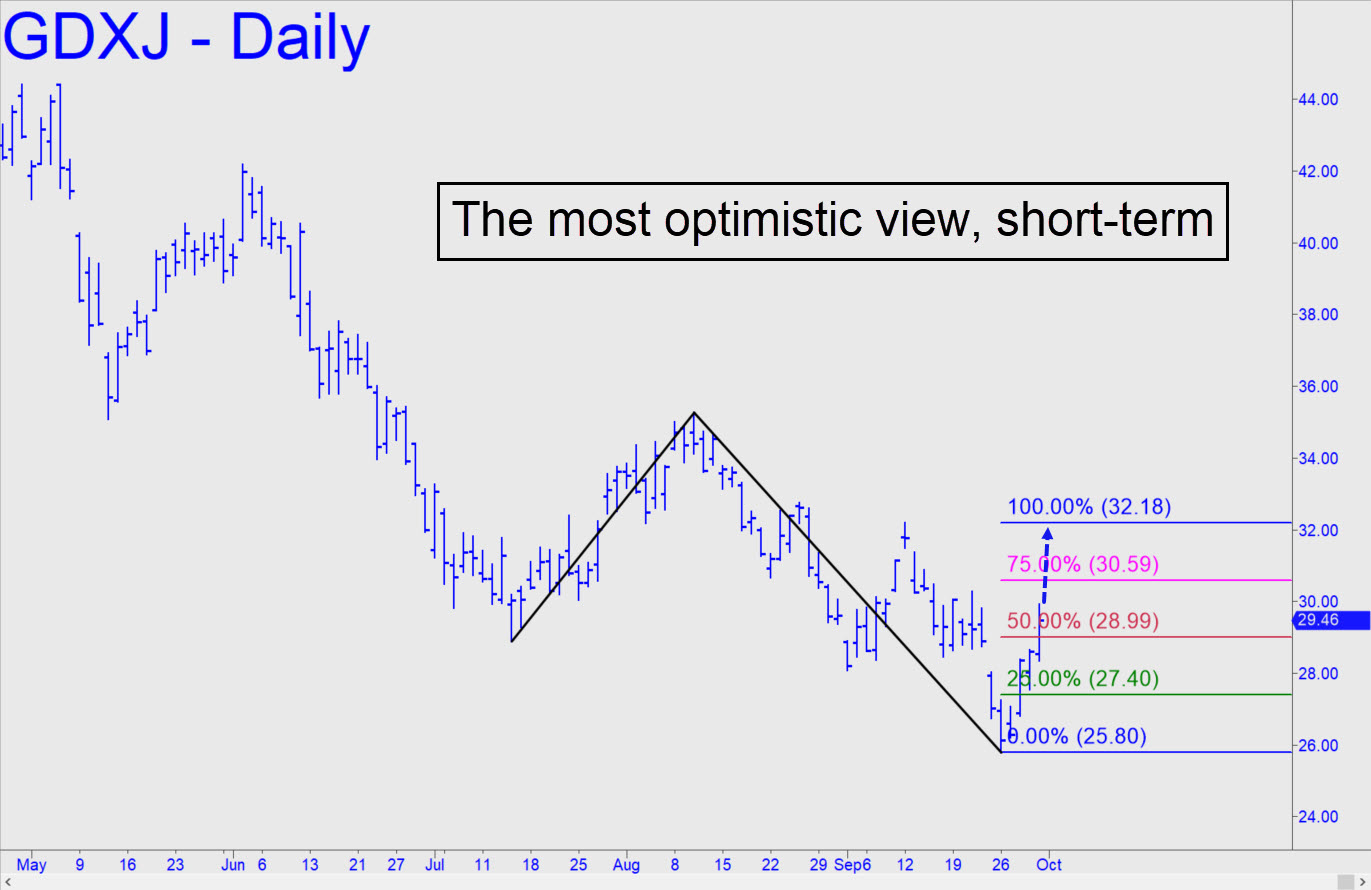

GDXJ bounced sharply last week off the target of a bearish pattern tracing back to April, so I am giving bulls the benefit of the doubt in this week’s update. Because the fledgling rally has not yet created an ABCD pattern yet with a D target, we must use a reverse pattern to estimate the potential of the move. The rABC formation shown, with a 32.18 target, is the most ambitious available on the daily chart. I am comfortable using it, however, because Friday’s upthrust blew decisively past p=28.99 and then closed above it. This all but guarantees the uptrend will continue to at least D=32.18. Note that a pullback to the green line would trigger an appealing ‘mechanical’ buy, stop 25.79. If the reversal went on to exceed two external peaks en route to the target, that would refresh the impulsiveness of the chart. As always, if a trend leg were to easily penetrate a D target, we would infer that a larger pattern is in play. ________ UPDATE (Oct 4, 11:42 p.m.): GDXJ slightly exceeded the 32.18 rally target I’d ‘guaranteed’ Sunday evening, retraced slightly, then pushed above an external peak at 32.20 before settling back a little. This is bullish price action but would become even moreso if the rally continues, exceeding yet one more ‘external’ peak at 32.75 within the next day or two.

GDXJ bounced sharply last week off the target of a bearish pattern tracing back to April, so I am giving bulls the benefit of the doubt in this week’s update. Because the fledgling rally has not yet created an ABCD pattern yet with a D target, we must use a reverse pattern to estimate the potential of the move. The rABC formation shown, with a 32.18 target, is the most ambitious available on the daily chart. I am comfortable using it, however, because Friday’s upthrust blew decisively past p=28.99 and then closed above it. This all but guarantees the uptrend will continue to at least D=32.18. Note that a pullback to the green line would trigger an appealing ‘mechanical’ buy, stop 25.79. If the reversal went on to exceed two external peaks en route to the target, that would refresh the impulsiveness of the chart. As always, if a trend leg were to easily penetrate a D target, we would infer that a larger pattern is in play. ________ UPDATE (Oct 4, 11:42 p.m.): GDXJ slightly exceeded the 32.18 rally target I’d ‘guaranteed’ Sunday evening, retraced slightly, then pushed above an external peak at 32.20 before settling back a little. This is bullish price action but would become even moreso if the rally continues, exceeding yet one more ‘external’ peak at 32.75 within the next day or two.

GDXJ – Junior Gold Miner ETF (Last:31.91)