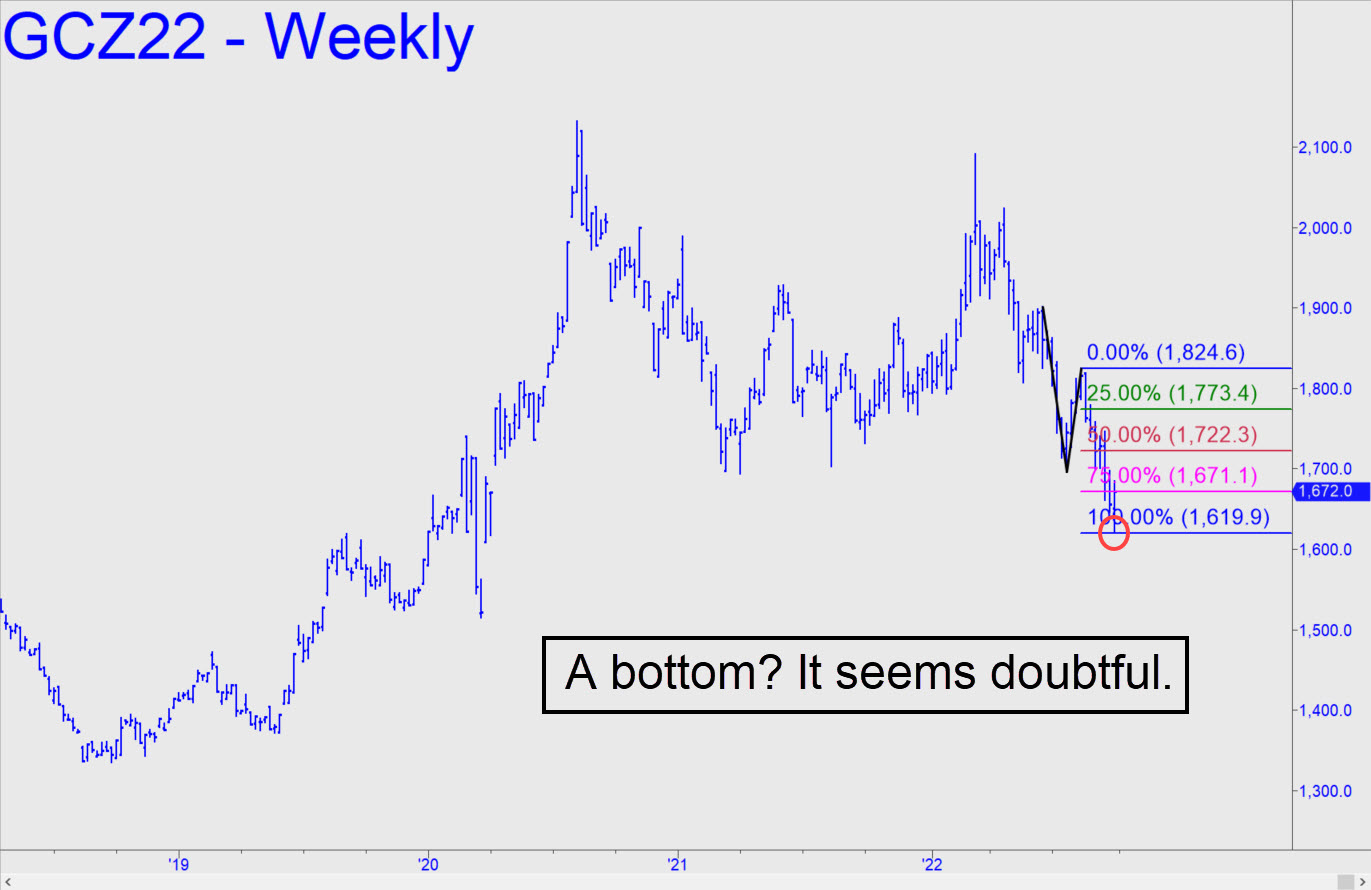

Last Wednesday, gold embarked on yet another rally that seems bound to disappoint. This one was a 60-pointer, and it came nearly precisely from the D target of the bearish pattern shown in the inset. An attempt to follow through bogged down at week’s end, leaving the futures with no net gain over the initial, impulsive thrust. That said, we’ll give bulls the benefit of the doubt nonetheless, predicated on a thrust through the 1686.50 midpoint Hidden Pivot of this pattern, which projects to as high as 1750.70.

Last Wednesday, gold embarked on yet another rally that seems bound to disappoint. This one was a 60-pointer, and it came nearly precisely from the D target of the bearish pattern shown in the inset. An attempt to follow through bogged down at week’s end, leaving the futures with no net gain over the initial, impulsive thrust. That said, we’ll give bulls the benefit of the doubt nonetheless, predicated on a thrust through the 1686.50 midpoint Hidden Pivot of this pattern, which projects to as high as 1750.70.

Thereafter, a pullback to the green line from our sweet spot between p and p2 should be bought ‘mechanically’ provided you know how to hold the entry risk down to less than $250 per contract. In the unexpected event that the rally exceeds D=1750.70, that would be the most bullish sign we’ve seen in a long while. It would bring into play a larger reverse pattern (a=1802.10 on 2/3/22) that projects to at least 1766.90, or 1911.50 at the outside. The foregoing notwithstanding, my gut feeling is that gold is about to relapse, eclipsing last week’s low at 1622.20. Not far below it is a voodoo number where I’d try bottom-fishing, but I’ll say no more about it until such time as the futures get there.