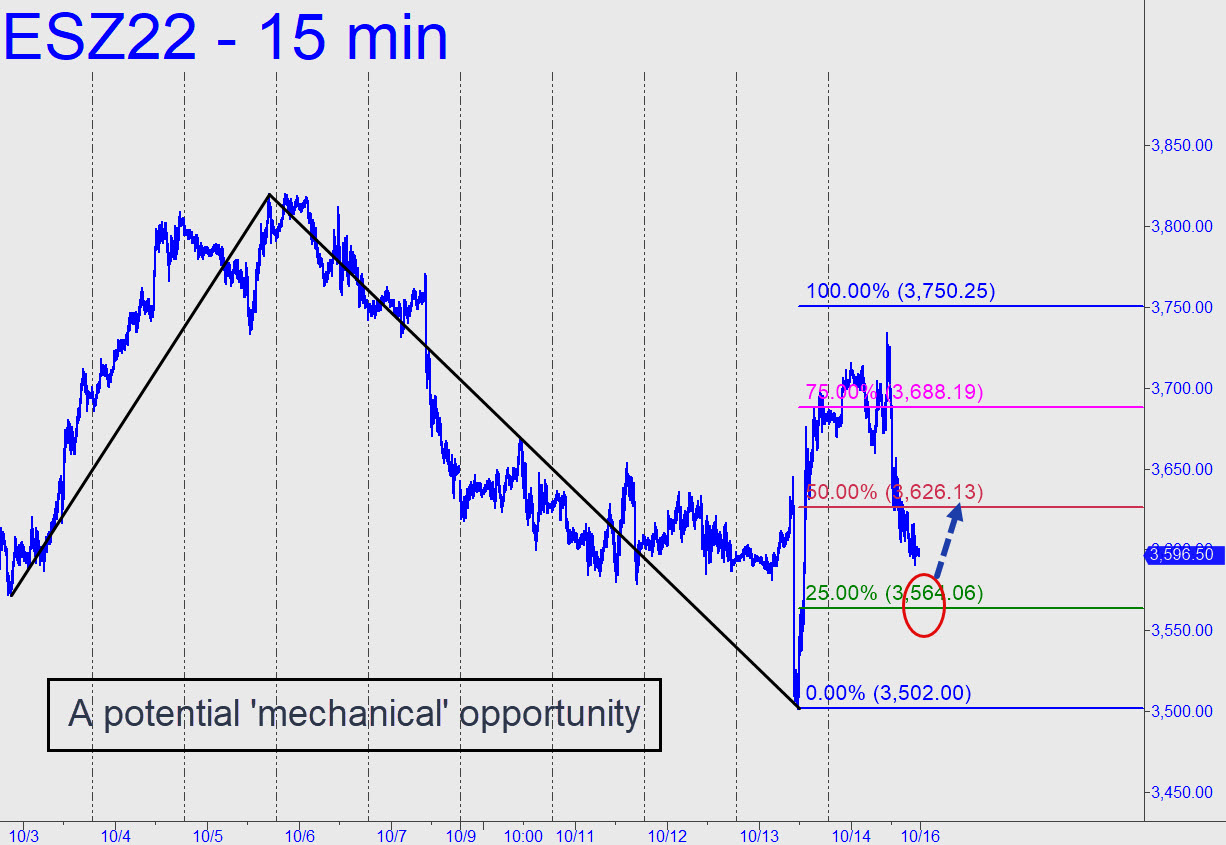

Mr Market screwed with bulls’ and bears’ heads Friday, falling steadily and hard after making an intraday high just ahead of the opening bell. In the chat room, we anticipated this with jackpot bet recommendations in AMZN in AAPL that involved the purchase of puts early in the session. There were no significant rallies intraday, nor even the customary attempt by DaBoyz to put the squeeze on shorts in the final hour. Although this would have caused bulls to back away rather than gamble on a felicitous opening Sunday evening, the futures paradoxically would have generated an attractive ‘mechanical’ buy signal if they’d sold off even harder and reached the green line at 3564.00 (see inset). That’s what I am recommending, provided you’re comfortable enough with ‘reverse-pattern’ trades to set up this one with entry risk held to no more than $150 per contract. A conventional entry, bidding at x with a stop at 3501.75, would not be appropriate because the initial risk would be around $3100 per contract.

Mr Market screwed with bulls’ and bears’ heads Friday, falling steadily and hard after making an intraday high just ahead of the opening bell. In the chat room, we anticipated this with jackpot bet recommendations in AMZN in AAPL that involved the purchase of puts early in the session. There were no significant rallies intraday, nor even the customary attempt by DaBoyz to put the squeeze on shorts in the final hour. Although this would have caused bulls to back away rather than gamble on a felicitous opening Sunday evening, the futures paradoxically would have generated an attractive ‘mechanical’ buy signal if they’d sold off even harder and reached the green line at 3564.00 (see inset). That’s what I am recommending, provided you’re comfortable enough with ‘reverse-pattern’ trades to set up this one with entry risk held to no more than $150 per contract. A conventional entry, bidding at x with a stop at 3501.75, would not be appropriate because the initial risk would be around $3100 per contract.

I am aware that many are bracing for a possible crash this week based on the widely circulated prediction of a guru who uses the lunar calendar. I doubt he’ll be right, since forecasts that get as much attention as this one seldom pan out. For my part, I can see more downside to only 3361.25 over the near term, but my outlook would darken if that Hidden Pivot support is easily breached. I have been saying stocks are primed for a severe crash that could begin at any time (although probably not next week for the reason given). The first sign of this would appear if, as noted above, the 3361.25 ‘hidden’ support is easily exceeded, especially on a closing basis soon after it is initially touched. Regardless, this number can be used to bottom-fish, even if the higher Hidden Pivot support at 3564 gets taken out. _____ UPDATE (Oct 17, 8:49 p.m.): With the futures moving higher, I’ll recommend shorting this gas bag with a reverse-pattern c’ anchored within 1.00 point of 3750.25. Your trigger interval (i.e., the distance between ‘c’ and ‘x’) should be no wider than 1.75 points. See my 12:50 p.m. post in the Trading Room for additional comments. This trade is for Pivoteers who are familiar with rABC/camouflage set-ups and is not recommended for beginners. Theoretical entry risk on four contracts would be around $350. _____ UPDATE (Oct 18, 8:30): The trade failed to trigger after the futures blew past my benchmark. I doubt this rally is destined for greatness, but I’m going to step away regardless, since it is starting to grate on my nerves. It is easily tradable nonethelsss using reverse patterns of small degree.