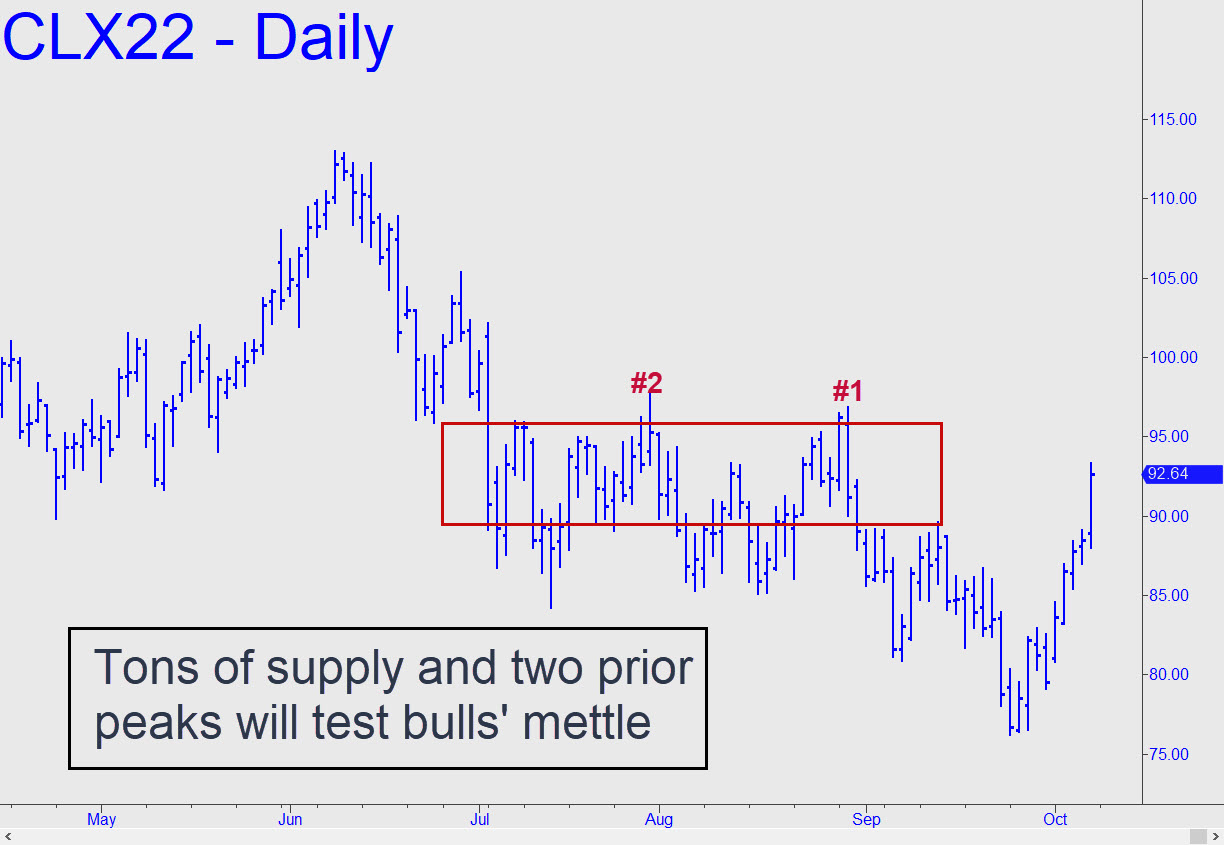

Friday’s psychotic leap took November Crude into a zone of heavy supply, where it had traded mostly within a $10 range between July and September. It seems doubtful that the mechanics who engineered the impressive short squeeze will be able to propagate another as the new week begins. However, if they do, exceeding two ‘external’ peaks at, respectively, 96.82 and 97.91 within a day or two, that would be the most bullish technical sign we’ve seen in a long time. More likely in my estimation is that the futures will bog down in a consolidation (or possibly distribution) below the peaks for an indefinite period. We’ll let price action speak for itself, however, milking it for all it’s worth no matter what happens. The trade posted in the chat room on Friday morning was an example of this, a tightly controlled short that caught the intraday high within three cents.

Friday’s psychotic leap took November Crude into a zone of heavy supply, where it had traded mostly within a $10 range between July and September. It seems doubtful that the mechanics who engineered the impressive short squeeze will be able to propagate another as the new week begins. However, if they do, exceeding two ‘external’ peaks at, respectively, 96.82 and 97.91 within a day or two, that would be the most bullish technical sign we’ve seen in a long time. More likely in my estimation is that the futures will bog down in a consolidation (or possibly distribution) below the peaks for an indefinite period. We’ll let price action speak for itself, however, milking it for all it’s worth no matter what happens. The trade posted in the chat room on Friday morning was an example of this, a tightly controlled short that caught the intraday high within three cents.

CLX22 – November Crude (Last:92.64)