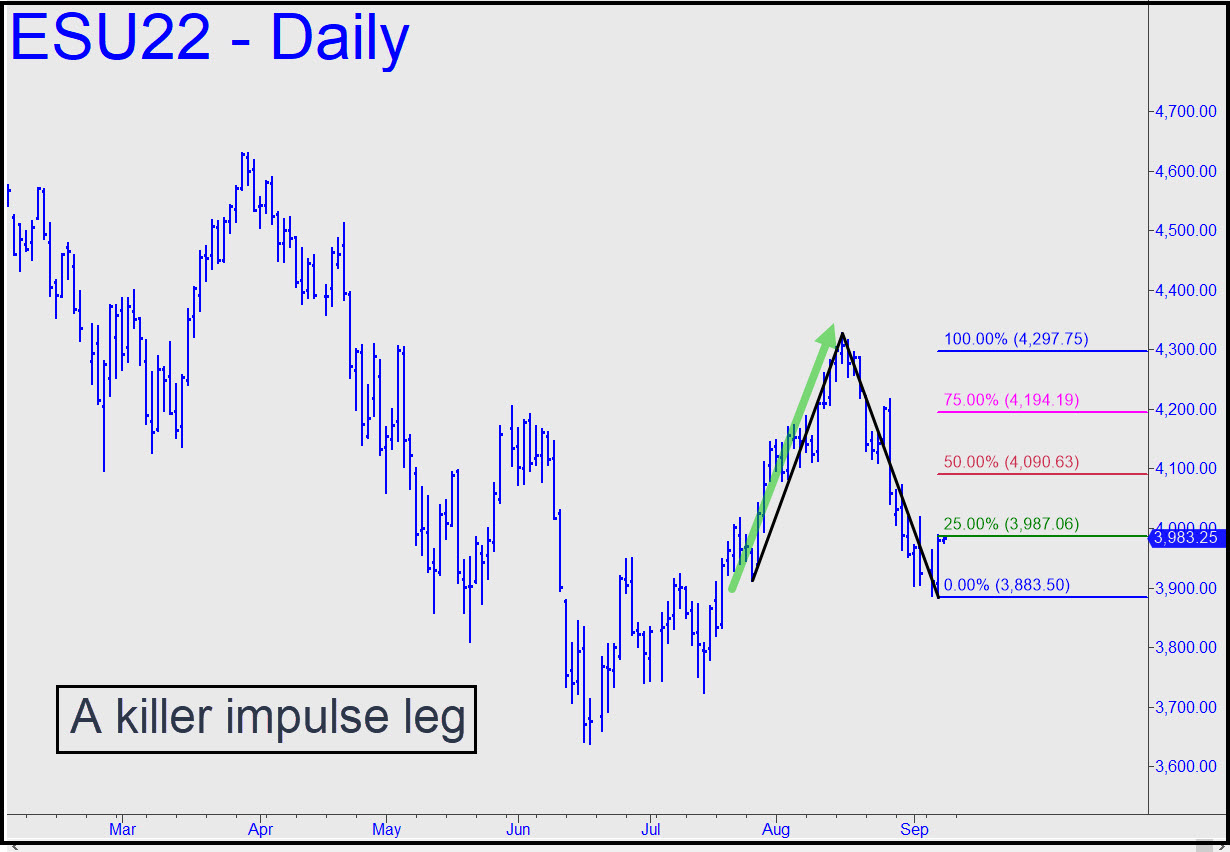

The impulse leg shown is such a killer, having exceeded two major ‘externals’, that two outcomes seem quite likely: 1) the rally will reach p=4090.63 at least, and probably p2=4194.19 or even D=4297.75 eventually; and, 2) any ‘mechanical’ buy that triggers on the way up is a good bet to produce a profit. The Catch-22 is that the steepness of the ascent won’t likely allow the one- or two-level pullbacks needed to trigger ‘mechanical’ entries. That doesn’t mean we can’t play, only that we’ll need to improvise to get aboard more or less risklessly in unconventional ways. _______ UPDATE (Sep 8, 10:20): Today’s headless-chicken price action created this conventional sub-pattern, which remains usable. Notice the $10,000 ‘mechanical’ winner (on four contracts) triggered around mid-session by the gratuitous swoon to the green line. Now, a decisive thrust through D=4042.50 would reaffirm the ease with which this rally will reach p=4090.63.

The impulse leg shown is such a killer, having exceeded two major ‘externals’, that two outcomes seem quite likely: 1) the rally will reach p=4090.63 at least, and probably p2=4194.19 or even D=4297.75 eventually; and, 2) any ‘mechanical’ buy that triggers on the way up is a good bet to produce a profit. The Catch-22 is that the steepness of the ascent won’t likely allow the one- or two-level pullbacks needed to trigger ‘mechanical’ entries. That doesn’t mean we can’t play, only that we’ll need to improvise to get aboard more or less risklessly in unconventional ways. _______ UPDATE (Sep 8, 10:20): Today’s headless-chicken price action created this conventional sub-pattern, which remains usable. Notice the $10,000 ‘mechanical’ winner (on four contracts) triggered around mid-session by the gratuitous swoon to the green line. Now, a decisive thrust through D=4042.50 would reaffirm the ease with which this rally will reach p=4090.63.

ESU22 – Sep E-Mini S&P (Last:3982.00)