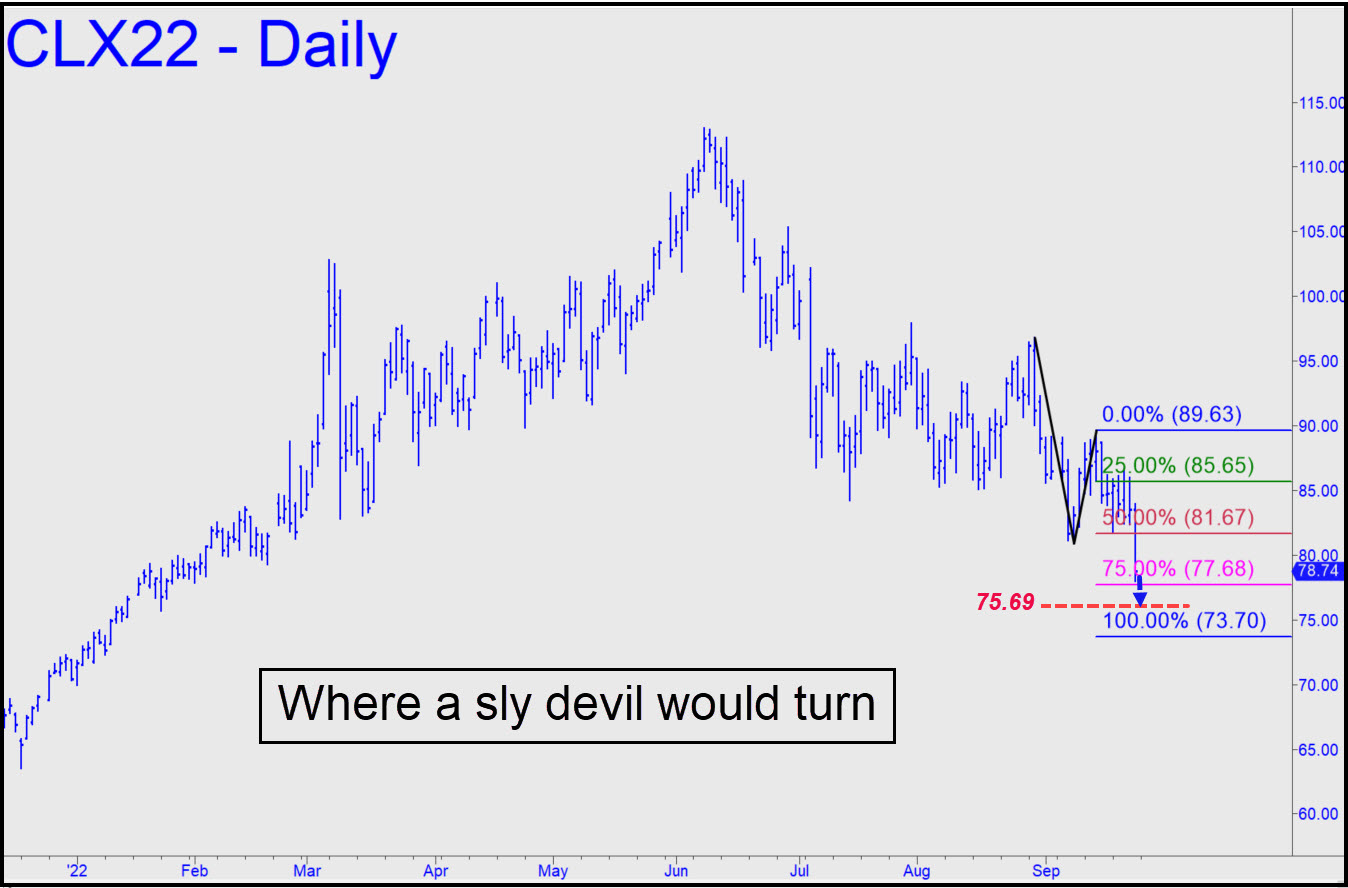

November Crude breached p2=81.67 with such force on Friday that we should assume it’s headed down to at least D=73.70. We’ll toss out this assumption for trading purposes, however, since crude is too devious to reward betting on a pattern this obvious. More likely, based on long observation, is that the turn will come from around midway between p2 and D, or 75.69. First, though, let’s see whether the futures can get a tradeable bounce from p2=77.68. If you’re familiar with reverse-pattern set-ups, I’d suggest anchoring a ‘c’ low there with an a-b ‘trigger’ of 1.00 point or less. That implies initial risk of no more than $250 per contract._______ UPDATE (Sep 28, 10:35 p.m.): A rally to the green line (x=86.65) would trigger a not unappealing ‘mechanical’ short, but I’ll suggest paper-trading this one unless your ‘camo’ chops are well honed.

November Crude breached p2=81.67 with such force on Friday that we should assume it’s headed down to at least D=73.70. We’ll toss out this assumption for trading purposes, however, since crude is too devious to reward betting on a pattern this obvious. More likely, based on long observation, is that the turn will come from around midway between p2 and D, or 75.69. First, though, let’s see whether the futures can get a tradeable bounce from p2=77.68. If you’re familiar with reverse-pattern set-ups, I’d suggest anchoring a ‘c’ low there with an a-b ‘trigger’ of 1.00 point or less. That implies initial risk of no more than $250 per contract._______ UPDATE (Sep 28, 10:35 p.m.): A rally to the green line (x=86.65) would trigger a not unappealing ‘mechanical’ short, but I’ll suggest paper-trading this one unless your ‘camo’ chops are well honed.

CLX22 – November Crude (Last:81.80)