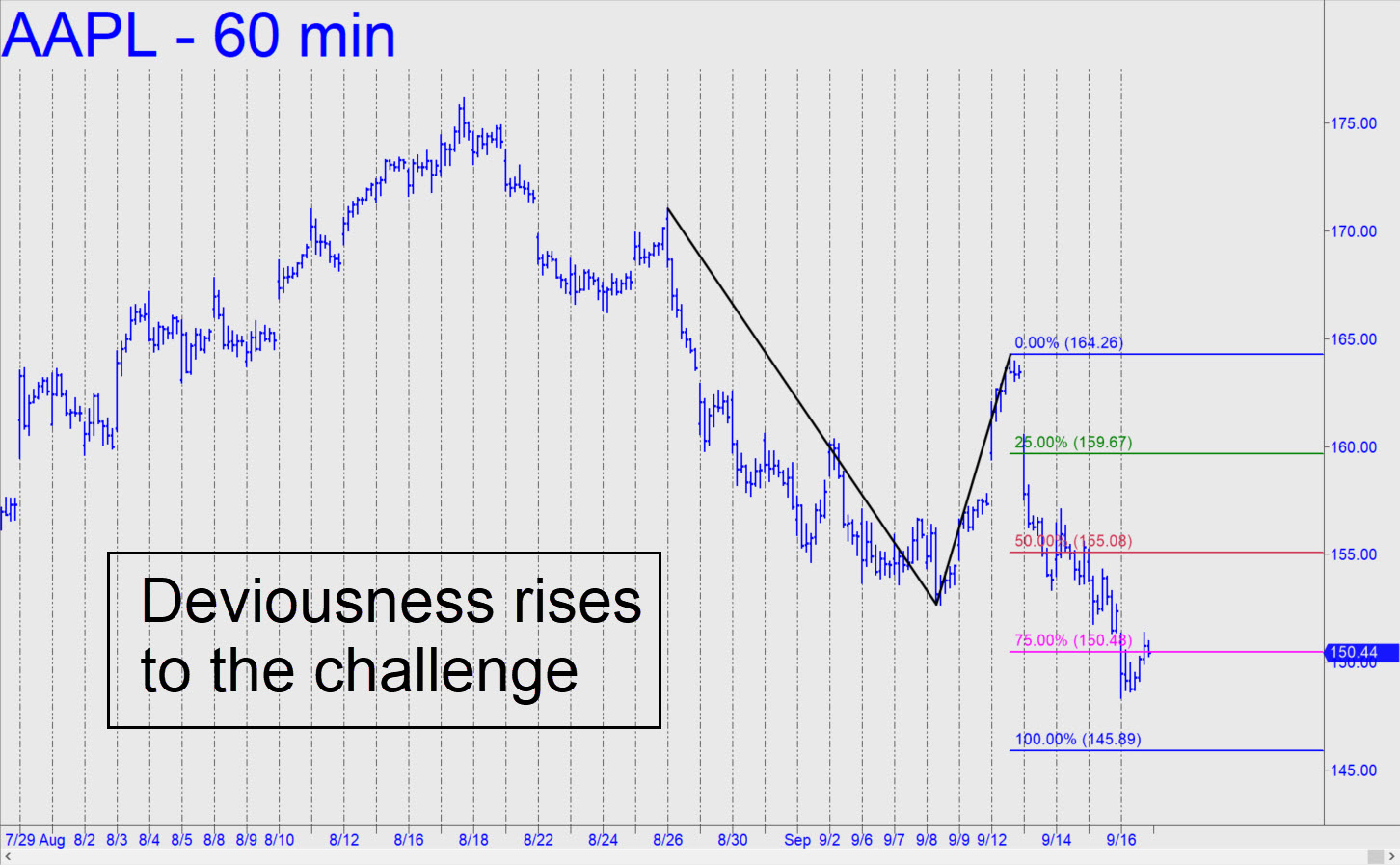

Wall Street’s best and brightest are as clever and scurrilous as any broad-tosser who ever plied the Piccadilly Circus or Times Square, but they will have their dexterous hands full as they continue to distribute AAPL shares ahead of the crash below $100 that is coming. For the moment, the stock looks bound for the middling downside ‘D’ target at 145.89 shown in the inset. The pattern is choppy enough to qualify as gnarly, so bottom-fishing there will have a good chance of producing a profit. We might look to exit such a position by reversing it. The mild caveat is that the A-B leg here is ‘sausage’, which argues against the target working as precisely as we are used to. I haven’t seen any evidence that subscribers are trading this stock, but please make your interest known if I am wrong.

Wall Street’s best and brightest are as clever and scurrilous as any broad-tosser who ever plied the Piccadilly Circus or Times Square, but they will have their dexterous hands full as they continue to distribute AAPL shares ahead of the crash below $100 that is coming. For the moment, the stock looks bound for the middling downside ‘D’ target at 145.89 shown in the inset. The pattern is choppy enough to qualify as gnarly, so bottom-fishing there will have a good chance of producing a profit. We might look to exit such a position by reversing it. The mild caveat is that the A-B leg here is ‘sausage’, which argues against the target working as precisely as we are used to. I haven’t seen any evidence that subscribers are trading this stock, but please make your interest known if I am wrong.

When AAPL hits 145.89, that will represent a 17% fall from mid-August’s peak, which, amazingly, came within less than 4% of achieving new record highs (!) My hunch is that the stock’s institutional sponsors want the stock to fall by at least 20%-30% before they start accumulating seriously again. Realize that their goal is no longer to push AAPL to new all-time highs, since that is probably impossible, but rather to buy it cheaply enough, and with sellers sufficiently depleted, to guarantee a profit on whatever short-squeeze rallies they can trigger off. Count on them to do this repeatedly as the Mother of All Bear Markets works its way to the bottom of the Marianas Trench over the next 2-3 years. ______ UPDATE (Sep 19, 8:10 p.m.): Today’s short-squeeze was rigged in the usual way: Pull all bids ahead of the opening bell, exhausting sellers. This ploy almost never fails, and today it produced a bullish impulse leg on the hourly chart. I don’t expect the rally to get very far, but we’ll need to respect the fledgling uptrend nonetheless with a cautiously bullish trading bias. ______ UPDATE (Sep 21, 12:24 p.m.): I should have mentioned this in the previous update, but the stock looks bound for a top either at 159.38 (A=148.71 on 8/19 at 7:00 a.m.); or at 161.00, a ‘voodoo’ number. Here’s the chart. Notice that I used an after-hours bar for the ‘A’ low. I did so because it is such a distinctive one-off bar. _______ UPDATE (Sep 21, 7:42 p.m.): Even at the apex of today’s nuttiness, AAPL didn’t quite make it to the 159.38 target. Now I doubt that it will, at least over the near term. Another factor working against bulls is that the stock’s canny handlers had two full days to distribute shares. Look for more downside on Thursday to at least p=150.80, with D=142.85 as my worst case in the days ahead. Here’s the chart. _______ UPDATE (Sep 22, 11:55 p.m.): The 150.80 target billboarded in my last update caught the low of a nearly $8 plunge within 11 cents. The subsequent $3.56 bounce could have been worth as much as $1400 to anyone who caught the bottom with four round lots. Since no one mentioned it, however, I did not establish a tracking position.