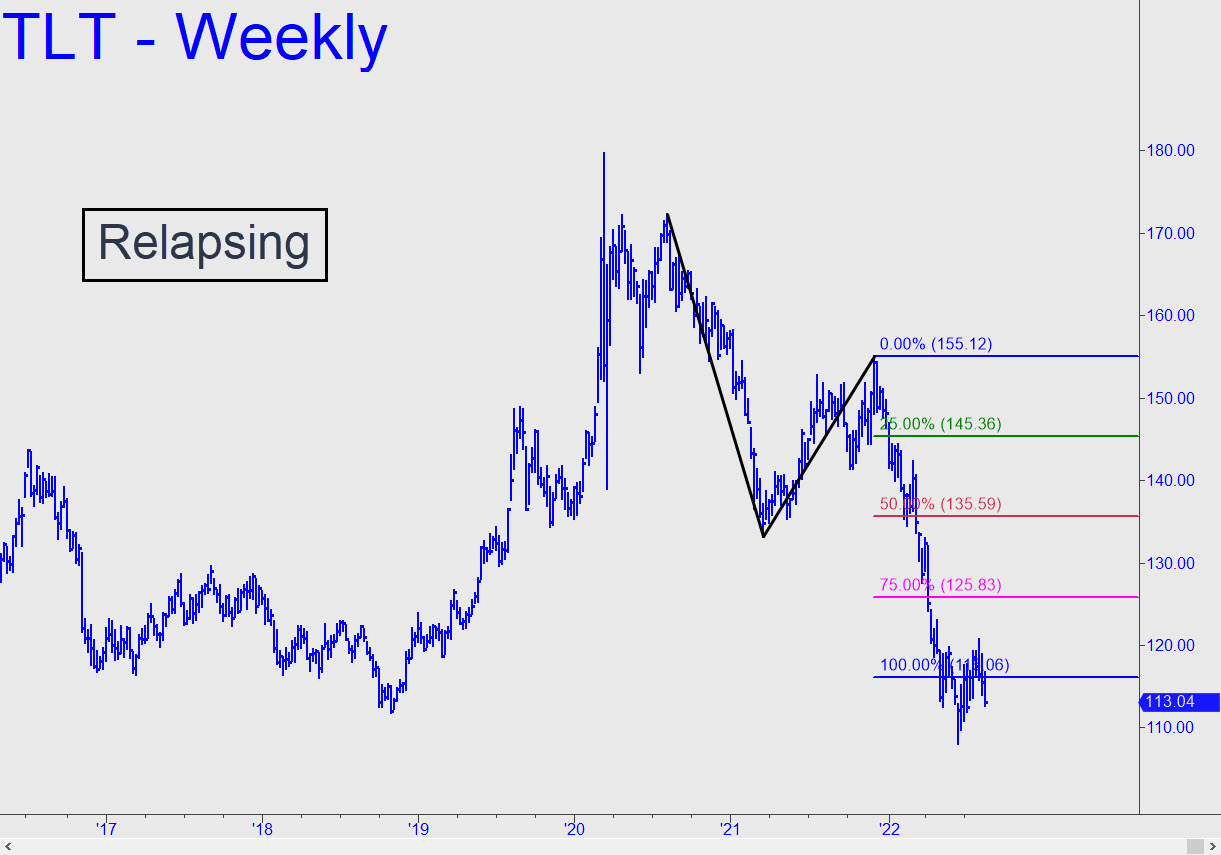

There is too much angst in the weekly chart, including the May/June destruction of big D=116.06, to offer much hope that the long-dated bond’s two-year agony is about to end. For now, I will allow but two bullish possibilities: 1) a bounce from the 109.07 ‘d’ target of this reverse pattern. It’s more than a slim reed, however, and therefore worth bottom-fishing, but don’t count too heavily on a major reversal; and then there is below it 2) a ‘voodoo’ number at 106.54 that could could also provide a tradeable bounce off a ‘reverse’ pattern with a ‘c’ low anchored at that price.

There is too much angst in the weekly chart, including the May/June destruction of big D=116.06, to offer much hope that the long-dated bond’s two-year agony is about to end. For now, I will allow but two bullish possibilities: 1) a bounce from the 109.07 ‘d’ target of this reverse pattern. It’s more than a slim reed, however, and therefore worth bottom-fishing, but don’t count too heavily on a major reversal; and then there is below it 2) a ‘voodoo’ number at 106.54 that could could also provide a tradeable bounce off a ‘reverse’ pattern with a ‘c’ low anchored at that price.

TLT – Lehman Bond ETF (Last:113.04)