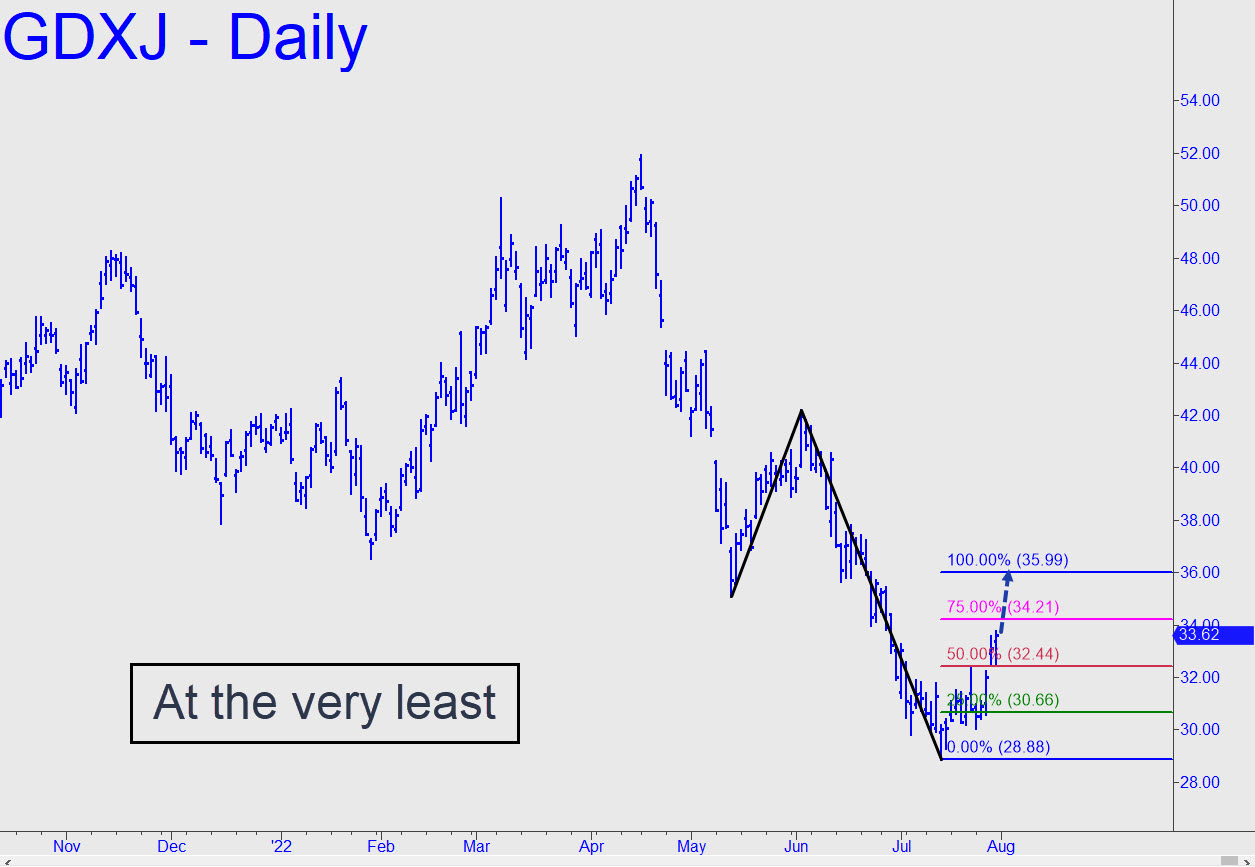

Much as I’d like to put the knock on last week’s rally, it actually looked pretty good — real, almost. In the reverse pattern shown, buyers showed no awareness whatsoever of what we might have viewed as daunting resistance at p=32.44. Thursday’s gap through it all but guaranteed a finishing stroke to D=35.99, but we’ll need to see how buyers handle this Hidden Pivot before we literally buy into the likelihood of a move into the wild blue yonder extending up to early June’s 42.19 peak. This suggests imminent weakness in energy prices that have been holding mining stocks down, perhaps even moreso than the strong dollar. _______ UPDATE (Aug 3, 4:30 p.m.): A pullback to the green line (x=30.66) would trigger an appealing ‘mechanical’ buy, stop 28.87.

Much as I’d like to put the knock on last week’s rally, it actually looked pretty good — real, almost. In the reverse pattern shown, buyers showed no awareness whatsoever of what we might have viewed as daunting resistance at p=32.44. Thursday’s gap through it all but guaranteed a finishing stroke to D=35.99, but we’ll need to see how buyers handle this Hidden Pivot before we literally buy into the likelihood of a move into the wild blue yonder extending up to early June’s 42.19 peak. This suggests imminent weakness in energy prices that have been holding mining stocks down, perhaps even moreso than the strong dollar. _______ UPDATE (Aug 3, 4:30 p.m.): A pullback to the green line (x=30.66) would trigger an appealing ‘mechanical’ buy, stop 28.87.

GDXJ – Junior Gold Miner ETF (Last:33.48)