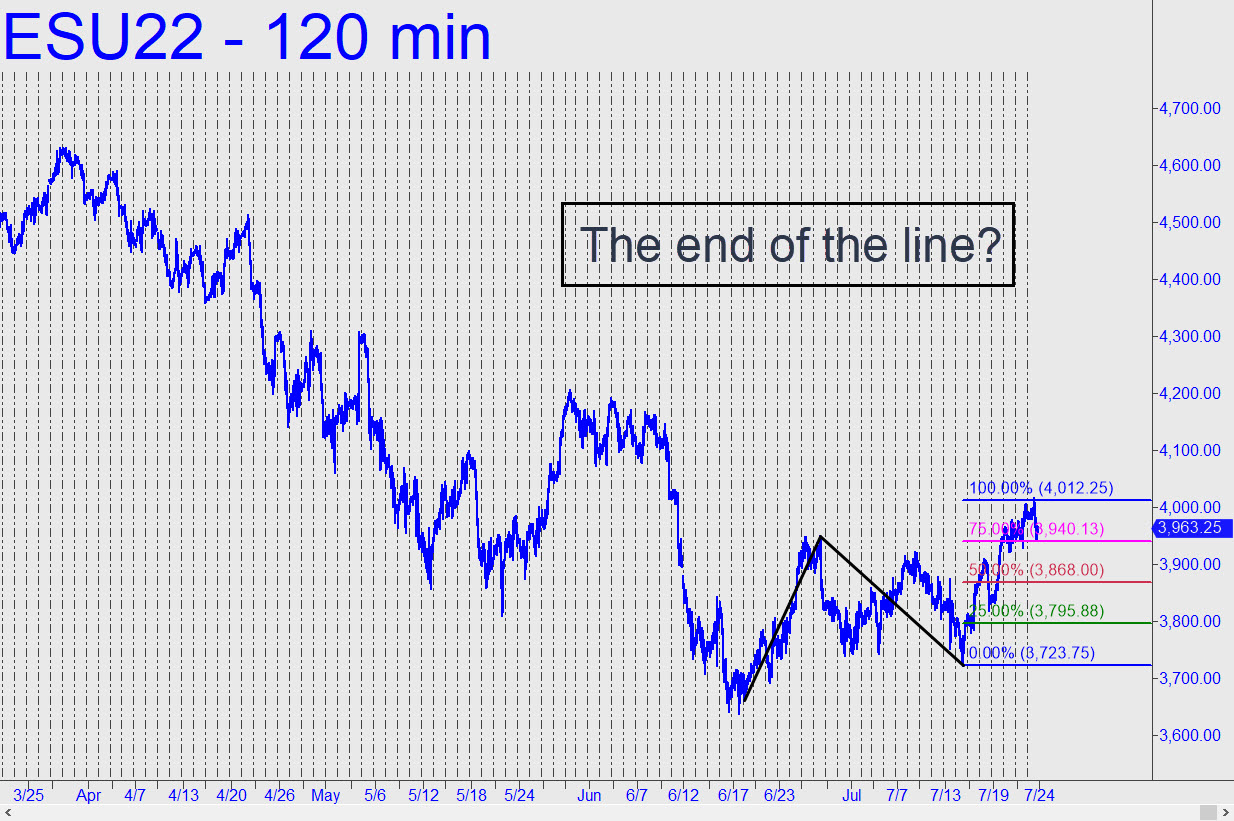

The futures reached the end of the line Friday at the 4012.25 Hidden Pivot target of a bear rally pattern begun five weeks ago from 3960. Is that it? We’ll let impending price action answer that question, since there is always the possibility that buyers will blow past D in a trice when the new week begins. That would put them on a course to test the resistance of a series of downtrending peaks recorded in early June. There are still outstanding targets at 4033 and 4116, plus a ‘soft’, best-case target at 4256. I haven’t made this tactic official, but you can use the HP levels of the spent pattern shown in the chart experimentally for ‘mechanical’ trades. ______ UPDATE (Jul 26, 6:43 p.m.): Index futures have lunaticked sharply higher in after-hours trading, presumably because both Microsoft and Google released dreadful earnings news. This is how DaBoyz punish bears for guessing right: by pulling their offers in a zero-volume environment so that stocks can zoom gratuitously. This will also give the news media a chance to come up with a dozen wrong reasons why stocks have rallied on bad news. How far will they get? Not very, would be my guess. ______ UPDATE (Jul 27, 7:26 p.m.): Finally, the short squeeze we all knew had to happen before the Mother of All Bear Markets can resume in earnest! On nearly universally anticipated “news” from the Fed, the futures blew past the 4033 target with enough force to be presumed headed to at least 4116.75, the next Hidden Pivot target in the sequence provided above. Here’s a smaller pattern that can be traded ‘mechanically’ on the way up, with a 4095.25 ‘D’ target that looks absolutely certain to be achieved. _______ UPDATE (Jul 28, 3:13 p.m.): I’ve raised the target to 4109.25, since in this case the ‘marquee’ low at 3820.25 was too distinctive to ignore. Here’s the chart. _______ UPDATE (Jul 28, 8:17 p.m.): On crap earnings for AMZN released after the close, DaBoyz repeated their nasty bear-squeeze trick from a day earlier, when they goosed MSFT and GOOG on similarly bad news. The result is a peak that overshot my 4109.25 target (see above) by a hair. Here’s the chart. The pullback so far could have been worth as much as $3,200 on four contracts. If you shorted the target, cover half (two) of your contracts now; place an order to cover a third contract at 4078.25, and use an impulsive stop-loss on the 15-minute chart for the last. Until such time as 4078.25 is hit, your remaining contracts should be worked o-c-o with a break-even stop-loss.

The futures reached the end of the line Friday at the 4012.25 Hidden Pivot target of a bear rally pattern begun five weeks ago from 3960. Is that it? We’ll let impending price action answer that question, since there is always the possibility that buyers will blow past D in a trice when the new week begins. That would put them on a course to test the resistance of a series of downtrending peaks recorded in early June. There are still outstanding targets at 4033 and 4116, plus a ‘soft’, best-case target at 4256. I haven’t made this tactic official, but you can use the HP levels of the spent pattern shown in the chart experimentally for ‘mechanical’ trades. ______ UPDATE (Jul 26, 6:43 p.m.): Index futures have lunaticked sharply higher in after-hours trading, presumably because both Microsoft and Google released dreadful earnings news. This is how DaBoyz punish bears for guessing right: by pulling their offers in a zero-volume environment so that stocks can zoom gratuitously. This will also give the news media a chance to come up with a dozen wrong reasons why stocks have rallied on bad news. How far will they get? Not very, would be my guess. ______ UPDATE (Jul 27, 7:26 p.m.): Finally, the short squeeze we all knew had to happen before the Mother of All Bear Markets can resume in earnest! On nearly universally anticipated “news” from the Fed, the futures blew past the 4033 target with enough force to be presumed headed to at least 4116.75, the next Hidden Pivot target in the sequence provided above. Here’s a smaller pattern that can be traded ‘mechanically’ on the way up, with a 4095.25 ‘D’ target that looks absolutely certain to be achieved. _______ UPDATE (Jul 28, 3:13 p.m.): I’ve raised the target to 4109.25, since in this case the ‘marquee’ low at 3820.25 was too distinctive to ignore. Here’s the chart. _______ UPDATE (Jul 28, 8:17 p.m.): On crap earnings for AMZN released after the close, DaBoyz repeated their nasty bear-squeeze trick from a day earlier, when they goosed MSFT and GOOG on similarly bad news. The result is a peak that overshot my 4109.25 target (see above) by a hair. Here’s the chart. The pullback so far could have been worth as much as $3,200 on four contracts. If you shorted the target, cover half (two) of your contracts now; place an order to cover a third contract at 4078.25, and use an impulsive stop-loss on the 15-minute chart for the last. Until such time as 4078.25 is hit, your remaining contracts should be worked o-c-o with a break-even stop-loss.

ESU22 – Sep E-Mini S&P (Last:4095.50)