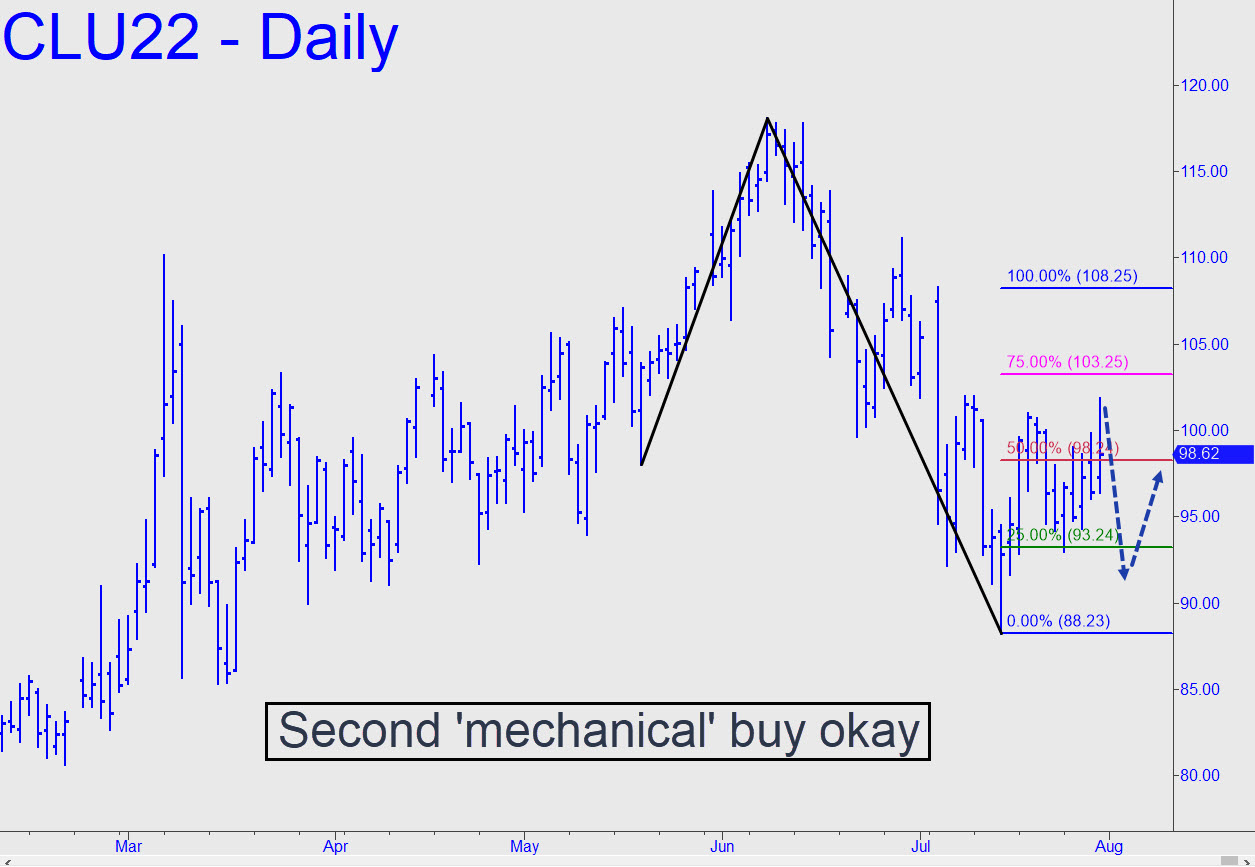

I’d advised against bidding ‘mechanically’ at the green line if September Crude should revisit it, but Friday’s impulsive thrust was powerful enough to suggest that ‘sloppy’ seconds could produce another $5000 winner like the one that played out over two days last week. That implies a ride from the green line (x) to the red (p), a climb that doesn’t look too challenging when visually imagined. Regardless, and unless there’s a swoon exceeding C=88.23, the 108.25 target will remain theoretically viable. _______ UPDATE (Aug 1, 10:48 p.m.): Yes, the plunge to the green line has triggered a mechanical buy, the second such signal from this pattern. My gut feeling is that the futures will achieve p=98.24, good for a one-level ride, but I am not recommending the trade unless you know how to ‘camo’ the entry risk down to perhaps 5% or less of the implied $20k (on four contracts) if C=88.23 were to be stopped out. ______ UPDATE (Aug 4, 10:54 p.m.): My gut feeling was wrong, for oil is weaker than I’d imagined. Even so, the September contract should get a bounce from here, since bulls got stopped out with today’s dip below C=88.23 of the reverse pattern.

I’d advised against bidding ‘mechanically’ at the green line if September Crude should revisit it, but Friday’s impulsive thrust was powerful enough to suggest that ‘sloppy’ seconds could produce another $5000 winner like the one that played out over two days last week. That implies a ride from the green line (x) to the red (p), a climb that doesn’t look too challenging when visually imagined. Regardless, and unless there’s a swoon exceeding C=88.23, the 108.25 target will remain theoretically viable. _______ UPDATE (Aug 1, 10:48 p.m.): Yes, the plunge to the green line has triggered a mechanical buy, the second such signal from this pattern. My gut feeling is that the futures will achieve p=98.24, good for a one-level ride, but I am not recommending the trade unless you know how to ‘camo’ the entry risk down to perhaps 5% or less of the implied $20k (on four contracts) if C=88.23 were to be stopped out. ______ UPDATE (Aug 4, 10:54 p.m.): My gut feeling was wrong, for oil is weaker than I’d imagined. Even so, the September contract should get a bounce from here, since bulls got stopped out with today’s dip below C=88.23 of the reverse pattern.

CLU22 – September Crude (Last:88.94)