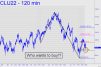

The selling that ended the week brought the futures to within $1.00 of a ‘mechanical’ buy at the green line (93.24). The trade rates a ‘5.0’ and would therefore require cautious handling via a ‘camouflage’ set-up on the lesser charts. The 5.0 rating means I think there’s a 50% chance the futures will rally from the green line to at least p=98.24, where a partial profit could be taken, before falling below C=99.23. My hunch is that crude will be subdued this week, given its failure to exceed some small peaks recorded in the second week of July. A modest bullish offset is that the rally in the first half of the week slightly surpassed its ‘D’ target. _______ UPDATE (Jul 26, 6:55 p.m.): The mechanical trade triggered in the middle of the night, producing a quick theoretical gain of as much as $5,000 per contract upon exit at p=98.24. Two subscribers reported jumping on it, although not in sufficient detail to warrant a tracking position. The 108.25 rally target shown in the chart remains theoretically viable, but I’m not recommending a second mechanical entry because I doubt it would be another easy winner.

The selling that ended the week brought the futures to within $1.00 of a ‘mechanical’ buy at the green line (93.24). The trade rates a ‘5.0’ and would therefore require cautious handling via a ‘camouflage’ set-up on the lesser charts. The 5.0 rating means I think there’s a 50% chance the futures will rally from the green line to at least p=98.24, where a partial profit could be taken, before falling below C=99.23. My hunch is that crude will be subdued this week, given its failure to exceed some small peaks recorded in the second week of July. A modest bullish offset is that the rally in the first half of the week slightly surpassed its ‘D’ target. _______ UPDATE (Jul 26, 6:55 p.m.): The mechanical trade triggered in the middle of the night, producing a quick theoretical gain of as much as $5,000 per contract upon exit at p=98.24. Two subscribers reported jumping on it, although not in sufficient detail to warrant a tracking position. The 108.25 rally target shown in the chart remains theoretically viable, but I’m not recommending a second mechanical entry because I doubt it would be another easy winner.

CLU22 – September Crude (Last:95.60)