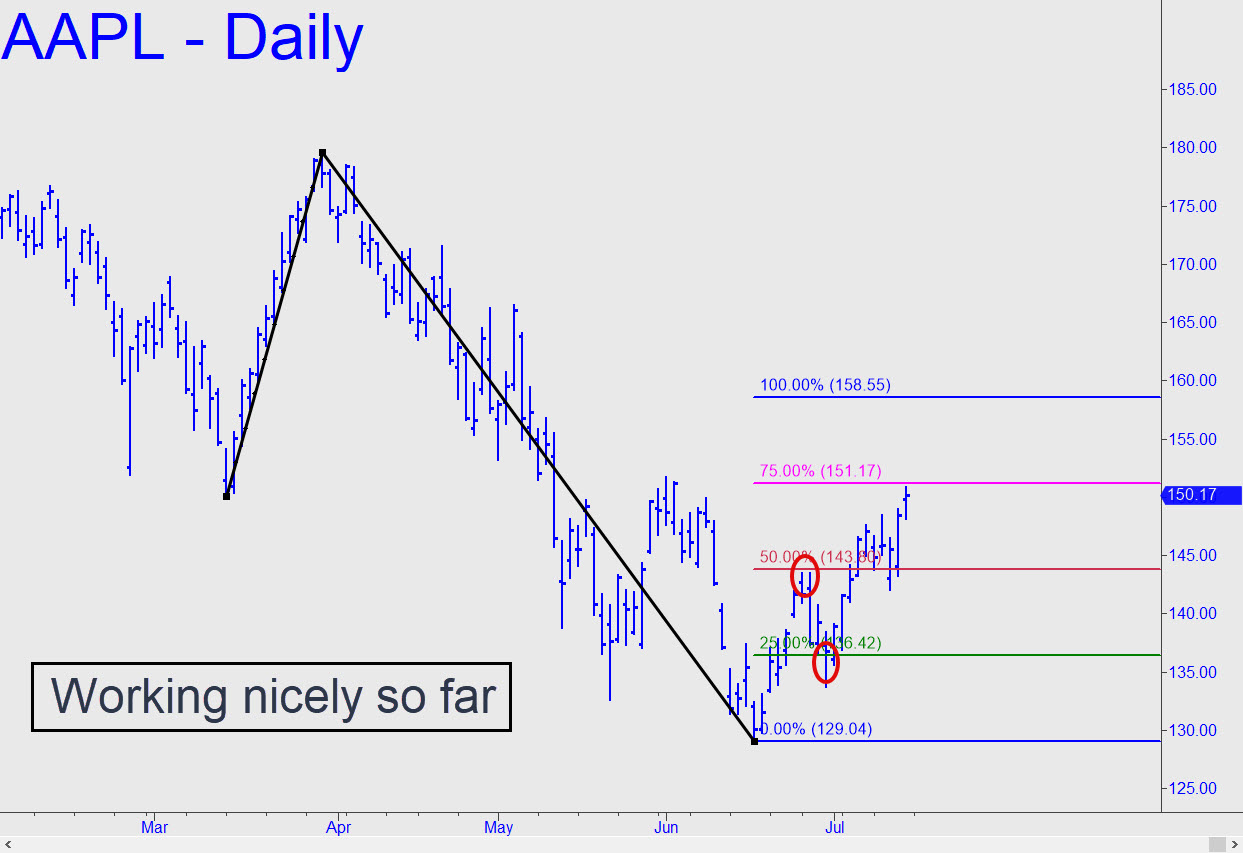

Conventional patterns project rally targets that seem too ambitious, so I’ve settled on an rABC that allows upside over the near term to a relatively modest 158.55. This should be an easy trek, but I would still consider shorting near the target with a ‘camouflage’ set-up that risks no more than 12 to 20 cents a share initially. A sign that the pattern is working is the winning ‘mechanical’ buy at the green line. Don’t pass up a second opportunity to buy there, stop 129.03, if the stock should unexpectedly revisit it by Wednesday. _______ UPDATE (Jul 18, 18:03): If AAPL is about to reclaim its usefulness as a market bellwether, it should deliver a ‘mechanical’ winner from the red line (p=143.80). The trade would require a stop-loss at 138.88, but I’d suggest paper trading if you are developing your ‘mechanical’ chops or just curious to see how well these trades work. _______ UPDATE (Jul 19, 10:22 p.m.): AAPL did in fact lead the way, but with a nasty short squeeze on the opening bar rather than a shakedown. The target at 158.55 is not quite a lock-up, but it is a good enough bet to suggest the broad averages are likely to move higher for the next 2-3 days.

Conventional patterns project rally targets that seem too ambitious, so I’ve settled on an rABC that allows upside over the near term to a relatively modest 158.55. This should be an easy trek, but I would still consider shorting near the target with a ‘camouflage’ set-up that risks no more than 12 to 20 cents a share initially. A sign that the pattern is working is the winning ‘mechanical’ buy at the green line. Don’t pass up a second opportunity to buy there, stop 129.03, if the stock should unexpectedly revisit it by Wednesday. _______ UPDATE (Jul 18, 18:03): If AAPL is about to reclaim its usefulness as a market bellwether, it should deliver a ‘mechanical’ winner from the red line (p=143.80). The trade would require a stop-loss at 138.88, but I’d suggest paper trading if you are developing your ‘mechanical’ chops or just curious to see how well these trades work. _______ UPDATE (Jul 19, 10:22 p.m.): AAPL did in fact lead the way, but with a nasty short squeeze on the opening bar rather than a shakedown. The target at 158.55 is not quite a lock-up, but it is a good enough bet to suggest the broad averages are likely to move higher for the next 2-3 days.

AAPL – Apple Computer (Last:150.97)