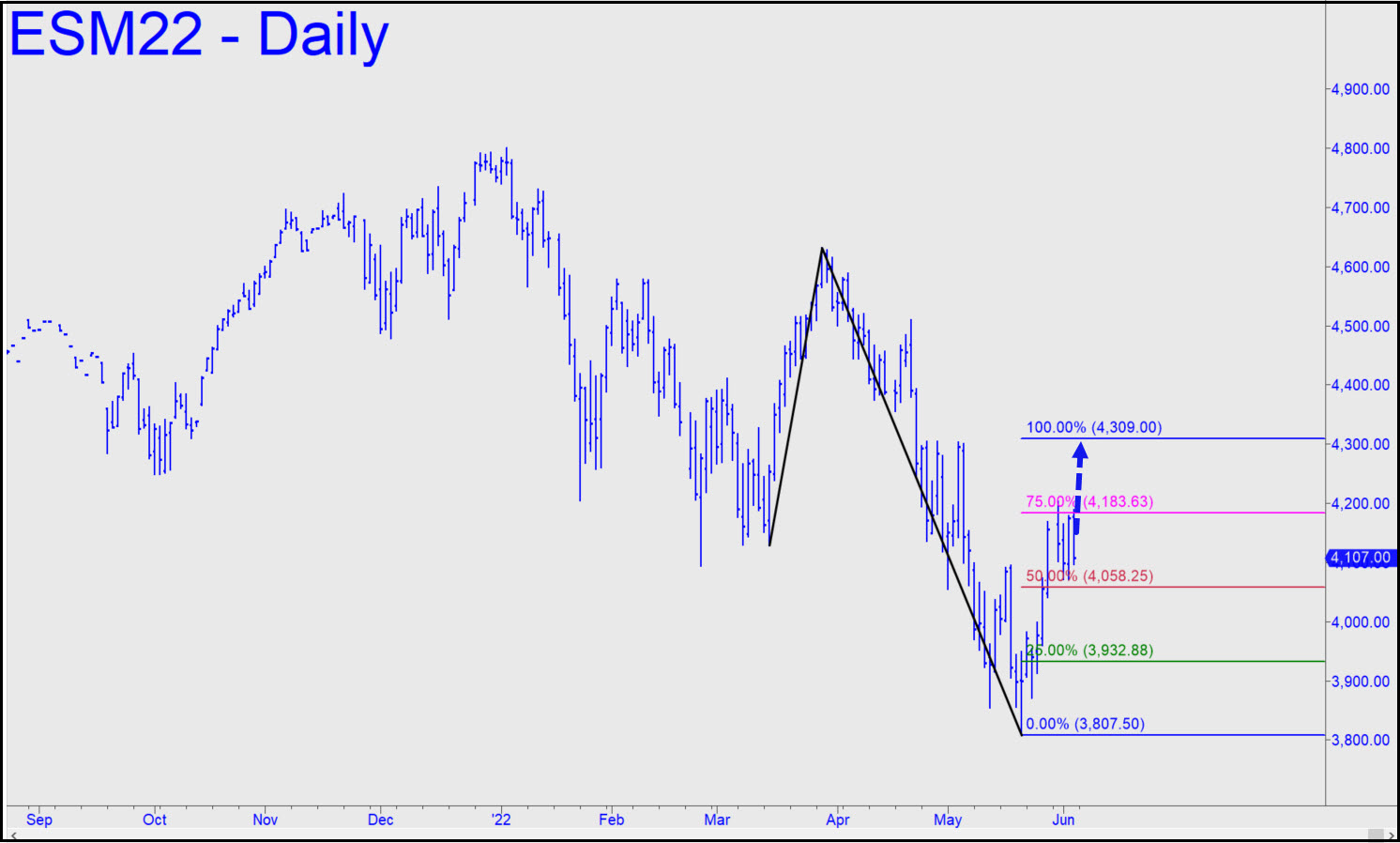

The futures wasted a week of our trading lives screwing the pooch, failing even to trip a ‘mechanical’ buy at the red line, let alone at the green as we prefer. This implies that Friday’s weakness was just noise and that ES remains bound for the ‘D’ target. I’ve raised it a tad, to 4309.00, to correct an inscrutable error that I blame, as I am wont to do, on quirks in the Tradestation platform. You can use 4309 as a lodestar for bull trades, since the implied 200 points of upside leaves plenty of room for profit. The pattern looks too obvious, even though it’s a reverse ABC, to allow a precise and painless short when D is reached. However, I still like it as a place to attempt shorting, and I would therefore suggest using a ‘camo’ trigger on the very lesser charts when the time comes. Stay tuned to the chat room and your email ‘Notifications’ if you would like further guidance on this. Please note that the unexpected swoon to x=3932.88 would trigger an enticing ‘mechanical’ buy, stop 3807.00. ______ UPDATE (June 6, 5:21 p.m.): Cancel the trade, since there’s not much swooning going on. It could be distribution, actually, and there’s no point in exposing ourselves to it. _______ UPDATE (Jun 10, 12:13 a.m.): A drop to the green line (x=3932.88) would trigger a ‘mechanical’ buy, stop 3807.00. I am not recommending the trade, however, even executed with ‘camouflage’, because of how sickly the futures looked all week. Ahead of the weekend we should be doubly cautious.

The futures wasted a week of our trading lives screwing the pooch, failing even to trip a ‘mechanical’ buy at the red line, let alone at the green as we prefer. This implies that Friday’s weakness was just noise and that ES remains bound for the ‘D’ target. I’ve raised it a tad, to 4309.00, to correct an inscrutable error that I blame, as I am wont to do, on quirks in the Tradestation platform. You can use 4309 as a lodestar for bull trades, since the implied 200 points of upside leaves plenty of room for profit. The pattern looks too obvious, even though it’s a reverse ABC, to allow a precise and painless short when D is reached. However, I still like it as a place to attempt shorting, and I would therefore suggest using a ‘camo’ trigger on the very lesser charts when the time comes. Stay tuned to the chat room and your email ‘Notifications’ if you would like further guidance on this. Please note that the unexpected swoon to x=3932.88 would trigger an enticing ‘mechanical’ buy, stop 3807.00. ______ UPDATE (June 6, 5:21 p.m.): Cancel the trade, since there’s not much swooning going on. It could be distribution, actually, and there’s no point in exposing ourselves to it. _______ UPDATE (Jun 10, 12:13 a.m.): A drop to the green line (x=3932.88) would trigger a ‘mechanical’ buy, stop 3807.00. I am not recommending the trade, however, even executed with ‘camouflage’, because of how sickly the futures looked all week. Ahead of the weekend we should be doubly cautious.

ESM22 – June E-Mini S&Ps (Last:4022.75)