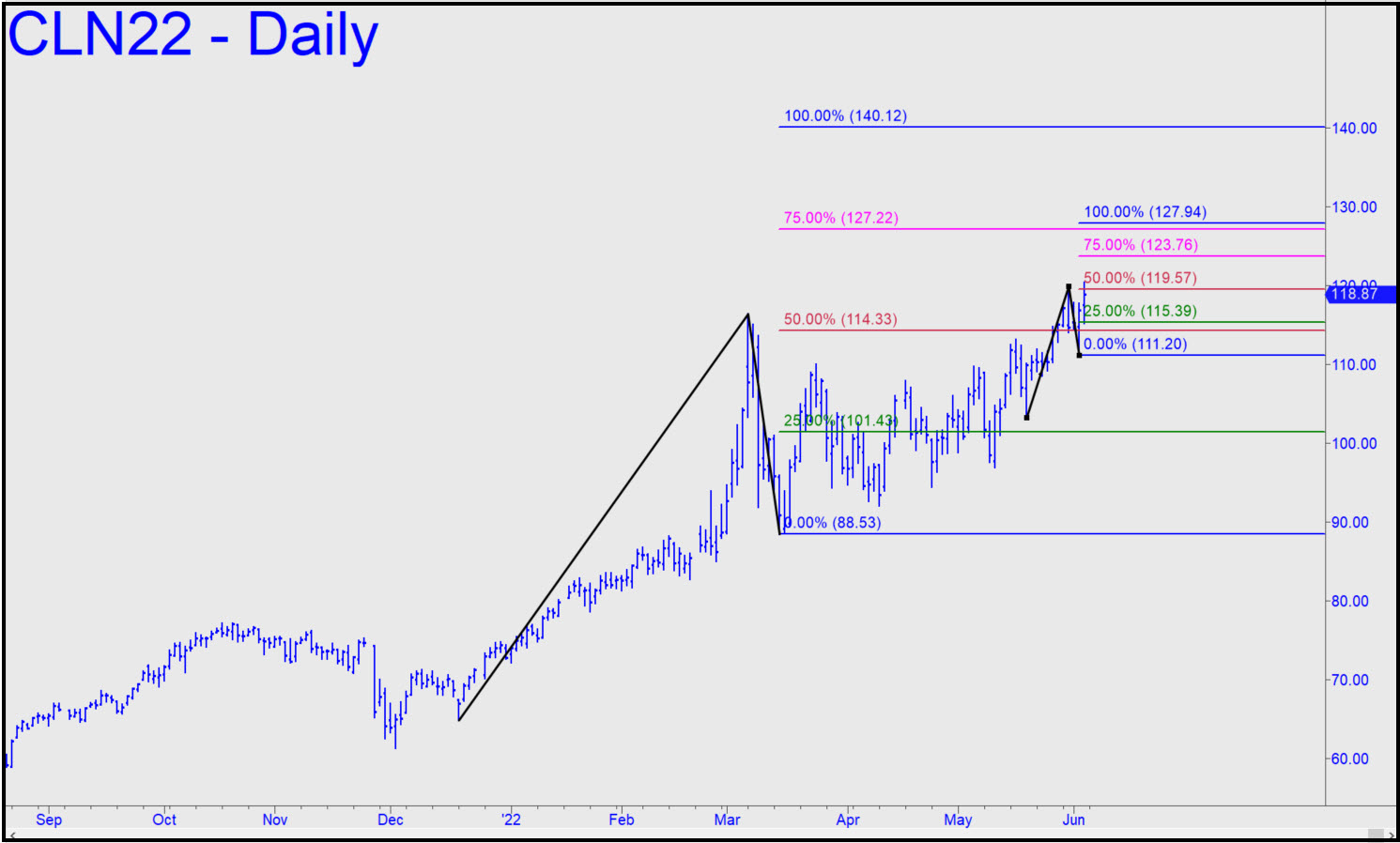

We’ve been using 140.12 as a big-picture target, but let’s focus on a lesser one at 127.94 for now. Friday’s tentative stab through the 119.57 midpoint resistance associated with the latter number, a Hidden Pivot resistance, was not sufficient for us to infer that a continuation of the rally to at least 127.94 is a done deal. However, a pullback to the small pattern’s green line would trip an enticing ‘mechanical’ buy. Since entry risk would exceed $4k per contract, the trade is suggested only for those who know how to cut the risk down to size with a camouflage set-up. _______ UPDATE (Jun 16, 10:40 p.m.): During today’s ‘requests’ session, I raised the possibility that crude had made an important top earlier this week at 123.68. If so, it will likely be found to have been attributable to the collapse of China’s manufacturing sector and the prospect of global recession. Let’s move to the sidelines for now.

We’ve been using 140.12 as a big-picture target, but let’s focus on a lesser one at 127.94 for now. Friday’s tentative stab through the 119.57 midpoint resistance associated with the latter number, a Hidden Pivot resistance, was not sufficient for us to infer that a continuation of the rally to at least 127.94 is a done deal. However, a pullback to the small pattern’s green line would trip an enticing ‘mechanical’ buy. Since entry risk would exceed $4k per contract, the trade is suggested only for those who know how to cut the risk down to size with a camouflage set-up. _______ UPDATE (Jun 16, 10:40 p.m.): During today’s ‘requests’ session, I raised the possibility that crude had made an important top earlier this week at 123.68. If so, it will likely be found to have been attributable to the collapse of China’s manufacturing sector and the prospect of global recession. Let’s move to the sidelines for now.

CLN22 – July Crude (Last:116.75)